The cryptocurrency market kicked off November with red territory dominating the landscape, as sentiment among derivatives traders turned decisively negative. Ethereum (ETH), Aster (ASTER) and Dash (DASH) have emerged as key altcoins at risk of large‑scale liquidation in this volatile environment. According to data compiled by CoinPhoton, these three carry heightened risk of forced unwinds if price momentum swings in either direction.

1. Ethereum (ETH)

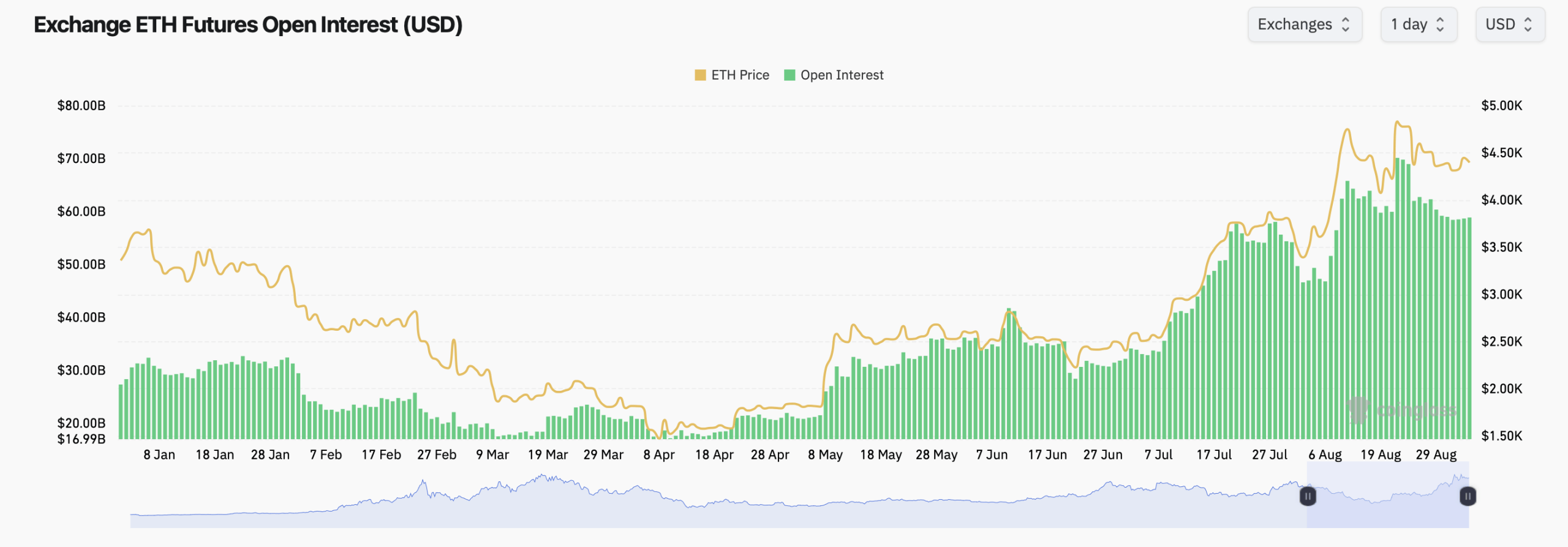

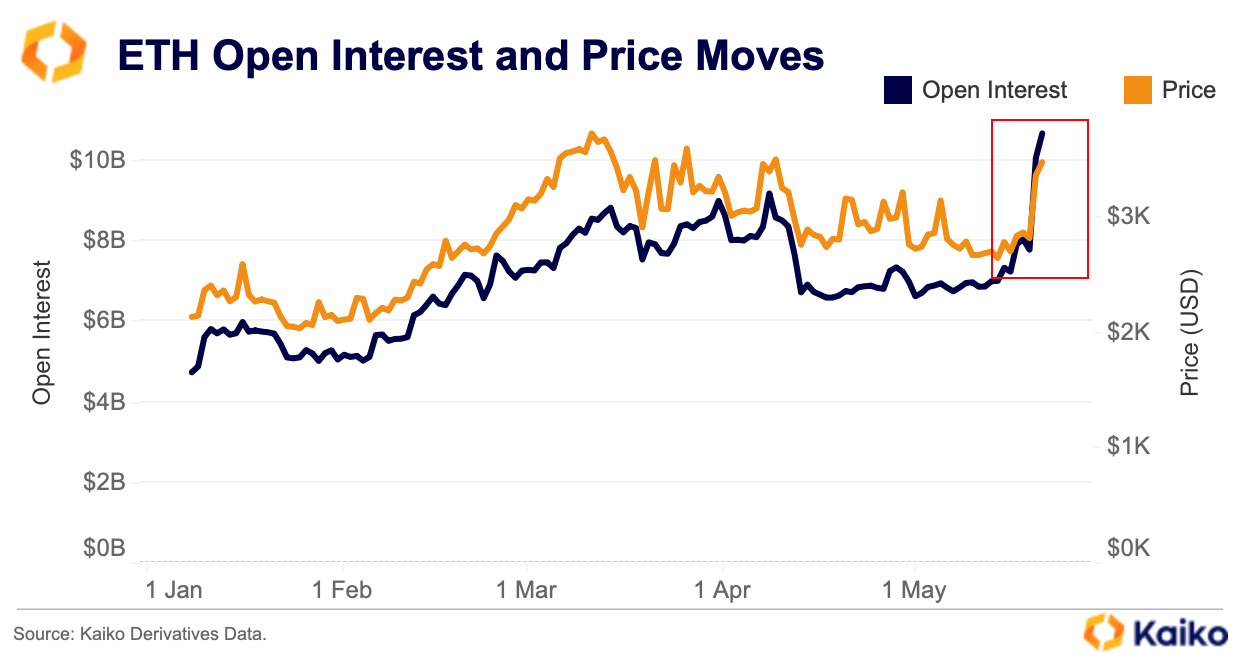

ETH is showing a significant imbalance between long and short positions: short positions currently dominate the open interest map.

-

If ETH recovers to around US$4,000, short positions may be liquidated to the tune of US$4.2 billion.

-

A sharper recovery up to US$4,300 could push potential liquidation of shorts close to US$8 billion.

-

On the fundamentals side, ETH’s network data shows encouraging signs: application‑revenue on the network has hit all‑time highs and stablecoin supply on the network continues to expand.

-

However, given the elevated short‑interest, traders who are short without risk control could face heavy losses if a rebound occurs.

Implication: ETH is vulnerable in either direction — if the price dips, those long may get liquidated; if it rebounds, shorts could be squeezed. With the structural network strength, the latter scenario may carry real risk of a large squeeze.

2. Aster (ASTER)

ASTER stands out for the distinct dislocation between shorts and longs. The short side appears heavily positioned.

-

A move up to US$1.40 could eliminate about US$44 million of short positions.

-

Conversely, if ASTER falls to around US$0.90, long‑positions could see more than US$15 million in liquidations.

-

A key catalyst: the public purchase by Changpeng Zhao (CZ), founder of Binance. He reportedly bought US$2.5 million of ASTER for the long term. That announcement appears to have triggered social‑media momentum and elevated bullish interest.

-

Given the heavy short interest, if momentum from social signals drives a sharp upward move, short‑squeeze risk is non‑trivial.

Implication: ASTER is somewhat more speculative and driven by social/influencer dynamics. The high short‑leverage makes it a candidate for a rapid reversal and squeeze if sentiment turns.

3. Dash (DASH)

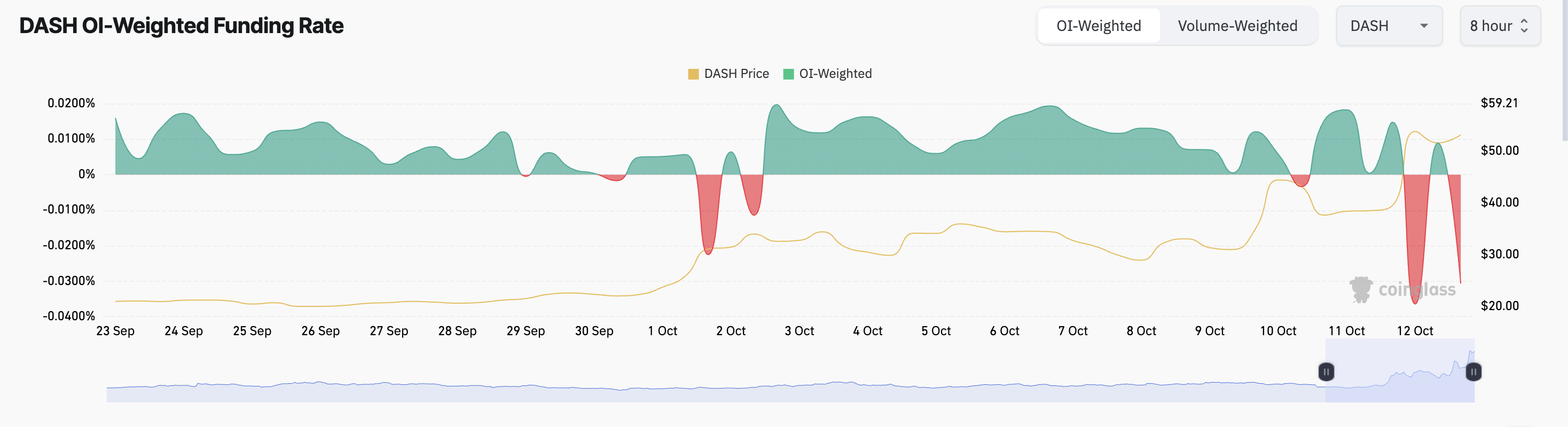

DASH is also in the spotlight — particularly in the context of privacy‑coins and network relevance.

-

If DASH rises to around US$105, about US$13 million of short positions could be liquidated.

-

On X (formerly Twitter), analysts have put even more bullish targets, some projecting US$100–140, and in an extreme FOMO scenario even US$250.

-

The key caution: when community optimism is high and shorts are crowded, the risk of a rapid squeeze grows. At the same time, without fresh fundamental catalysts, any upswing may lack strong sustainability.

Implication: DASH is at risk of a sudden short squeeze if prices rally, but similarly vulnerable if sentiment reverses. Its role in the privacy‑coin niche gives it thematic interest but also elevated speculative risk.

Overall Market Context & Risk Considerations

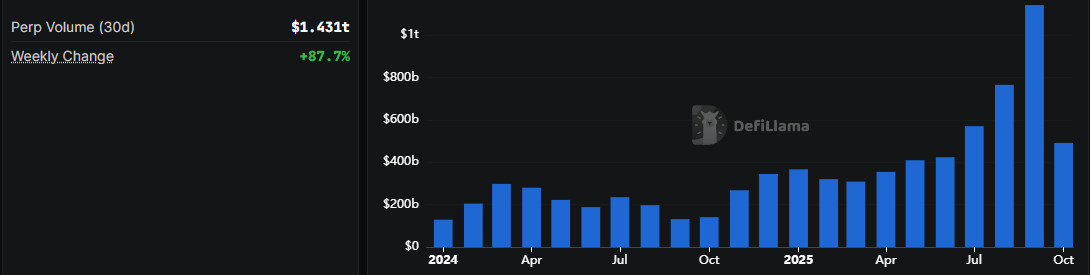

The first week of November has already shown volatile sentiment, with funding rates and derivative positioning tilting toward bearish (short) exposure. The three altcoins above exemplify how shifts in momentum, whether upward or downward, can trigger outsized liquidation events.

Key takeaways:

-

Short‑side crowding: Many traders are betting on downward price moves; if momentum flips, they may be caught.

-

Catalyst dependence: ASTER’s social momentum, ETH’s network strength, DASH’s thematic niche — each relies on specific drivers. If those fade, risk rises.

-

Volatility risk: With high leverage in the system, price swings in either direction can lead to rapid forced liquidations — impacting both longs and shorts.

-

Not investment advice: As the original article notes, this is informational only and not financial advice.

Final Thoughts

For market participants, these altcoins represent both opportunity and risk. On the one hand, short‑crowded assets like ASTER and DASH could see sharp squeezes if sentiment reverses. On the other hand, in a weak market, the same crowded positions may amplify downside. For ETH, despite strong on‑chain fundamentals, the large levered positioning means that even a modest rebound could trigger significant market movement.

If you’re active in derivatives or leveraged positions, careful risk‑management is especially critical right now. Watching funding rates, open interest changes, social signals and price momentum can help anticipate potential liquidation clusters.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.