With the real-world asset (RWA) sector showing signs of revival, informed investors are turning their attention toward projects that link blockchain-based finance with tangible assets. According to recent analysis, the RWA segment gained roughly 6.3% in the past 24 hours and about 8% over the week — setting the stage for renewed interest in certain tokens. Below, we explore three standout tokens that may benefit from favorable macro-conditions and technical momentum in November 2025.

1. Maple Finance (SYRUP): Potential for a Strong Reversal

Maple Finance is a leading RWA infrastructure protocol focused on enabling institutional borrowers to access credit via tokenised pools on-chain. The project has recently put forward Proposal MIP-019, which aims to expand token buy-backs, broaden governance participation and phase out the existing staking mechanism — all intended to strengthen the token’s foundation and increase its long-term sustainability.

From a technical standpoint, Maple appears to be forming a reversal: between July 18 and October 27, SYRUP’s price made lower lows while its RSI produced higher lows — a bullish divergence that often signals diminishing selling pressure and the potential for an upcoming rise. For the reversal to be confirmed, the key resistance level to watch is $0.46; a successful breakout could target near $0.52. On the other hand, if the token fails to hold above $0.36, a drop toward $0.33 may invalidate the bullish setup.

Given the confluence of structural upgrades and technical signals, Maple Finance represents a compelling RWA play for November — provided the broader macro environment remains supportive.

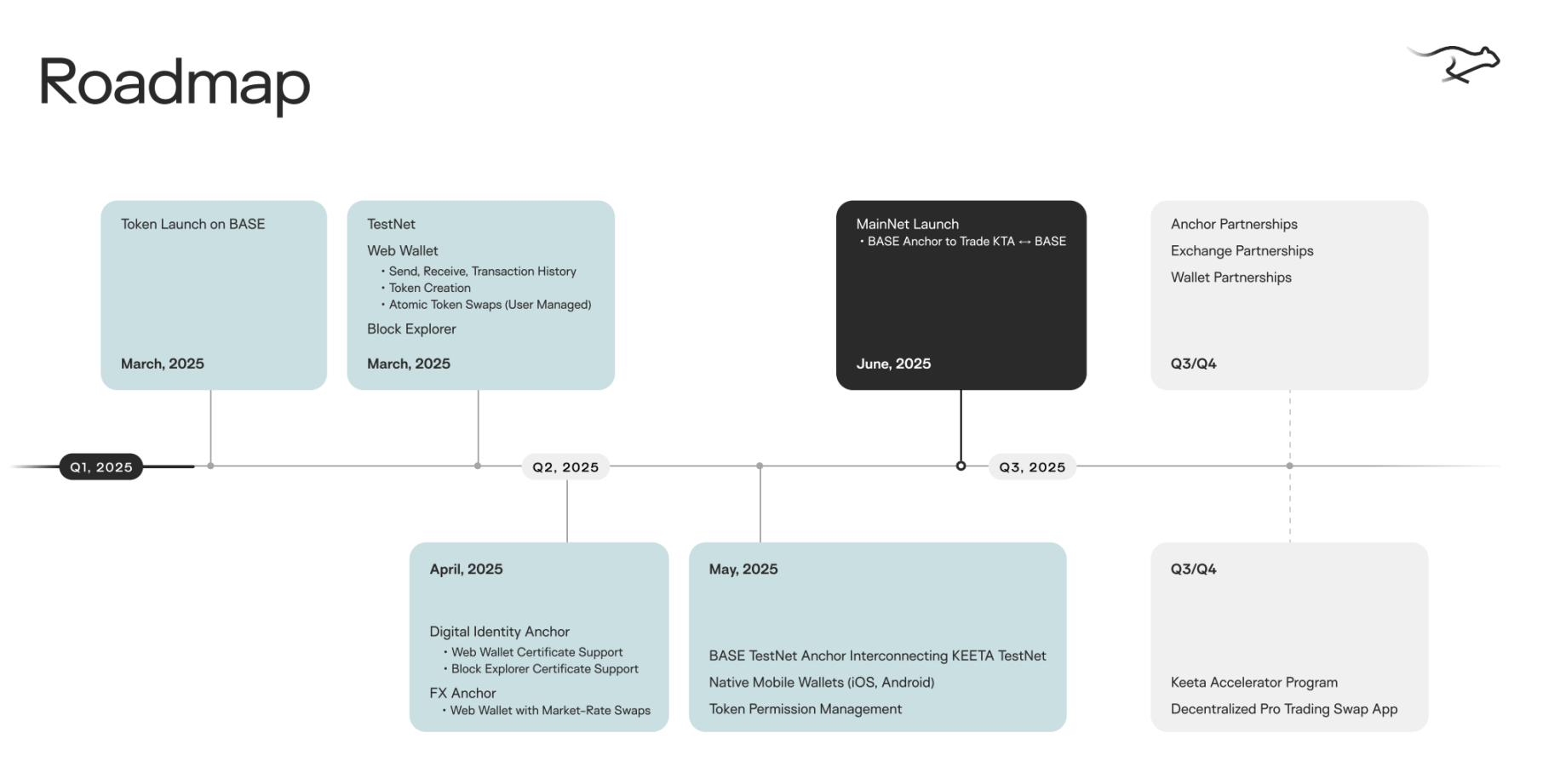

2. Keeta (KTA): Sustainable Growth Trajectory

Keeta distinguishes itself as an RWA project that emphasises sustainable growth rather than rapid reversal. It bridges blockchain liquidity with real-world fixed income and credit assets — a strategy that could benefit significantly if interest-rates begin to decline and investors hunt for yield beyond traditional DeFi. On-chain data reveals meaningful accumulation: over the past week, the token rose approximately 22.6% even after a 7.2% intraday pullback; the top 100 addresses increased their holdings by about 1.46% (≈ 11.82 million KTA, ~US$5.9 million) in that span.

Technically, KTA shows a hidden bullish divergence on the 12-hour chart: from 25 to 28 October, price formed higher lows while the RSI made lower lows — a pattern often interpreted as a weakness in the recent down-move and a potential launch point for new upside. The key resistance to clear: $0.63. A breakthrough could take the token toward $0.77, implying nearly 26% upside. A strong bullish case even stretches toward $1.27 if broader sentiment improves. Conversely, a drop below $0.49 could weaken the short-term uptrend, risking a correction toward $0.40 or lower.

For investors seeking a RWA project with accumulation interest and structural momentum, Keeta is worthy of attention in November’s evolving market.

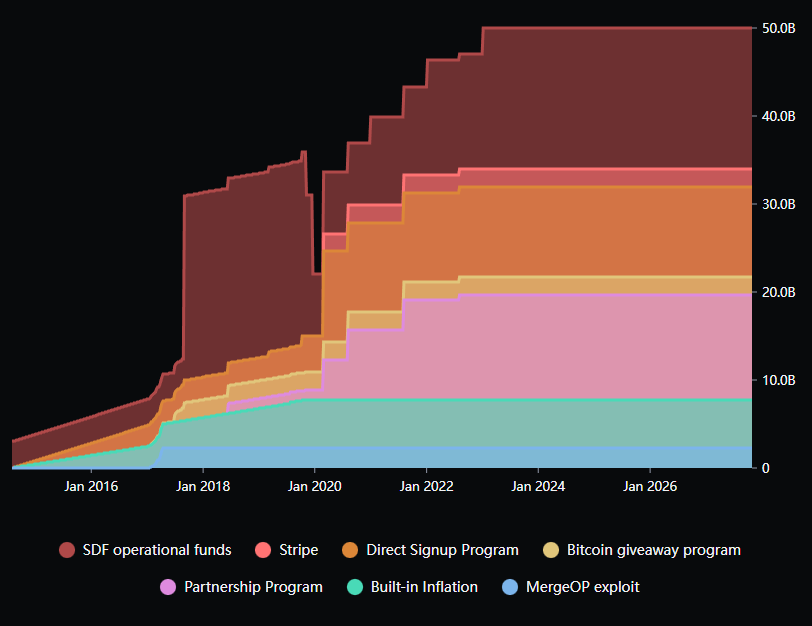

3. Stellar (XLM): Under-recognised Value with RWA Potential

While primarily known as a blockchain for payments and cross-border transactions, Stellar’s ecosystem is increasingly relevant to the RWA narrative. The real-world asset value represented on the network has surged to around US$639.38 million — up 26.6% month-on-month — yet the token price has not fully reflected this growth. According to commentary from Ray Youssef, institutional capital has temporarily rotated out of payments-centric networks like Stellar, favouring higher-yield RWA tokens and data-infrastructure platforms.

From a technical lens, XLM is trading around $0.33, facing resistance near $0.36. A breakout could aim for $0.41, but a subtle bearish divergence is emerging: between 13–28 October, the price chart shows lower highs while RSI posted higher highs — a sign the upward momentum may be weakening. Should the token break down, levels near $0.31 or even $0.28 might come into play.

For investors interested in a more familiar blockchain asset that is gradually aligning with the RWA trend, Stellar represents an intriguing mix of established network effects and growth potential.

Final Thoughts & Considerations

The three tokens outlined above — Maple Finance (SYRUP), Keeta (KTA), and Stellar (XLM) — each present distinct risk/reward dynamics within the broader RWA theme. Their similarities lie in being well-positioned to benefit from a pivot in interest-rates, increasing institutional capital flows, and the broader maturation of on-chain finance.

However, several caveats must be kept in mind:

-

Macro-factors remain paramount: A move by Federal Reserve toward dovish policy or favourable global trade developments (e.g., US-China) could trigger a stronger move into RWA assets.

-

Technical triggers matter: Breakouts and divergences discussed above are not guarantees — they indicate setups, not certainties.

-

Liquidity dynamics: Tokens with large whale activity (e.g., KTA) can be subject to sharp swings if accumulation/leverage unwinds.

-

Diversification & research: As always, these tokens should be considered parts of a broader portfolio, not standalone bets. This commentary is not investment advice.

In summary: November 2025 could well become a turning point for RWA-linked crypto assets. Investors seeking exposure to real-world yield opportunities and on-chain finance might do well to monitor these three tokens closely as the landscape unfolds.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.