In recent days, Bitcoin (BTC) has come under mounting pressure, trading around the US$104,100 mark after a sharp loss of more than 10% in just one week. With growing investor concern that it may fall below the crucial US$100,000 threshold, attention is turning toward the potential opportunities in altcoins — particularly those whose price movements are less tied to Bitcoin’s direction.

While most tokens historically move in tandem with Bitcoin, some rare exceptions exhibit a negative or very low correlation, meaning they might actually benefit when Bitcoin weakens. Below are three standout altcoins that analysts believe could thrive if Bitcoin fails to hold above US$100 k.

1. Tezos (XTZ): Independent Blockchain, Anti-Correlation Advantage

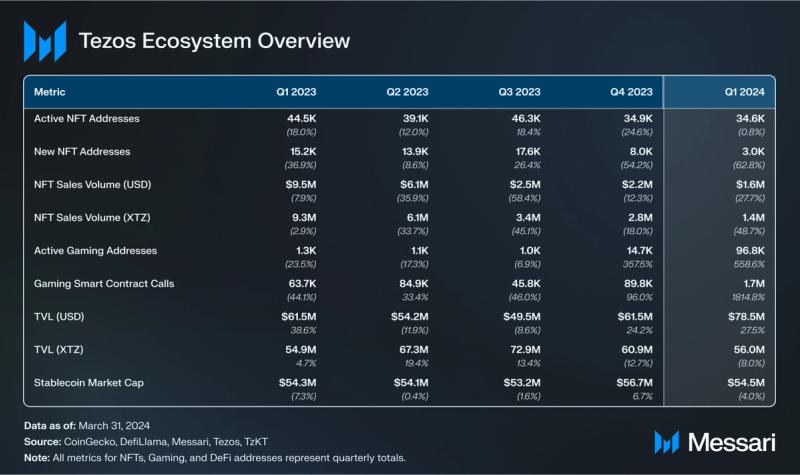

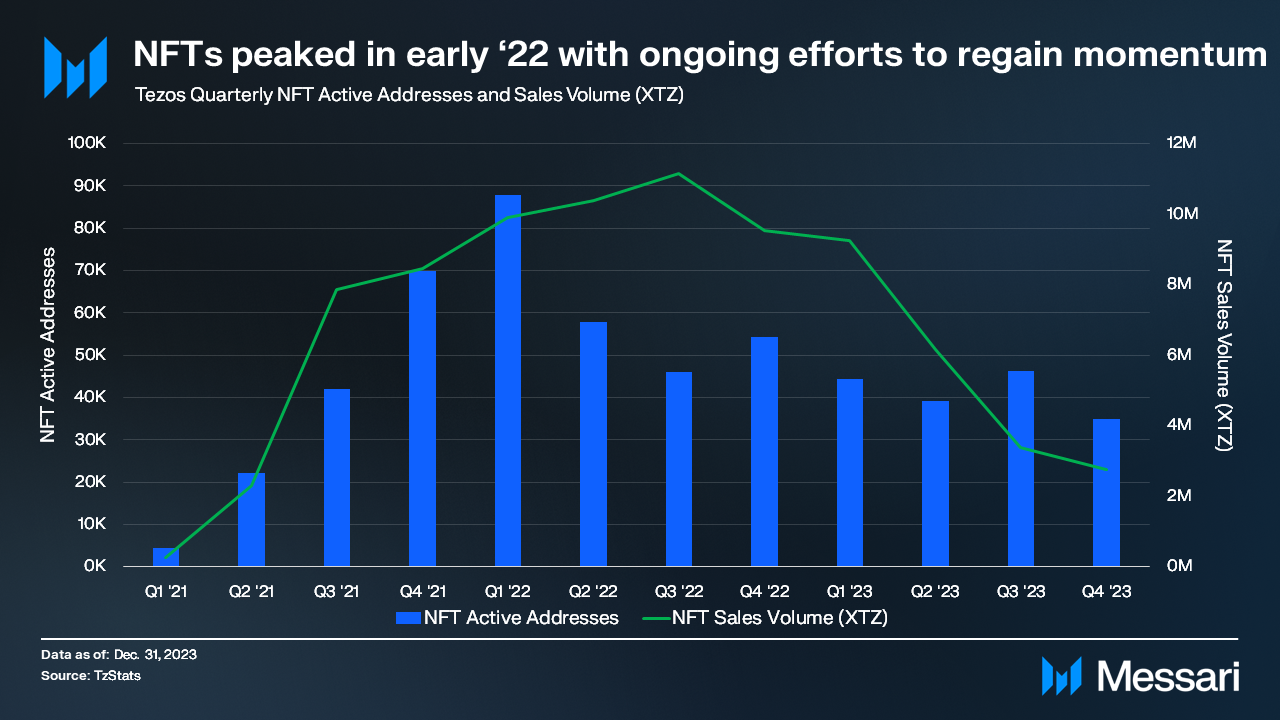

Tezos has emerged as a strong candidate for outperforming in a Bitcoin-down scenario. Its blockchain is self-upgradable and governed on-chain, giving it structural independence from many large-cap tokens that tend to follow Bitcoin’s lead.

In the past year, the Pearson correlation coefficient between Tezos and Bitcoin was just −0.07 — implying that XTZ often moves slightly in the opposite direction of BTC.

From a technical-analysis perspective:

-

Tezos faces its first resistance at roughly US$0.53; beyond that, US$0.55 would reinforce the bullish case, with a possible extension to US$0.58 and US$0.60.

-

On the downside, a drop under US$0.51 could break the short-term bullish structure.

Given its low correlation and early signs of accumulation among smart-money and whale investors, Tezos stands out as one of the altcoins best positioned to benefit if Bitcoin slides further.

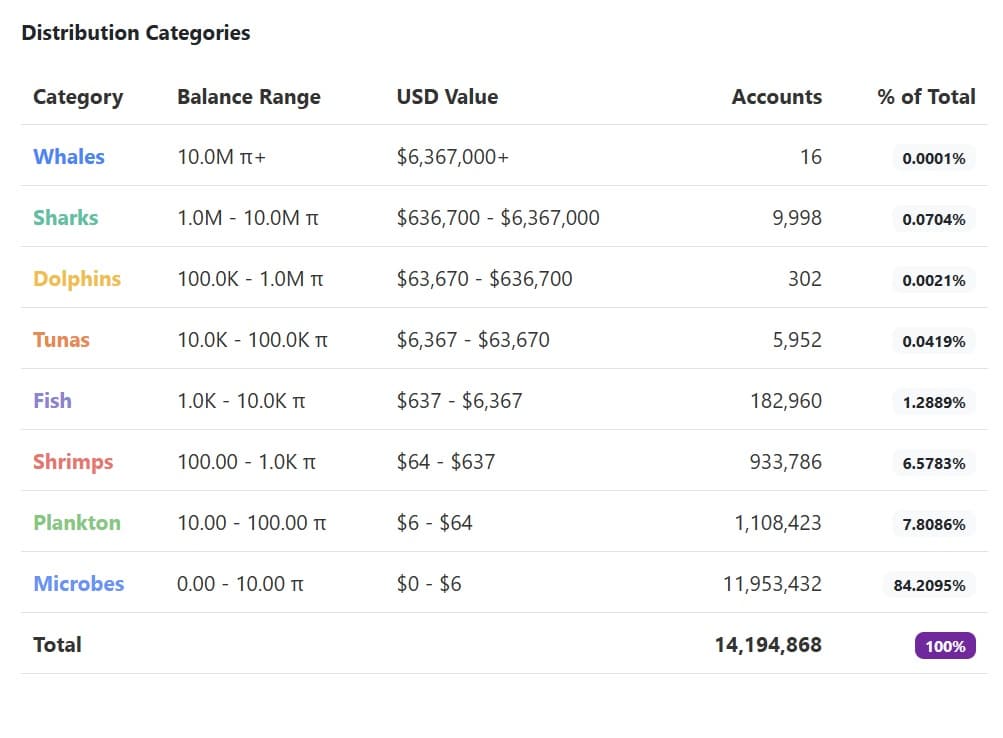

2. Pi Coin (PI): Diverging from the Pack

Pi Coin is another altcoin showing promise in a Bitcoin weakness scenario due to its pronounced divergence from Bitcoin’s recent performance. While Bitcoin dropped nearly 10% in the past week, Pi only declined about 1% — evidence of its increasing independence.

Over the past year, Pi’s correlation with Bitcoin has been approximately −0.30 — a meaningfully negative relationship.

Technical key levels for Pi:

-

A break above US$0.26 would signal strength; surpassing US$0.29 would reinforce momentum.

-

On the flip side, a drop below US$0.22 could open the way toward US$0.19 and weaken the bullish narrative.

Thanks to its divergence from Bitcoin and signs of accumulation by smart money, Pi Coin is viewed as among the top altcoins to watch in the event of a deeper Bitcoin correction.

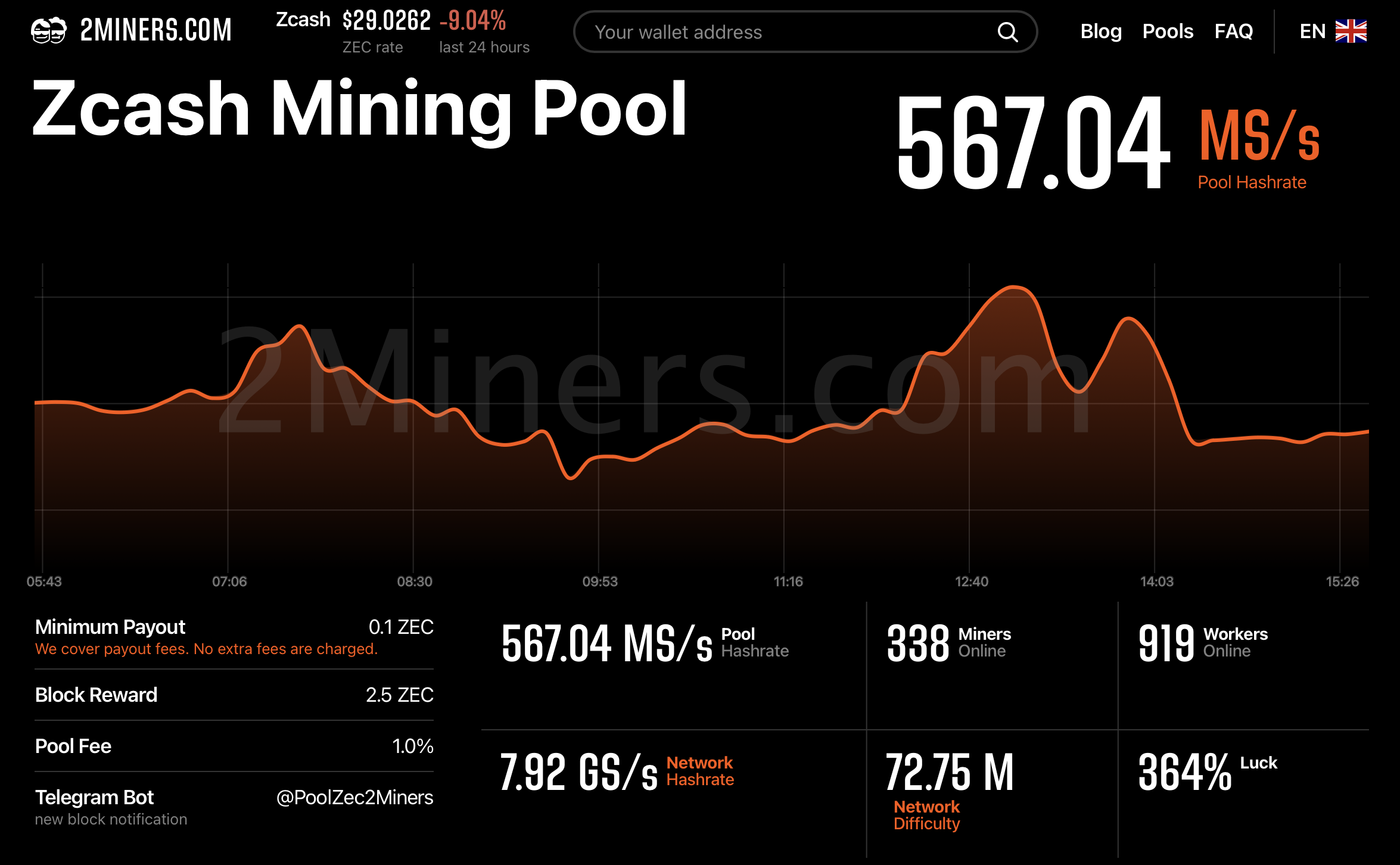

3. Zcash (ZEC): Privacy Coin with a Turnaround Correlation

Zcash, a prominent privacy-focused cryptocurrency, completes the trio. Historically, ZEC’s correlation with Bitcoin was modestly positive (+0.28), but in the past month it has dropped to around −0.55 — indicating that ZEC may now move inversely to Bitcoin.

Highlights for ZEC:

-

ZEC recently logged a nearly 200% monthly gain while Bitcoin fell ~15.8%.

-

The Chaikin Money Flow (CMF) metric has been consistently above, indicating strong accumulation by large holders.

-

From a technical standpoint, the next major resistance sits at US$594; exceeding this could lead to ~23% upside. However, a fall below US$341 or US$245 would threaten the bullish structure.

Given its shift toward negative correlation with Bitcoin plus strong accumulation indicators, Zcash is considered a viable hedge within the altcoin segment amid Bitcoin weakness.

Conclusion

In an environment where Bitcoin’s strength is under question, altcoins that show independence from or inverse correlation to BTC become particularly interesting. Tezos, Pi Coin and Zcash each tick that box — while also exhibiting early technical or on-chain signs of strength. However, it’s important to reiterate: this is not investment advice. These insights are informational only. Any decision to trade or invest should follow your own research and risk assessment.

—————————————————-

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

For collaborations and inquiries: CryptoBCC.com@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.