In a strategic pivot reflecting the evolving geopolitics of finance, Russia is actively developing a legal structure for cryptocurrency transactions with the express goal of circumventing Western sanctions. Russia’s latest regulatory efforts suggest a broader shift: embracing digital assets for international commerce while keeping domestic usage tightly restricted.

The Emerging Legal Framework

According to recent media reports, Russia’s Ministry of Finance and Central Bank have agreed to legalise the use of cryptocurrencies specifically for cross-border trade settlements. This measure builds on earlier regulatory moves, including the legalisation of crypto mining and the establishment of “experimental legal regimes” allowing certain crypto operations.

Crucially, while cryptocurrencies are being opened up for international commerce, their use in domestic consumer payments remains banned—a mechanism designed to preserve the primacy of the Russian ruble while enabling alternative financial channels abroad.

Motivations Behind the Shift

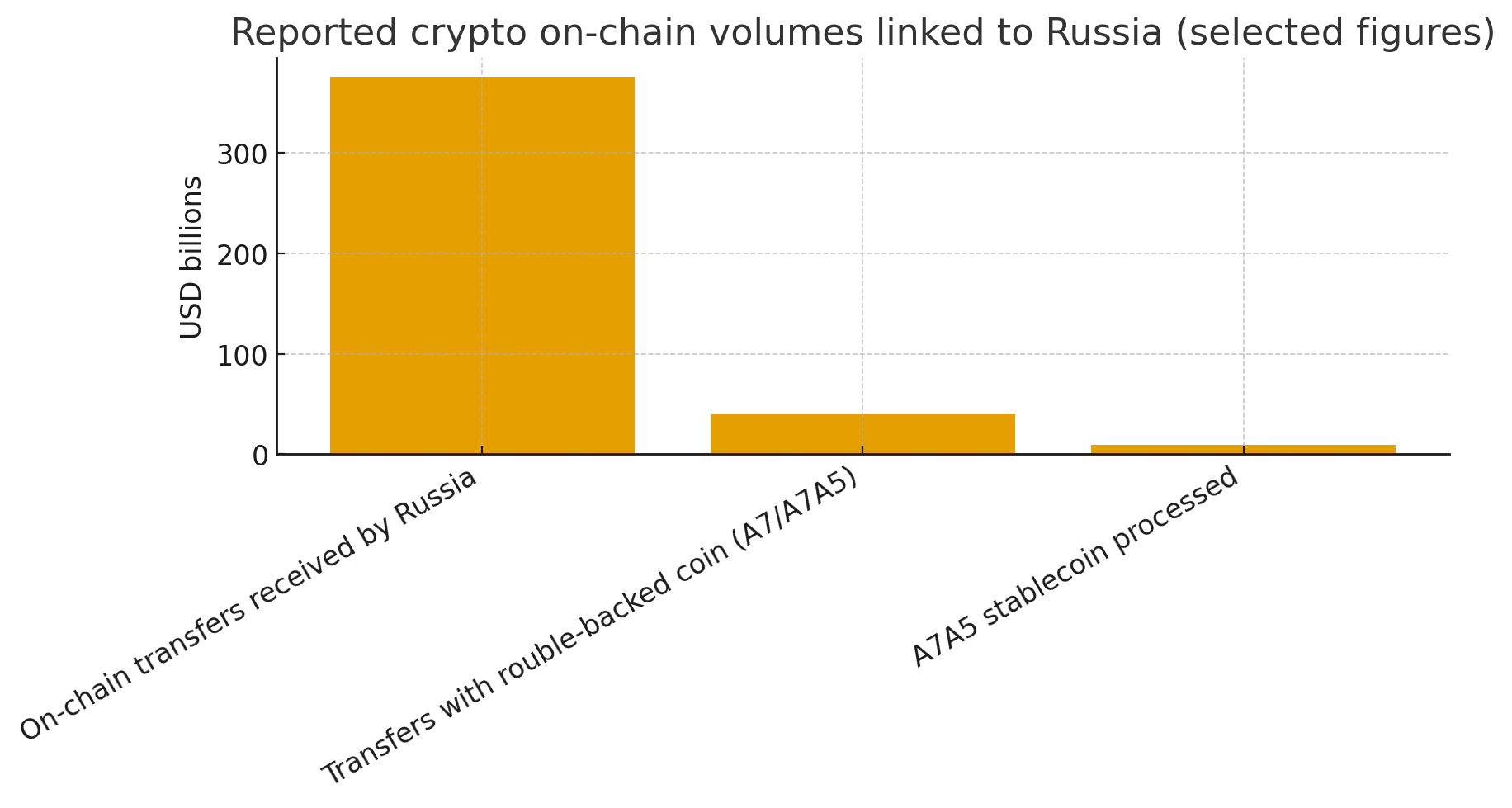

The regulatory evolution is widely interpreted as a response to the economic isolation imposed by Western sanctions following Russia’s actions in Ukraine. With access to traditional international banking and payment systems impaired, expanding digital-asset use offers Russia an alternative path for maintaining cross-border trade and financial flows.

By establishing a legal framework for crypto in international trade, Russia can reduce dependence on legacy systems such as SWIFT and the U.S. dollar-based payments architecture, which remain vulnerable to Western controls.

Regulatory Safeguards and Continued Restriction

While opening a door for international crypto usage, Russia is simultaneously imposing regulatory safeguards: businesses engaged in crypto cross-border transactions will still face requirements such as know-your-customer (KYC) and anti-money-laundering (AML) compliance, under supervision by the Central Bank and other authorities.

At the same time, domestic retail use of cryptocurrencies remains prohibited: the state appears intent on preventing the spread of crypto payments among ordinary consumers, thereby protecting the rouble’s status and curbing financial instability.

Implications and Challenges

This regulatory recalibration has several significant implications:

-

Alternative Payment Channels: Russia is positioning itself to trade with non-Western countries—such as China, India, and Turkey—by leveraging crypto-based settlement mechanisms.

-

Sanctions Evasion Risk: As many analysts point out, the use of digital assets for sanctions-bypass remains a risk. While the blockchain is transparent, identifying and policing cross-border flows remains complex.

-

Regulatory Credibility and Implementation: Legalising crypto for international trade is one thing; building reliable infrastructure, compliant service providers, and effective oversight is another. The success of this initiative depends on how effectively Russia can implement and regulate the system.

-

Domestic Financial Stability: By continuing to ban domestic crypto payments, Russia is trying to avoid crypto-induced volatility or a competing currency challenge to the rouble. But this raises questions about how the domestic crypto ecosystem will evolve under such constraints.

Looking Forward

Russia’s new framework signals a clear shift: cryptocurrencies are no longer viewed solely as speculative assets or domestic risks, but as tools of economic strategy and resilience. However, many questions remain: how well will the new system handle enforcement and oversight? Will Western authorities respond with tighter regulations or coordinated monitoring? And how will global crypto platforms and service providers react to a market entering via Russia’s alternative financial route?

What is clear: Russia is embracing digital assets not primarily for retail innovation, but as a strategic lever in a constrained international payments landscape. The coming months will reveal whether this regulatory bet can become a viable channel—or if it will encounter bottlenecks, resistance, or unintended consequences.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.