Despite the broader “altcoin season” still not fully materialising, several altcoins have stood out with strong performance in the second week of November — yet those very gains carry heightened risk of large-scale liquidations among short-term traders. According to a recent analysis by CryptoBCC, three notable tokens are now under the spotlight for such risks.

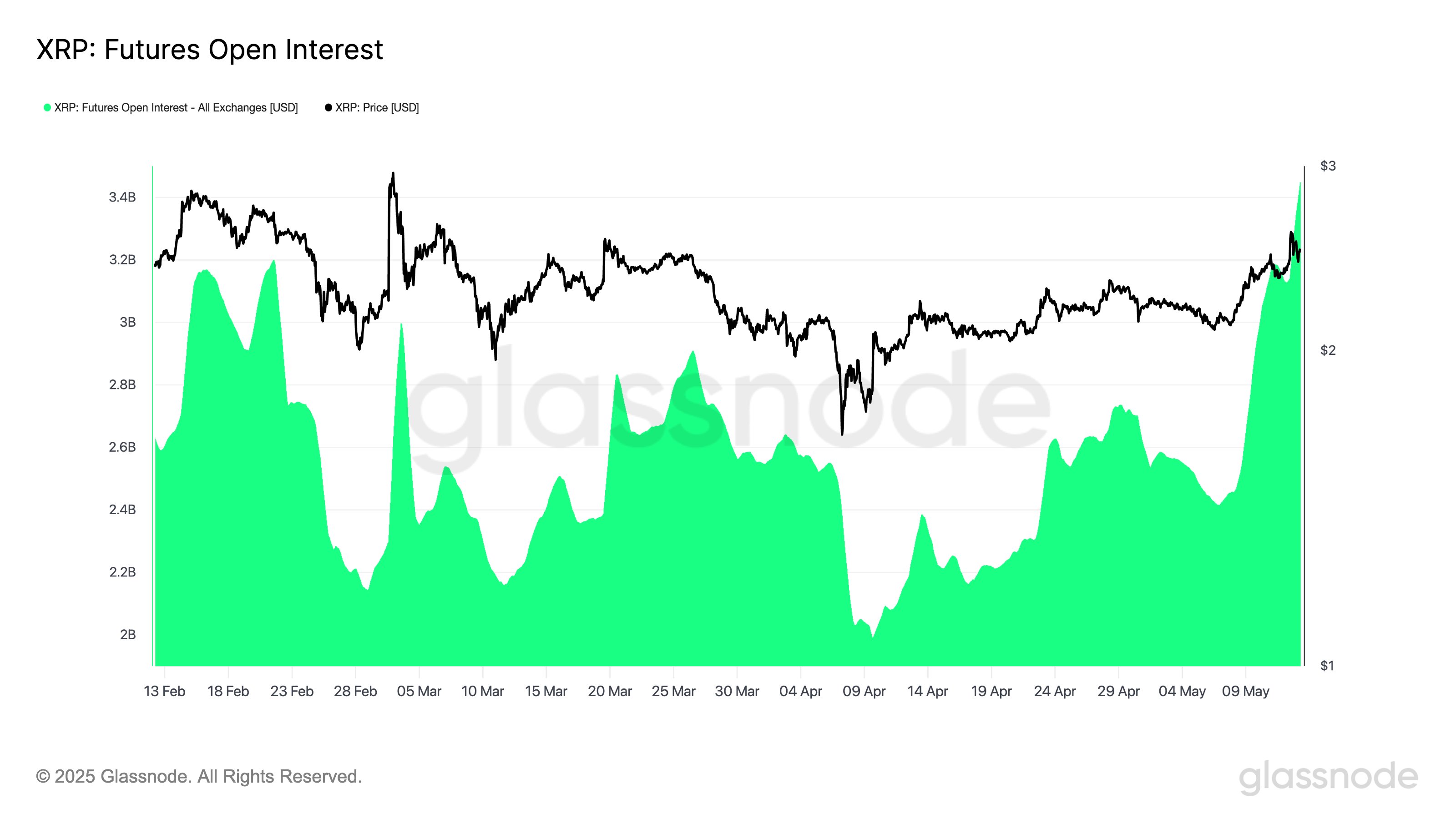

1. XRP

The sentiment among short-term traders remains very bullish on XRP, especially in light of the anticipated approval of spot XRP ETFs — the firm Canary Capital is reportedly preparing one for launch on 13 November.

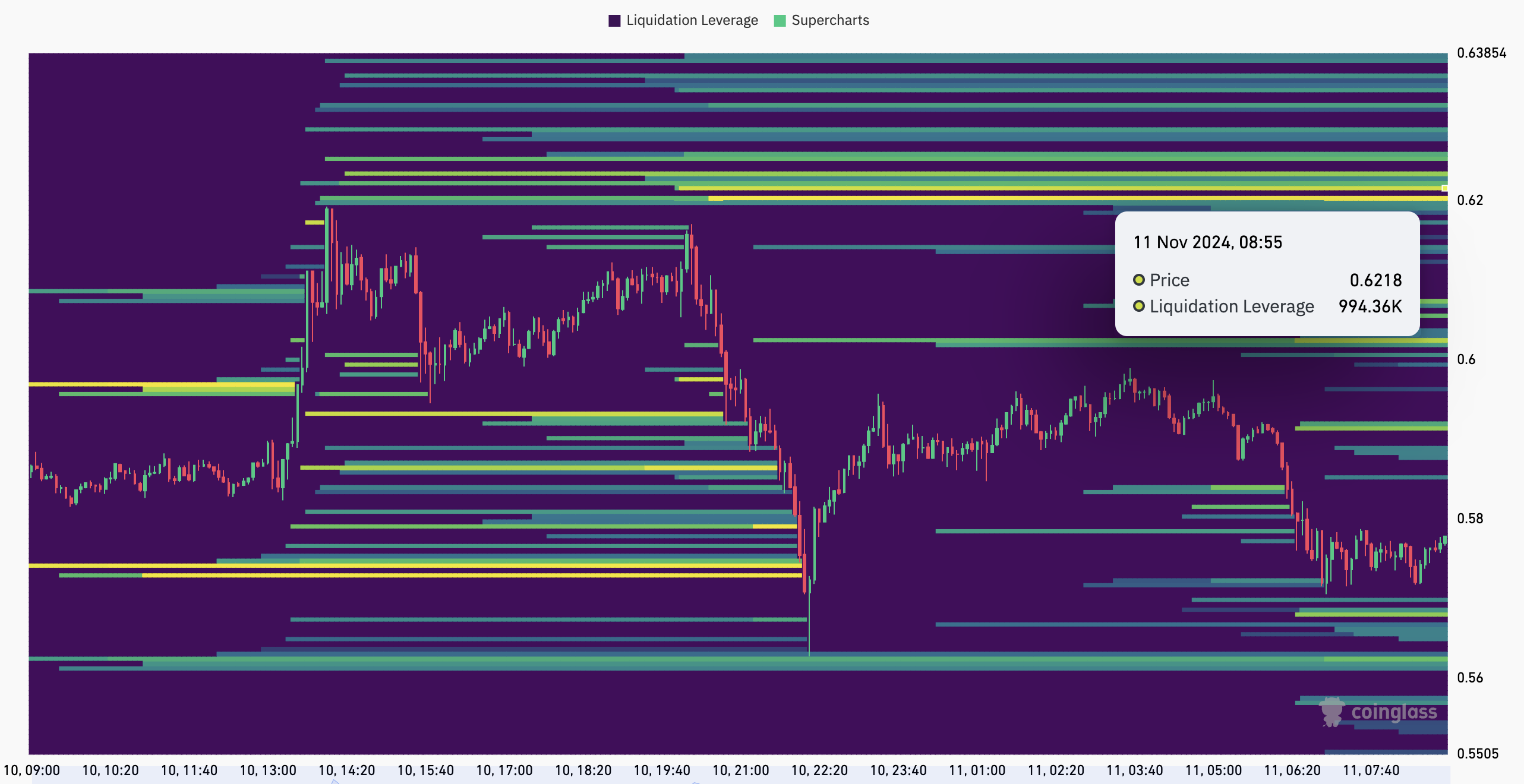

A 7-day liquidation map shows a large concentration of long positions that are at risk if price dips.

However, there are warning signs: new wallet counts for XRP have decreased significantly in the past week, and the long-versus-short MVRV indicator has dropped — both factors suggesting waning investor enthusiasm and heightened likelihood of a correction.

Should XRP decline to $2.10, it could trigger more than $340 million in long liquidations. On the flip side, if XRP rallies to $2.75, some $69 million in short positions may be liquidated.

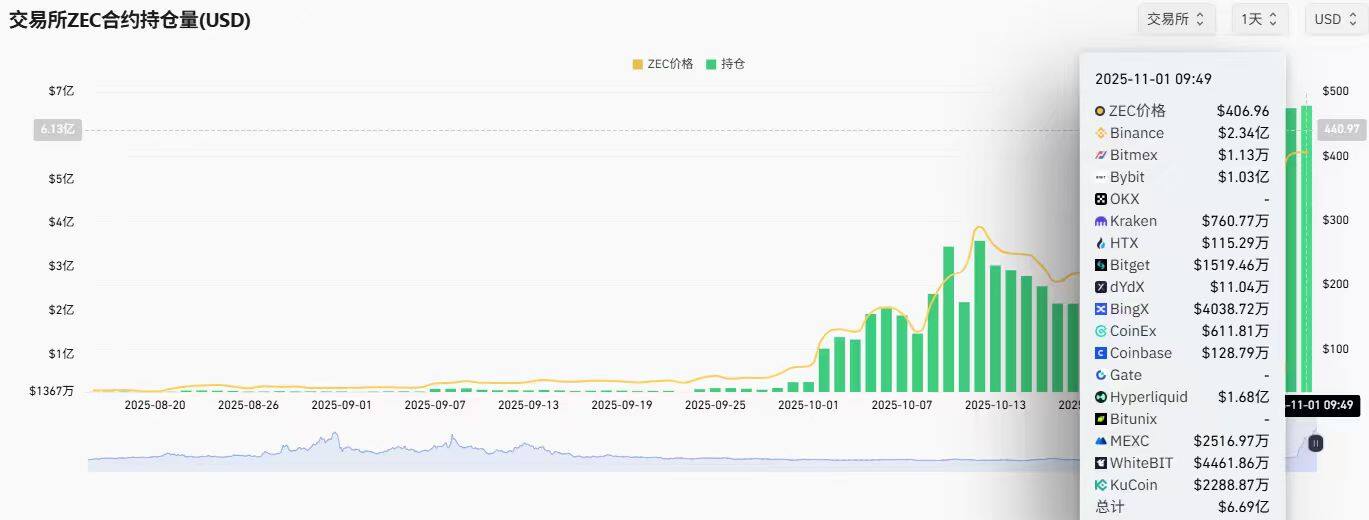

2. Zcash (ZEC)

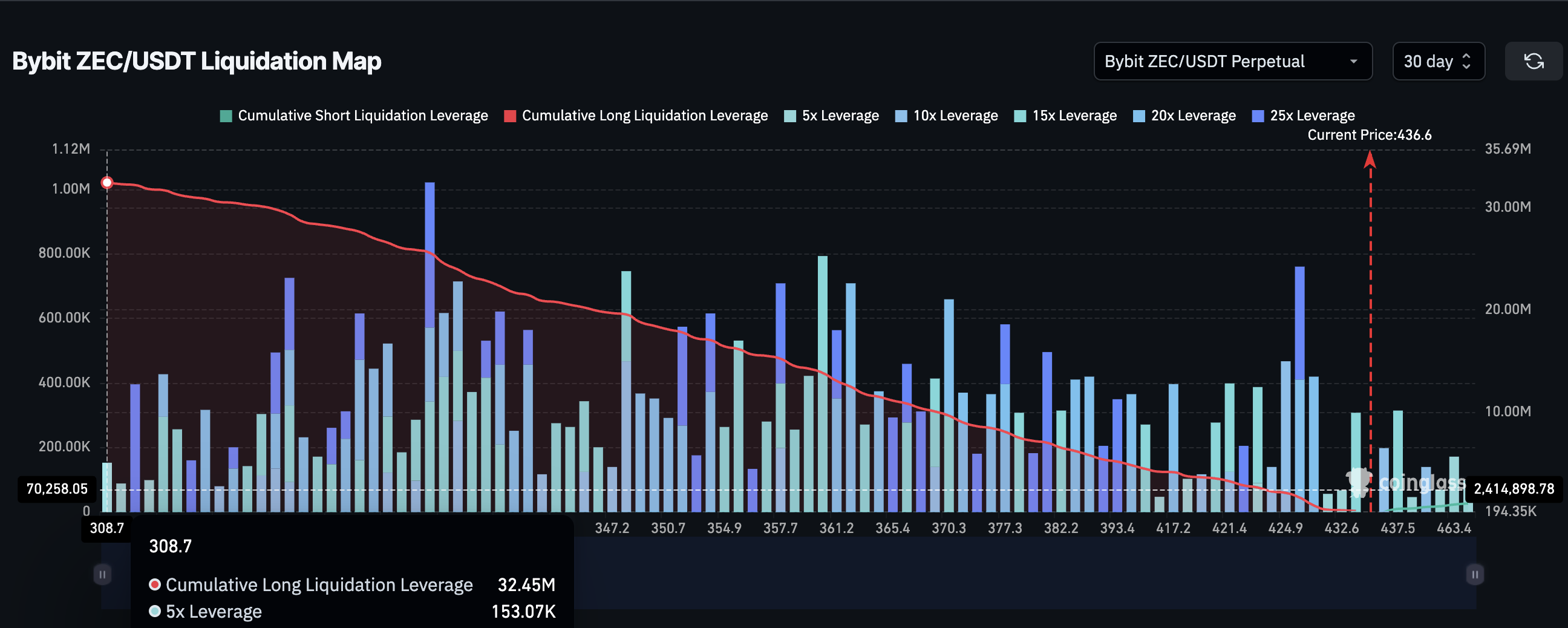

ZEC has shown an impressive upward move in the second week of November — after topping around $750, it pulled back toward $550. Some traders remain hopeful that it may approach the $1,000 mark.

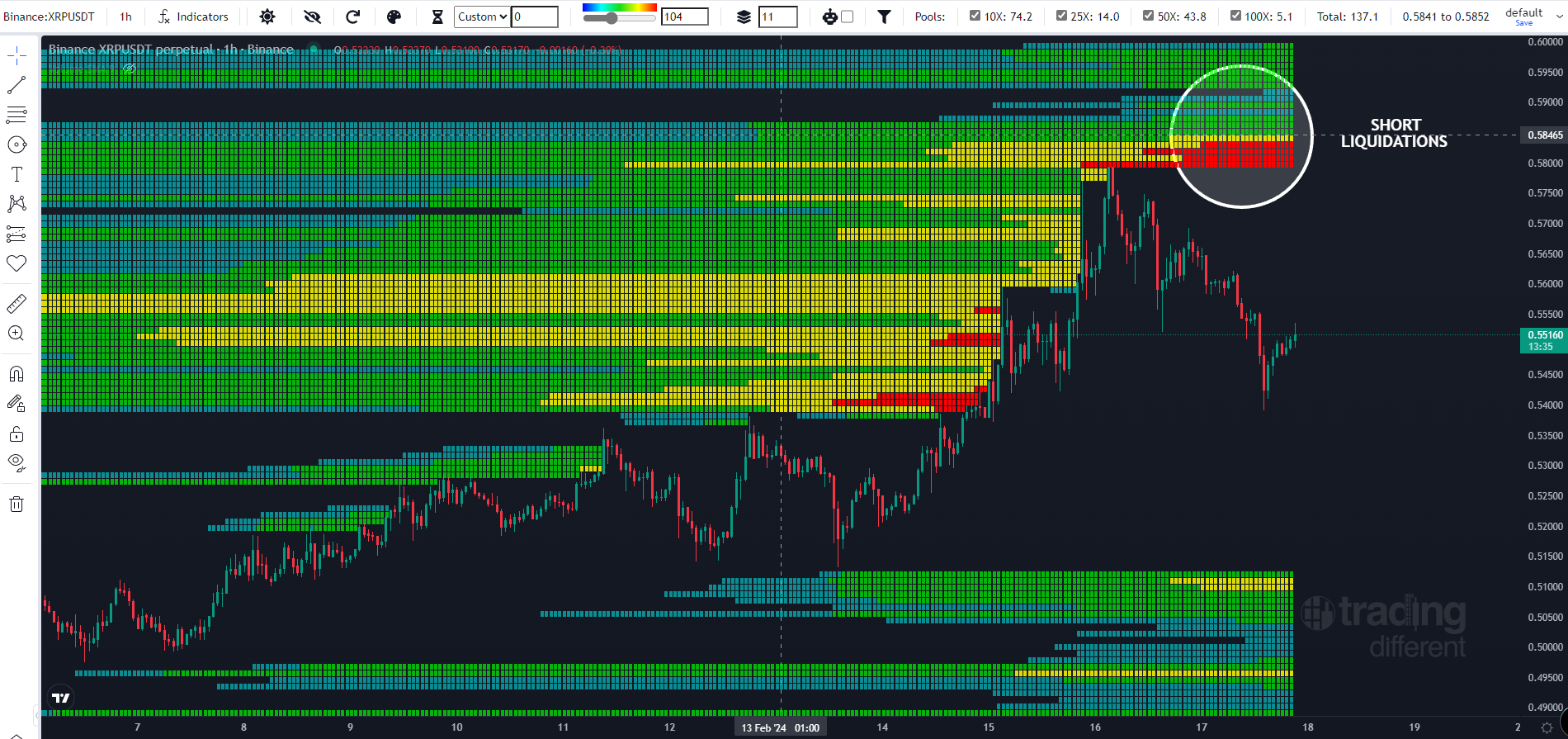

The 7-day liquidation map reveals many short-term traders increasing leveraged long positions, which escalates risk if a correction happens.

If ZEC drops to $540, more than $72 million of long positions could be wiped out. Conversely, a move up to $760 could see around $44 million of short positions liquidated.

Analysts warn that ZEC may be forming a classic parabolic “blow-off” pattern after its ten-fold move, meaning that unless an adjustment occurs, the risk of a sharper reversal increases.

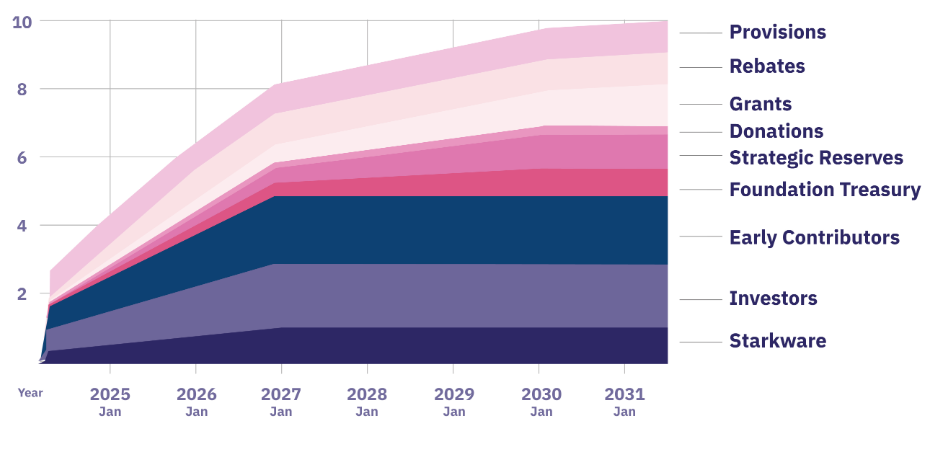

3. Starknet (STRK)

Starknet’s token STRK delivered a surprise move — rising roughly 30% in just one day in the second week of November, erasing losses from the prior month.

Short-term sentiment is upbeat: liquidation data show long positions overwhelmingly dominate the risk profile.

However, a significant caveat: according to CryptoRank, more than 127 million STRK tokens are due for unlock this week — a major supply event that could impose downward price pressure and increase risk for leveraged long traders.

If STRK falls to $0.128, roughly $14 million of long positions may be liquidated. If it surges to $0.20, approximately $1.78 million of short positions could be liquidated.

-

All three altcoins — XRP, ZEC, STRK — display strong near-term momentum, which has attracted speculative interest and leveraged trading.

-

However, each also carries embedded risks: weakening new-wallet or on-chain signals (XRP), parabolic structure and vulnerability to correction (ZEC), or big upcoming supply unlocks (STRK).

-

Liquidation maps suggest that if either price reverses, the magnitude of forced exits (especially of long positions) could amplify the move downward.

-

As always, this analysis is informational only — not investment advice. Traders should exercise caution, conduct their own research (DYOR), and carefully consider leverage and position sizing.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.