The cryptocurrency ecosystem has recently witnessed an uptick in on‑chain activity for TRON (TRX), suggesting the possibility of a rebound after a period of relative stagnation. According to recent data, this resurgence is driven by growing decentralized exchange (DEX) usage on the TRON network and a more stable investor sentiment.

Surge in On‑Chain Demand and DEX Volume

Over the past week, TRON’s DEX trading volume climbed to approximately $843.5 million, a significant increase from the $532.53 million recorded the week prior.

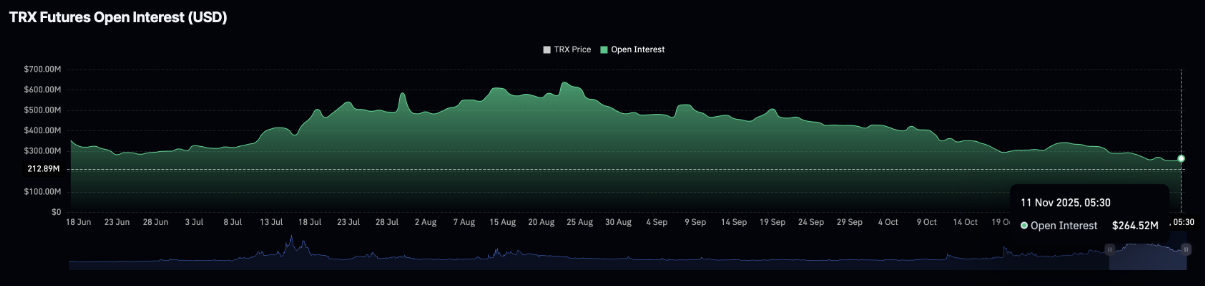

This jump signals more users active on‑chain, utilising TRON’s ecosystem more intensively. At the same time, open interest (OI) for TRX futures is holding steady around $264.52 million, maintaining levels above the $250 million threshold from the prior week.

The implication: more trading activity, less panic among retail investors, and a stronger foundation for potential upside.

Technical Picture: Recovery in Progress, But Resistance Ahead

Technically, TRX appears to be trying to turn a corner. It currently trades below the 200‑day exponential moving average (EMA) at $0.3022, while its 50‑day EMA is in a downtrend, having crossed below the 100‑day EMA — a typical “death cross” signal.

However, positive signs are emerging:

-

The Relative Strength Index (RSI) has rebounded from an oversold region and is approaching the midline.

-

The MACD histogram recently turned green and the MACD line crossed above its signal line, indicating increasing upward momentum.

Key resistance levels to watch: -

EMA 200 at ~$0.3022

-

EMA 50 around ~$0.3104

-

Previous highs near ~$0.3261 (from August 14 / October 6)

On the downside, if TRX falls back toward ~$0.2764 (last week’s low), the rebound attempt could falter, potentially exposing a drop to ~$0.2632 (May 31 low).

The Bigger Picture & What It Means

The stronger DEX volume and stabilized futures open interest suggest that TRON’s ecosystem is gaining traction again. Increased on‑chain usage often precedes stronger token performance. Meanwhile, better investor sentiment reduces the likelihood of panic selling, which in turn mitigates downside risk.

Still, the rebound is not guaranteed. TRX remains below major moving averages and faces resistance. The broader crypto market environment will also play a key role — if market sentiment turns negative, even strong on‑chain metrics might not prevent price pressure.

Final Thoughts

In summary: TRON (TRX) appears to be in the early stages of a recovery, with rising decentralized exchange activity and more stable investor sentiment providing encouraging foundation. Technical indicators are beginning to turn positive — but major hurdles remain. If TRX can clear key resistance levels and hold support zones, the path toward ~$0.30 and above could open. Conversely, a breakdown in support could delay the rebound.

This article is for informational purposes only and should not be taken as investment advice. Always do your own research and consider your risk tolerance before investing.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.