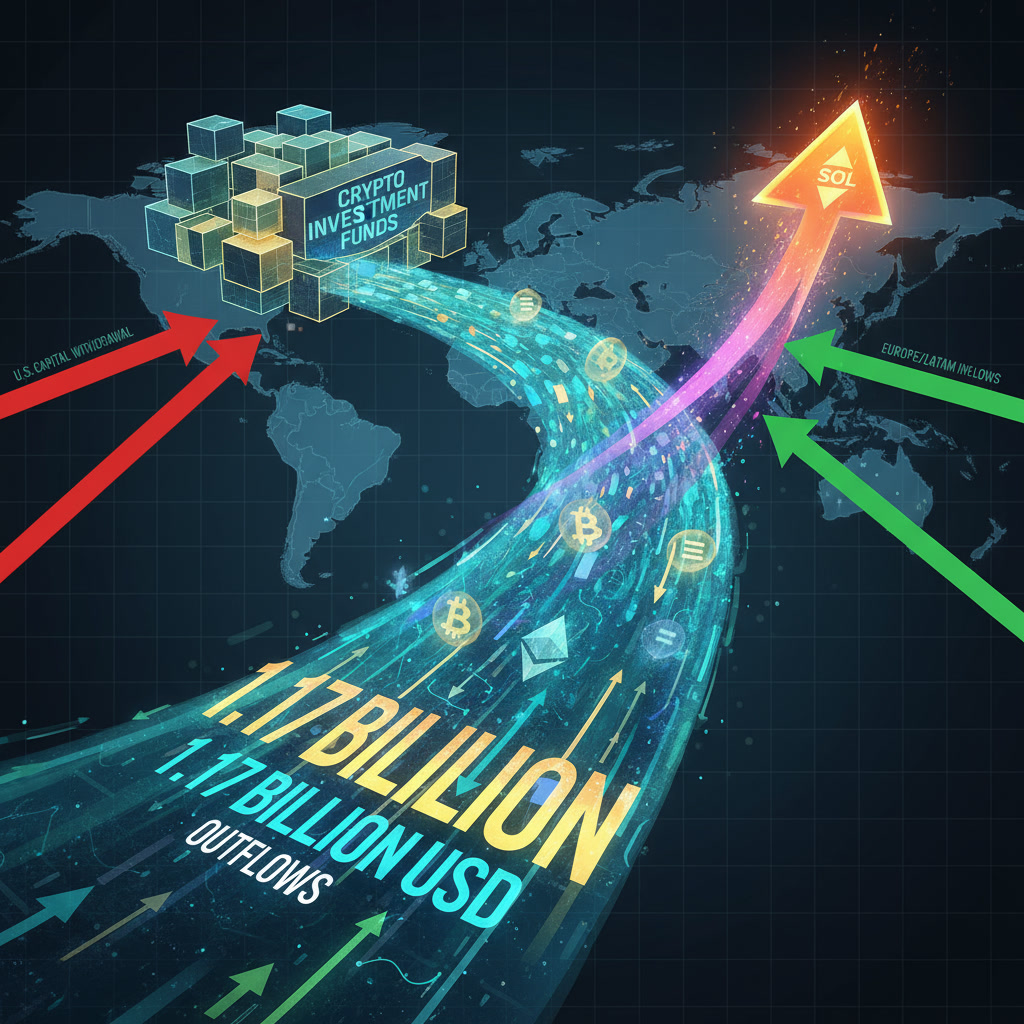

Last week, global investment products in the cryptocurrency sector experienced a sharp reversal: according to a report by CoinShares, net outflows of approximately US$1.17 billion were recorded from crypto-asset funds.

The Big Picture

Investment vehicles in the crypto space — including ETPs (exchange-traded products) managed by asset managers such as BlackRock, Fidelity Investments, Grayscale Investments, Bitwise Asset Management and ProShares — were the focus of the assessment.

The outflow contrasts with still-relatively high trading volumes (the weekly ETP trading volume reached about US$43 billion) which suggests investors are still active, but perhaps shifting or exiting positions.

Drivers & Regional Breakdown

James Butterfill, Head of Research at CoinShares, pointed to a climate of negative sentiment — not least following a turbulence episode on 10 October and ongoing uncertainty about the timing of a potential interest‐rate cut by the Federal Reserve in December.

From a regional perspective:

-

The U.S. led the outflows, with about US$1.22 billion exiting U.S.-based funds.

-

By contrast, European and Latin American markets saw modest inflows:

-

Switzerland: ~US$49.7 million incoming.

-

Germany: ~US$41.3 million.

-

Brazil: ~US$12 million.

-

By Asset: Bitcoin, Ethereum & Others

Among crypto assets:

-

Products linked to Bitcoin bore the brunt: roughly US$932 million was withdrawn in the week.

-

Short-Bitcoin funds actually saw some inflows (~US$11.8 million) during the same period.

-

For Ethereum-linked products, the global net outflow was about US$438 million, with U.S.-domiciled spot-ETH ETFs alone losing ~US$507.7 million. These losses were somewhat mitigated by inflows elsewhere.

-

Interestingly, some altcoins enjoyed strength: for example, products tied to Solana (SOL) reported US$118 million of inflows during the week — pushing cumulative nine-week inflows for SOL to about US$2.1 billion.

Market Implications

The significant outflows from major funds highlight several key concerns and dynamics in the crypto-asset market:

-

Investor sentiment is fragile: The sharp drawdowns and macro uncertainties (rate policy, regulatory risk, etc.) appear to be driving caution or capital exit.

-

Volatility remains elevated: The report mentions that BTC and ETH had weekly drops of about 5.3 % and 8.4 % respectively, though there was a partial recovery on Sunday into Monday.

-

Regional divergence: The U.S. seems to be experiencing the brunt of outflows, while some other regions are seeing modest inflows — suggesting geographic shifts in investor appetite.

-

Selective interest in altcoins: While the majors suffered net outflows, some alt coins like SOL are capturing new capital. This could hint at selective rotation or a search for higher-beta exposures.

-

ETP flows matter: Funds that aggregate institutional and retail flows (like ETPs) serve as one of the clearest barometers of market sentiment; hence, massive outflows are a red flag.

-

Potential buying opportunities? For contrarian investors, large outflows can either herald capitulation (potential bottoming) or signal a deeper drawdown ahead. The key will be monitoring whether capital will return.

Looking Ahead

Given this backdrop, a few items to watch:

-

Interest rate outlook: If the Fed signals a credible path to rate cuts, it might ease risk-on flows and encourage re-entry into crypto funds.

-

Regulation & crypto policy: Any regulatory developments (especially in the U.S.) may either reassure or spook investors further.

-

Fund‐flow reversal: A meaningful return of capital (positive net inflows) into crypto investment products could mark a sentiment shift.

-

Asset rotation: Will funds continue to favour altcoins (SOL, etc.) over majors like BTC and ETH, or will the majors re‐emerge as safe havens within crypto?

-

Price action & correlation: If price begins stabilising, will flows follow? Or will flows continue to lead price?

Conclusion

The recent US$1.17 billion outflow from crypto investment funds marks a notable moment for the cryptocurrency asset class. It underscores how macro factors, sentiment, and fund‐flow dynamics are deeply intertwined with asset-price behaviour. While the broad withdrawal may signal caution, the selective inflows into certain altcoins and regions suggest a nuanced picture — one where capital is not simply fleeing crypto wholesale, but rather reallocating. Watching fund flows in conjunction with price moves, policy signals, and global capital rotation will be critical in determining whether this is a transient correction, a structural shift, or the precursor to the next leg of the cycle.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.