In recent remarks at the BCVC Summit in New York, Stephen Miran — Governor of the Federal Reserve (Fed) — sounded an alert to the financial‑markets community: the accelerating growth of U.S.‑dollar‑pegged stablecoins may be quietly reshaping the interest‑rate landscape.

The Growing Role of Stablecoins

Stablecoins are cryptocurrencies whose value is tied to a stable asset, most often the U.S. dollar. They were originally designed to provide a “crypto‑friendly” version of fiat currency or a bridge between volatile cryptocurrencies and real‑world value.

Governor Miran emphasized that these tokens are no longer niche: they are gaining traction globally, and in doing so, they are starting to influence demand for traditional dollar‑denominated assets. For example:

-

He noted that stablecoins are already increasing demand for U.S. Treasury bills and other liquid dollar assets from foreign purchasers.

-

He referenced estimates that the stablecoin market could grow into the $1 trillion to $3 trillion range within a few years.

In summary: as more capital shifts into stablecoins, especially outside the United States, that means increased purchases of dollar‑denominated safe assets — and that has implications for supply and demand in the broader financial system.

Why This Could Lower Interest Rates

Miran explained that one key mechanism is through what economists call the neutral rate of interest (often written r‑star) — the level of the short‑term interest rate that neither stimulates nor slows the economy.

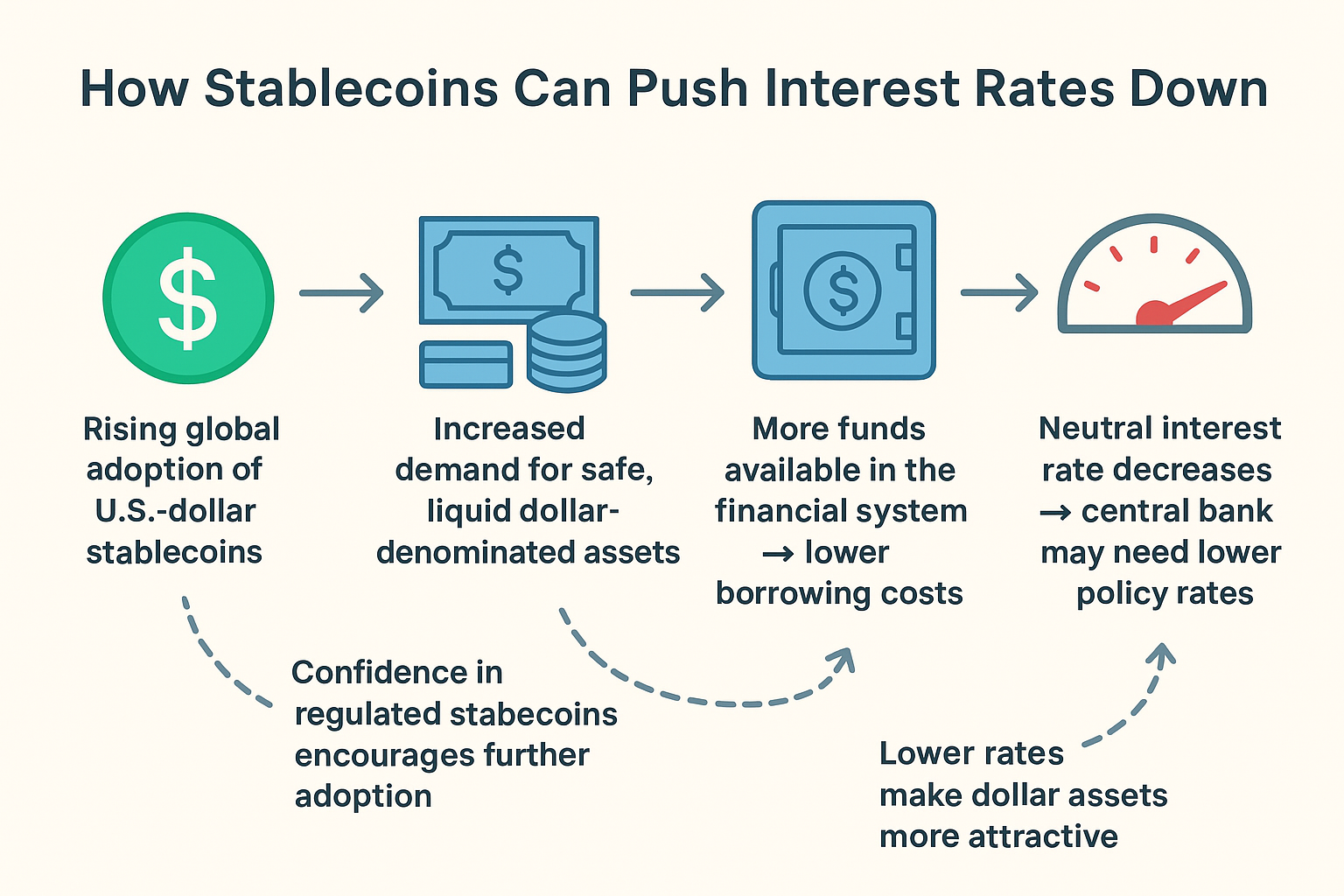

Here’s how the logic works:

-

As stablecoins grow, they bring additional funds into the economy’s pool of “loanable funds” (money that is available for borrowers).

-

A growing supply of loanable funds tends to push downward the rate that must be paid for borrowing (all else equal) — i.e., it lowers the neutral rate.

-

If the neutral rate is lower, then policy rates (such as the Fed’s benchmark rate) may need to be lower than they otherwise would to maintain appropriate monetary‑policy stance. Miran put it succinctly: “If r* is lower, policy rates should also be lower than they would otherwise be.”

-

Therefore, the rise of stablecoins may act as a downward pressure on interest rates by altering the underlying structure of funds and demand for safe dollar assets.

In Miran’s words: stablecoins may become “the multitrillion‑dollar elephant in the room” for central bankers.

Broader Implications for Monetary Policy & Financial Markets

The potential for stablecoins to influence rates and asset demand has several knock‑on effects:

-

Government borrowing costs

Because stablecoin‑driven demand is increasing purchases of U.S. Treasuries and dollar‑liquid assets, the cost of U.S. government borrowing could be lowered. Miran observed that this trend “lowers borrowing costs for the U.S. government.” -

Dollar strength and global flows

Stablecoins denominated in U.S. dollars reinforce the global role of the dollar: they allow people across jurisdictions to hold and transact in dollars more easily. Miran pointed to this as a factor in the growing attractiveness of dollar assets.

This could lead to higher demand for U.S.‑dollar assets from abroad, which further feeds into the dynamics of rates and cross‑border flows. -

Monetary‑policy challenges

Because the growth of stablecoins may lower the neutral rate, central banks may find that the “effective” floor for policy rates is lower than they estimated. Failing to adjust policy accordingly could mean unintended contractionary effects. Miran warned: “A failure of the central bank to cut rates in response to a reduction in r* is contractionary.”Regulation and oversight

Miran also emphasized that regulatory clarity matters. He praised the GENIUS Act in the U.S., which provides a framework for stablecoin issuers (requiring reserves backed 1:1 with safe assets) and thus helps integrate stablecoins into the regulated system.

Stronger regulation may increase adoption and thereby strengthen the effect of stablecoins in the system — but also implies more oversight of the risks. -

Financial‑stability considerations

Although Miran’s speech was focused on rates and funds, the growth of stablecoins also raises questions of systemic risk (runs, redemption risk, deposit‑substitution) and bank disintermediation. The structural change in how funds flow matters for bankers and regulators alike.

Key Takeaways

-

The rise of stablecoins is not just a crypto phenomenon: it has implications for mainstream monetary‑policy channels.

-

Because stablecoins increase demand for dollar assets and expand the supply of loanable funds, they can exert downward pressure on the neutral rate of interest — meaning that central banks may need to adjust their policy horizon.

-

If central banks ignore this structural shift, they risk setting policy that is inadvertently too restrictive.

-

From an investor or policymaker perspective, this means that rate‑forecasting may need to incorporate the growth path of stablecoins and their impact on asset‑markets and funds‑flows.

-

Regulation matters: a robust framework for stablecoins increases legitimacy and integration into the financial system, which in turn enhances the magnitude of the effect described.

Concluding Thought

The financial world is witnessing how what once seemed like a crypto‑niche innovation is morphing into a structural factor in global finance. The growth of stablecoins may quietly reshape where money flows, how much is available to be lent, and ultimately, the level at which interest rates settle. For central bankers, regulators and market participants alike, this means paying attention not just to inflation or employment, but also to the plumbing of digital‑dollar flows and how they feed into the traditional rate‑setting mechanism.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.