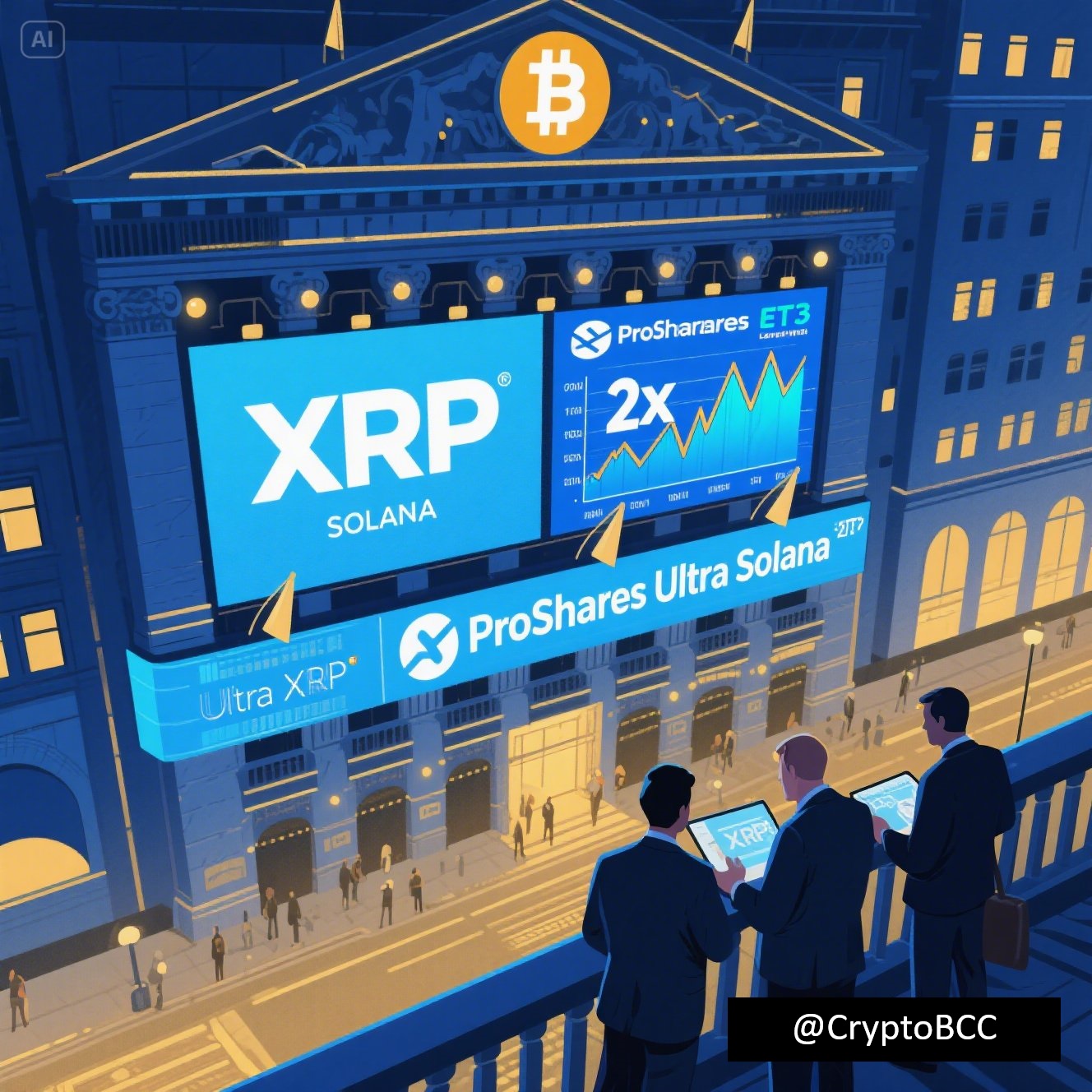

In a groundbreaking move for the digital asset space, NYSE Arca has officially approved the listing and trading of ProShares Ultra XRP ETF and ProShares Ultra Solana ETF, signaling a significant shift in the integration of cryptocurrencies into traditional financial markets.

This landmark approval not only opens the door for broader institutional investment in XRP and Solana (SOL) but also reflects the increasing appetite for crypto-based financial instruments within regulated U.S. exchanges.

A Major Step Toward Legitimacy

With this approval, NYSE Arca, a leading electronic securities exchange in the U.S., enables ProShares to legally list and trade leveraged ETFs tied to XRP and Solana’s daily performance. This milestone brings two volatile but high-potential assets into a more secure and accessible environment for both institutional and retail investors.

While these products offer high upside potential, they also come with notable risks, especially due to the leveraged structure and the inherent volatility of crypto markets.

Understanding the ProShares Ultra XRP ETF

The ProShares Ultra XRP ETF aims to deliver twice the daily return of XRP, giving investors a leveraged exposure to the token’s price movements. However, it also comes with a clear risk disclosure: the prospectus warns of potential manipulation, extreme volatility, and even the risk of XRP’s price dropping to zero.

According to ProShares’ 2023 documentation:

“XRP remains a relatively unregulated and speculative asset class, subject to sudden price changes and liquidity constraints. Investors should be fully aware of these risks before entering the market.”

This ETF is clearly designed for experienced investors seeking short-term leveraged gains, not for passive or long-term holders.

The Rise of Solana: ProShares Ultra Solana ETF

Mirroring the structure of the XRP product, the ProShares Ultra Solana ETF has also received green light from NYSE Arca. This ETF will track twice the daily price fluctuations of Solana (SOL), offering another high-risk, high-reward opportunity to crypto-savvy investors.

John Smith, Chief Investment Officer at ProShares, emphasized:

“Listing Solana on NYSE Arca is a crucial milestone. It enables deeper institutional access and enhances Solana’s presence in mainstream finance.”

The ETF is expected to accelerate institutional adoption of Solana and add to its growing credibility as a blockchain infrastructure for DeFi, NFTs, and Web3 applications.

Opportunities and Risks for Investors

Both ETFs bring unique advantages — primarily double leverage exposure and regulated trading mechanisms via NYSE Arca. They also provide greater market liquidity and lower barriers to entry for U.S.-based investors interested in crypto without holding tokens directly.

| Feature | ProShares Ultra XRP ETF | ProShares Ultra Solana ETF |

|---|---|---|

| Objective | 2x daily price movement of XRP | 2x daily price movement of Solana |

| Risk Factors | High volatility, potential price to zero | Market fluctuation, liquidity concerns |

| Transparency | Public filings, NYSE & SEC compliant | Public filings, NYSE & SEC compliant |

| Target Investors | High-risk-tolerant, short-term traders | Institutions, short-term strategic investors |

However, the leverage effect can magnify losses as much as gains. The U.S. SEC has consistently warned that crypto ETFs are not suitable for all investors due to increased volatility, risk of manipulation, and lack of historical benchmarks.

Frequently Asked Questions

How does ProShares Ultra XRP ETF differ from regular crypto ETFs?

It uses 2x leverage, meaning it aims to double the daily percentage movement of XRP’s price — unlike standard ETFs, which passively track prices.

What is the biggest risk of investing in the Ultra Solana ETF?

The extreme price swings of Solana, combined with leverage, can lead to rapid losses. Market liquidity and Solana’s dependency on ecosystem development are key concerns.

Is NYSE Arca a trustworthy venue for crypto ETFs?

Yes. NYSE Arca operates under strict U.S. regulations, offering transparent price discovery, high liquidity, and robust trading infrastructure.

What should investors consider before buying the ProShares Ultra XRP ETF?

They must assess their risk tolerance, understand the product’s structure, and ensure their investment strategy aligns with short-term, leveraged instruments.

What does the listing of Ultra Solana ETF mean for the market?

It marks a new phase in crypto adoption, making Solana more accessible to institutional investors and boosting its legitimacy within the financial mainstream.

Final Thoughts

The approval of ProShares Ultra XRP and Solana ETFs by NYSE Arca is a bold step in bridging the gap between traditional finance and the crypto world. While these leveraged ETFs present compelling opportunities for agile investors, they come with substantial risks that demand thorough due diligence and clear strategy.

As institutional doors begin to open wider for digital assets, products like these may shape the next evolution of crypto integration — bringing volatility, but also legitimacy, innovation, and capital into the ecosystem.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.