In our review for October 25, we examine how the top-cryptocurrencies are behaving with respect to key support and resistance levels, volume dynamics, and potential scenarios. The assets under scrutiny include Bitcoin (BTC), Ethereum (ETH), BNB, XRP, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), HYPE, Chainlink (LINK) and Stellar (XLM). Our aim is to provide a comprehensive snapshot of where things stand, what to watch next, and what could unfold depending on which side (bears or bulls) gains the upper hand.

Bitcoin (BTC)

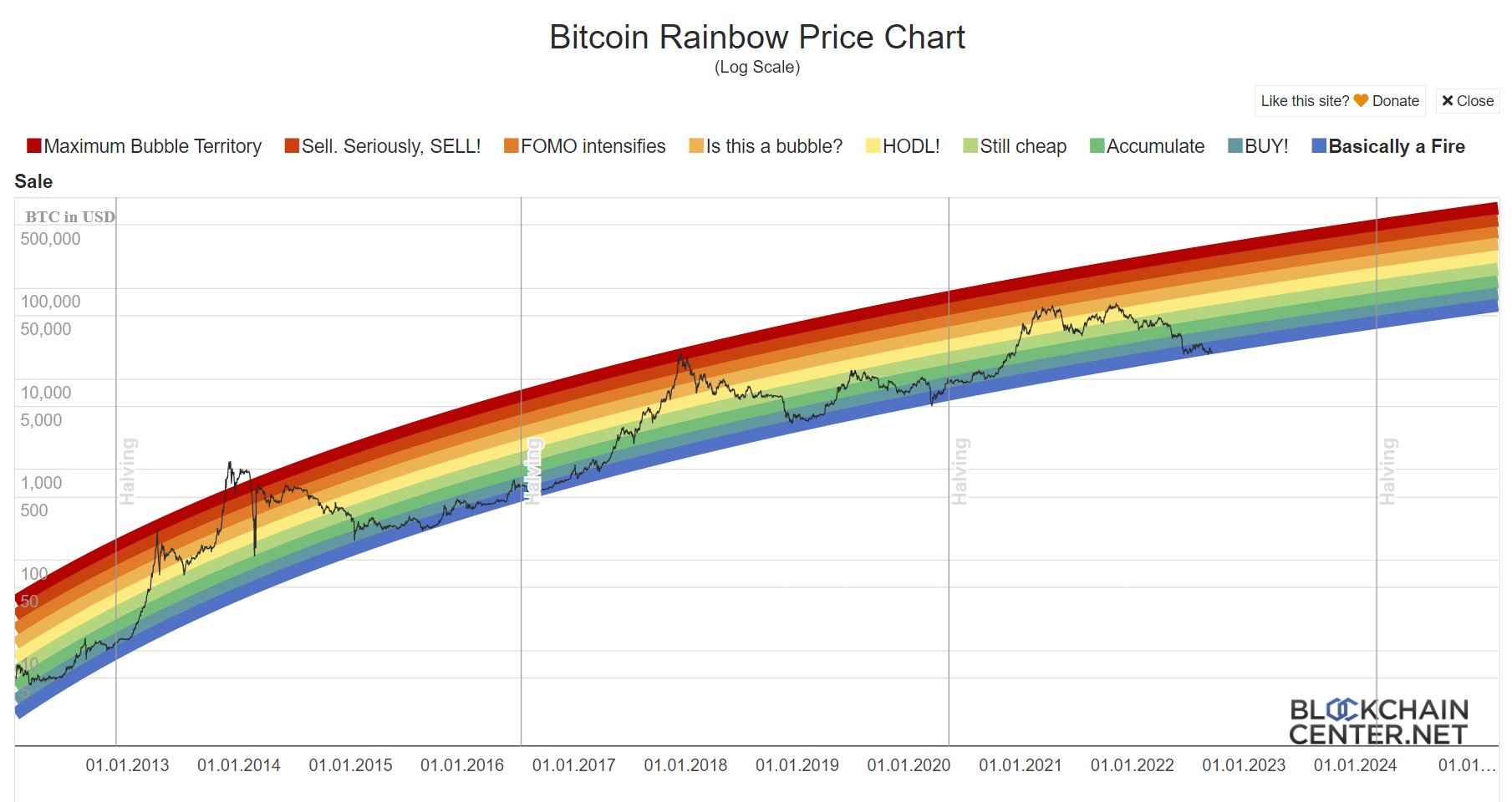

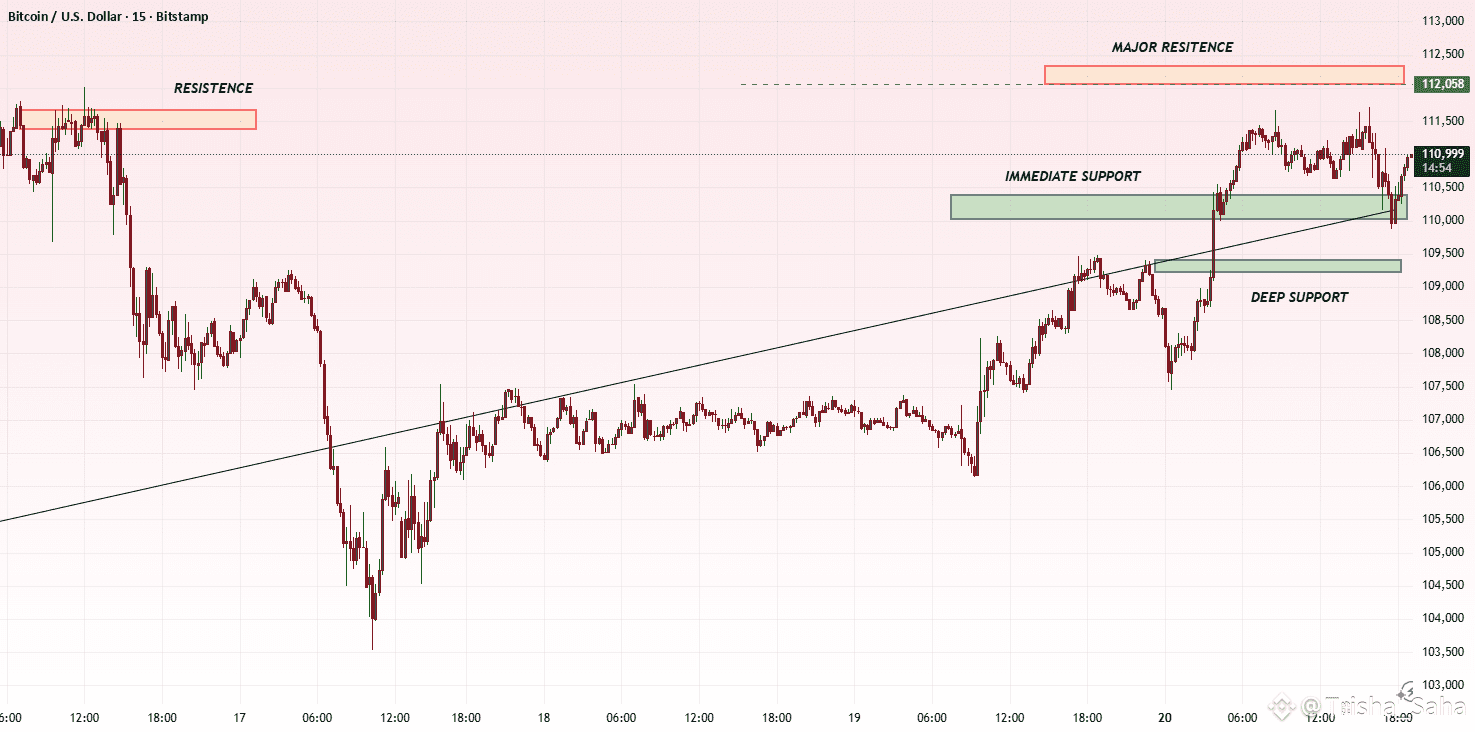

BTC is attempting to reclaim upward momentum but the bears remain stubbornly active around the $112,000\$112{,}000 zone. Analysts at Bitfinex note that the 18.1% correction from peak to trough this month is consistent with previous cycle tops since 2023—suggesting accumulation rather than an immediate trend reversal.

According to Mike Novogratz (CEO of Galaxy Digital), BTC needs to hold around the $100,000\$100{,}000 level; he forecasts a trading range of roughly $100,000 \$100{,}000 to $125,000\$125{,}000 until a breakout occurs.

Key levels to watch:

-

Support: $107,000\$107{,}000 — if broken, risk of deeper pullback toward $100,000\$100{,}000 or even $87,801\$87{,}801 under a double-top scenario.

-

Resistance: clearance above the moving averages would open up the historical high near $126,199\$126{,}199.

Implication: The market is in a delicate accumulation phase: bulls need a breakout above resistance to resume uptrend, while bears might succeed in pushing toward stronger correction if support fails.

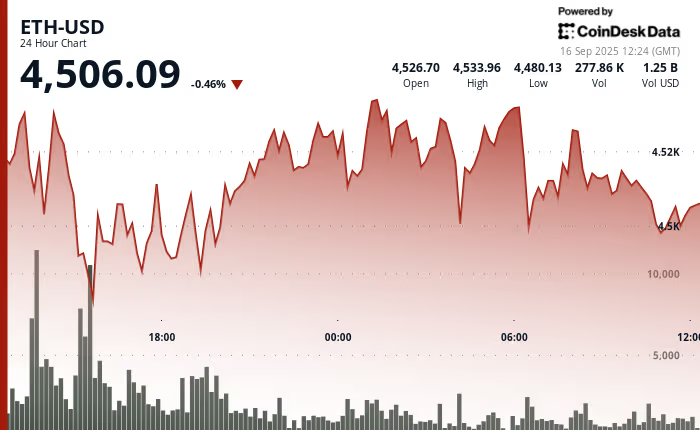

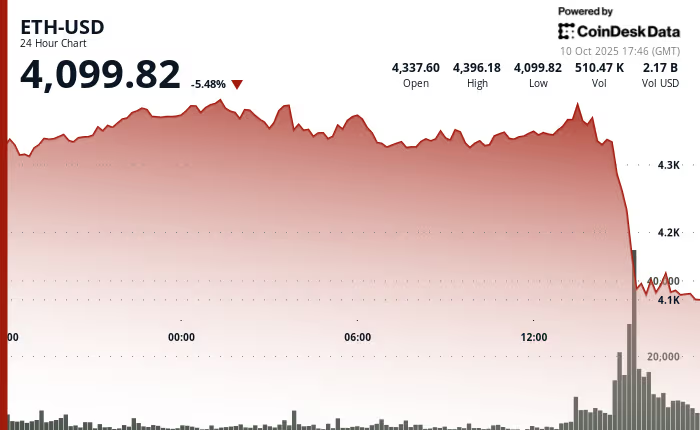

Ethereum (ETH)

If the bulls can push above that EMA, it would signal waning selling pressure and could open a move toward the 50-day SMA. Conversely, failure to clear the EMA could leave ETH vulnerable to a drop toward $3,435, or further down to $3,350.

Implication: ETH remains in a consolidation/weak trend phase. A breakout above the short-term EMA could offer the next directional cue; otherwise risk remains for a deeper slide.

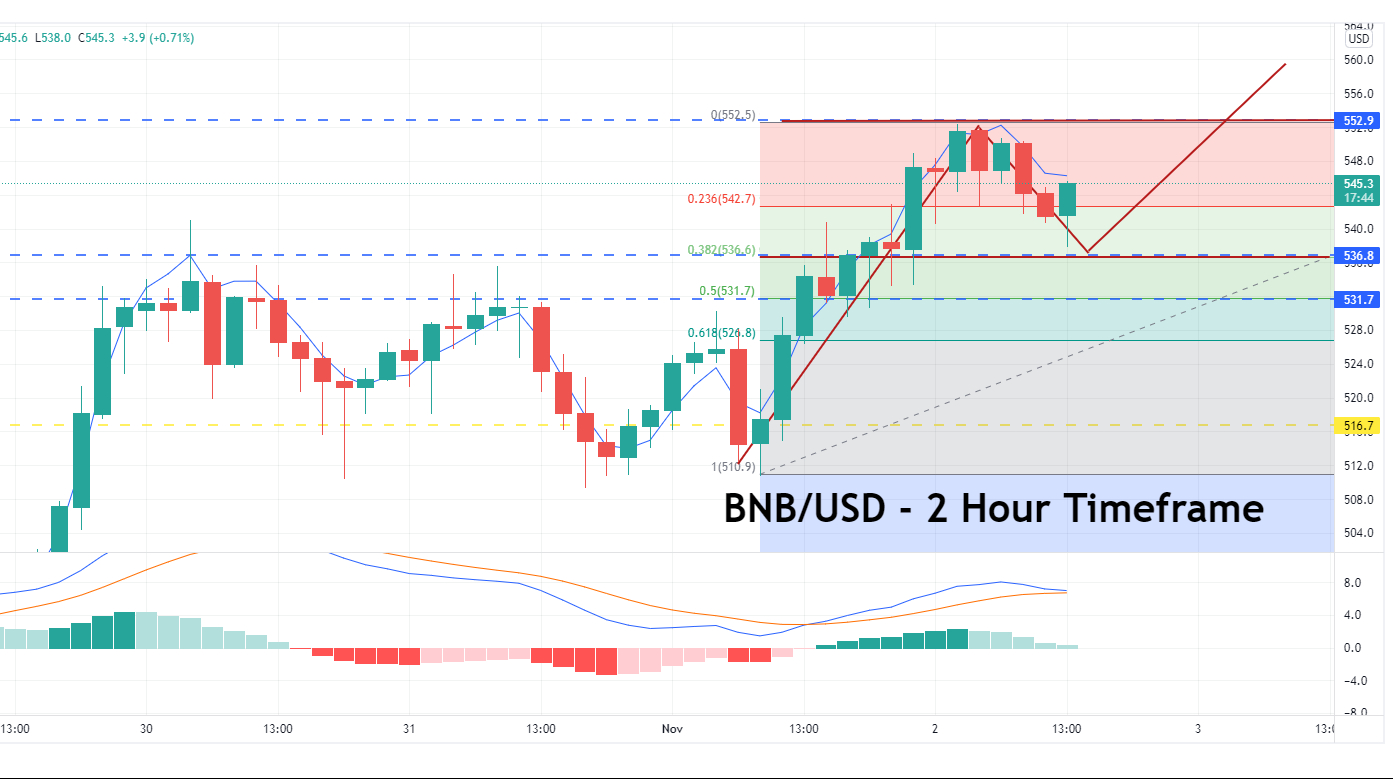

BNB

If bulls fail to clear $1,120 (near the 20-day EMA), there’s a risk of a slide toward $1,021 (and possibly $1,000). On the upside, a break above $1,156 opens the door toward $1,239 (61.8% Fibonacci).

Implication: BNB is in a tug-of-war between recovery attempts and renewed bearish pressure. A breakout would favour bulls; otherwise a deeper correction may begin.

XRP

If XRP can close above the EMA, the path opens toward $2.69 and then the upper trendline. If it fails, it may continue to drift lower within the channel.

Implication: Watch for either a breakout above the EMA (bullish signal) or renewed bearish rejection (potential sideways or lower movement).

Solana (SOL)

If bulls break past that level, SOL could jump toward $238, even $260. But if rejected here, the price may return to support.

Implication: SOL is at a decision point—either launching upward if momentum builds, or stalling if bears re-assert control.

Dogecoin (DOGE)

If bulls regain control and clear $0.21, the next target lies around $0.23 (50-day SMA) and potentially $0.29. If bears dominate and push below $0.18, downside risk could reach $0.16 or even $0.14.

Implication: DOGE is range-bound within a low volatility environment; a breakout either way could give the next leg of movement.

Cardano (ADA)

Resistance sits at the EMA20 (~$0.69); if bulls push through that, the next target is the 50-day SMA (~$0.79) and possibly the descending trendline. If ADA fails to break upward, there’s a risk of dropping toward $0.50.

Implication: ADA is in a cautious recovery posture; traders should look for confirmation of trend reversal or risk a deeper retreat.

HYPE

If bulls can force its way above the EMA20 (~$40.02), the move could extend toward the 50-day SMA (~$46.18). Conversely, failure could lead to a breakdown toward $30.50.

Implication: HYPE is showing potential for an upward move, but the breakout remains to be confirmed.

Chainlink (LINK)

If bulls manage a close above that EMA, LINK could target $23.73 and maybe $25.64. If rejected, the downside risk is to $15.43.

Implication: LINK remains in a falling channel; a breakout could mark a trend change, else more downside may unfold.

Stellar (XLM)

If the bulls overcome the EMA and break the downward trendline, that would signal strength. If they don’t, the bears may force a drop toward $0.29 and possibly $0.25.

Implication: XLM remains in a cautious recovery process; the EMA20 is the immediate hurdle.

Summary & Outlook

Across the ten major cryptocurrencies analyzed, the common theme is: tight consolidation and a latent potential for either breakout or breakdown. Many of them are at or near respected support/resistance zones (moving averages, trendlines, Fibonacci levels). The market appears to be accumulating rather than easily trending at the moment—suggesting that a decisive second leg upward may require a clear catalyst.

Key takeaways:

-

Bulls need to push through the short-term resistances (often 20-day EMA or similar) to regain momentum.

-

Bears retain the ability to force a deeper correction if support levels give way.

-

This environment favours traders who place themselves just beyond key breakout or breakdown levels, with tight risk controls.

-

Given the accumulation tone, the next major move may be significant—but which direction remains uncertain until triggers emerge.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency trading involves high risk; please conduct your own research and consider your risk tolerance before acting.

Feel free to ask if you’d like a deeper breakdown of any particular asset (e.g., ADA, SOL) or an updated view including volume/market-sentiment indicators.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.