After an impressive surge in early Q4, Solana (SOL) is now under mounting pressure, having lost nearly 20 % of its value in just a few trading sessions. While the on‑chain fundamentals remain robust, technical indicators and market sentiment suggest a risk of a deeper correction—potentially dragging SOL below the psychological threshold of $100.

Technical Landscape: Trending Toward the Edge

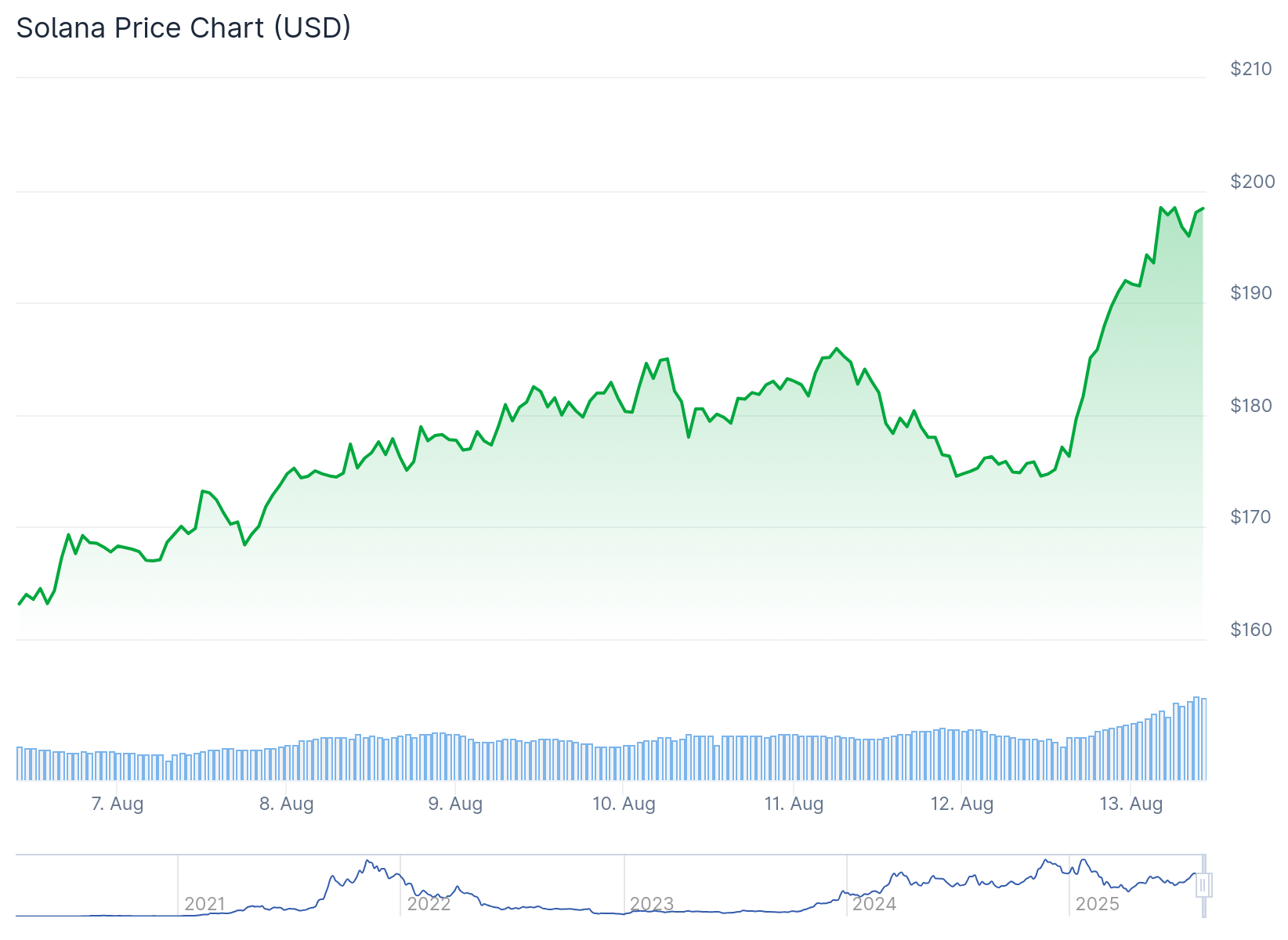

Currently trading around $156, having recently dipped to a short‑term low of around $148, Solana is hovering near its long‑term up‑trend line that dates back to 2023. According to one trader on X (formerly Twitter):

“If this breaks, trust me there’s no magic — it’s a 30‑40% slide straight into the next liquidity zone.”

If Solana fails to maintain its trend support, analysts warn of a possible 30‑40 % decline—potentially dragging the price into or under the $100 region. Key zones to watch include:

-

The $150–$160 range: a critical support cluster.

-

A lower risk‑entry area around $122.

-

Resistance around $200, which would signal a reversal of the downward momentum.

Meanwhile, liquidity heatmap data for the SOL/USD pair reveal that the price has already swept through the $180 support zone and cleared many lower liquidity clusters. The next significant liquidity concentration lies near $200‑$220.

In short: unless SOL holds above its trendline and key support, the path downward looks plausible.

On‑Chain & Ecosystem Strength: A Contradictory Signal

Contrasting the wobbly price action, Solana’s underlying network metrics show sustained strength:

-

The network is reportedly generating about $8.5 million in blockspace value per week.

-

DEX trading volume is around $29 billion, reportedly exceeding that of Ethereum (ETH).

-

Transaction count is approximately 543 million, with over 15.5 million active addresses—figures that place Solana among the most active chains.

-

The ecosystem is also a major hub for stablecoin flows; October saw record stablecoin movements on the network.

These indicators challenge the narrative that “Solana is dead,” suggesting that despite the price headwinds, the project continues to deliver on its technical and network potential.

Market Sentiment & Dependencies: The Bigger Picture

While Solana’s network fundamentals remain favorable, the broader cryptocurrency market sentiment and macro conditions play a critical role:

-

The recovery of Solana—and by extension many altcoins—will depend significantly on the performance of Bitcoin (BTC). Analysts note that unless Bitcoin stabilises above its key support (near ~$95 k), altcoin rebounds may be delayed.

-

Investor behaviour and institutional exposure also matter: for example, a firm known as Forward Industries, Inc. reportedly holds around 6.82 million SOL with an average purchase price of $232, currently recording a ~24 % unrealised loss (~$382 million).

-

The sentiment is that even though there’s strong on‑chain action, the short‑term outlook is cautious until market structure improves.

Possible Scenarios Ahead

Given the setup, we can frame a few potential scenarios for Solana’s near to medium‑term direction:

-

Bearish scenario:

– Price breaks the up‑trend line and key support at ~$150.

– A 30‑40 % drop materialises, possibly bringing SOL under $100.

– Continued weak sentiment and Bitcoin weakness compound the decline. -

Base case / consolidation:

– Price holds the ~$150–$160 support region, oscillates sideways.

– On‑chain data remains strong, but meaningful upside is delayed until broader market improves. -

Bullish scenario:

– SOL holds support, Bitcoin stabilises, sentiment flips.

– Price could target resistance near $200, and longer‑term structural uptrend resumes.

Final Thoughts

In short: despite robust on‑chain fundamentals and a vibrant ecosystem, Solana is facing a delicate moment. The price is threatening to break significant technical support, and a drop toward—or even below—$100 is not off the table if the trend line fails and wider market conditions remain weak. Investors should keep a close eye on:

-

Whether SOL can hold above $150–$160.

-

Bitcoin’s ability to stabilise and support altcoins.

-

Liquidity zones and order‐flow behaviour around key price thresholds.

As always: this is not investment advice. The cryptocurrency market is highly volatile, and past performance is not indicative of future results. Make sure to do your own research and manage your risk accordingly.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.