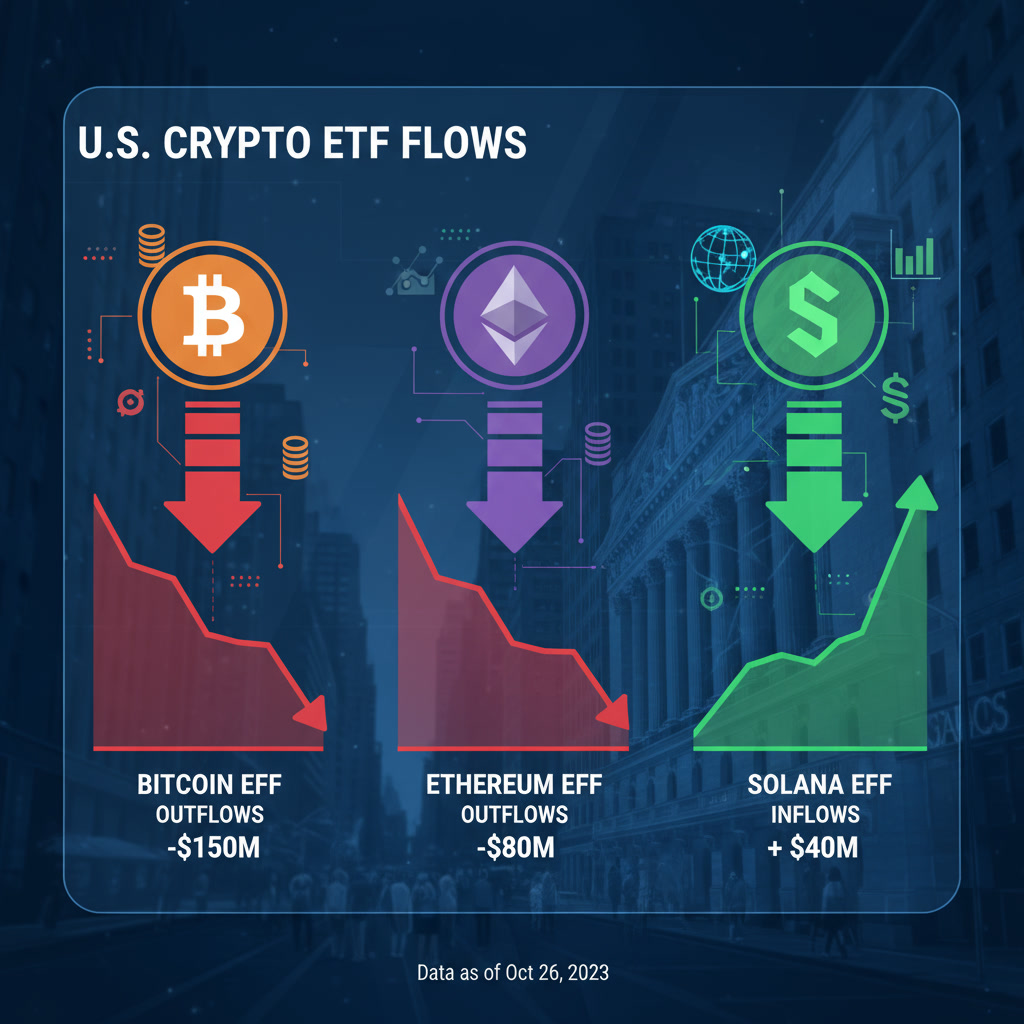

In recent data, it has emerged that all U.S. spot exchange‑traded funds (ETFs) tracking Bitcoin and Ethereum are experiencing significant net outflows, with zero new inflows recorded across the board. According to the report:

-

On October 30, all 12 U.S. spot Bitcoin ETFs recorded combined net redemptions of US$488.4 million.

-

Similarly, all 9 U.S. spot Ethereum ETFs posted net outflows totaling US$184 million, and no fund saw an inflow.

-

In contrast, the spot ETF for Solana captured fresh capital of about US$37.33 million, led by one fund that took in around US$36.55 million.

-

Among Bitcoin ETFs, the largest outflow was recorded by the BlackRock‑sponsored IBIT fund (US$290.9 million), followed by about US$46.55 million from the Fidelity Investments fund and US$65.62 million from the ARK Invest & 21Shares fund.

-

Despite the outflows, IBIT remains the largest Bitcoin ETF globally, holding over 805,000 BTC — at an approximate value of US$87 billion.

-

Meanwhile, Bitcoin’s price dropped about 1.4% to roughly US$109,345, amid concerns over the Federal Reserve’s interest‑rate policy.

Implications and Analysis

The lack of new inflows into Bitcoin and Ethereum ETFs suggests waning institutional enthusiasm or at least a pause in fresh commitments at the passive‑fund level. Some key takeaways:

-

The fact that every single fund (for both BTC and ETH) recorded net outflows suggests a broad‑based withdrawal, not localized to one fund.

-

This contrasts with Solana’s ETF receiving new money, implying that investors might be shifting capital toward newer or more speculative crypto exposures, rather than the dominant incumbents.

-

The large size of IBIT (holding ~805,000 BTC) means redemptions from it in absolute terms are bigger and may reflect scale rather than just investor sentiment.

-

Falling crypto prices (e.g., Bitcoin at ~US$109k) combined with macro‑uncertainty (Fed policy) are likely suppressing fresh capital deployment.

-

For long‑term holders or fund sponsors, persistent outflows can raise questions about the momentum of adoption of spot crypto ETFs and the narrative of “institutional flows” driving prices higher.

What This Might Mean Going Forward

-

If outflows continue, ETFs may be dragging rather than supporting the asset price. Fewer new buyers from large‑scale, passive vehicles reduces one potential source of demand.

-

On the flip side, significant redemptions could increase selling pressure, especially if the ETF managers have to liquidate holdings to meet redemptions (though many ETFs use creation/redemption in kind rather than cash).

-

The shift of interest toward altcoins (as seen with Solana) might signal that investors are positioning for a “next generation” crypto story rather than relying purely on Bitcoin or Ethereum dominance.

-

Regulatory, macro and sentiment headwinds remain: Fed policy, crypto regulation, and institutional risk appetite will be key determinants of whether these outflows are transient or part of a longer trend.

-

For investors: Low ETF inflows might indicate that the “easy money” rally narrative (i.e., “institutional flood = price rise”) is currently on pause. It may signal more caution or potentially consolidation in the market.

Conclusion

In summary, the latest figures show that all U.S.-listed spot ETFs focused on Bitcoin and Ethereum are experiencing net outflows and no new capital is coming in. This quieting of institutional fund flows is noteworthy, given the much‑anticipated role of ETFs in driving crypto adoption and price support. As the market digests this development, the broader crypto ecosystem may turn its attention to alternative tokens, macro pressures, and regulation as the next catalysts.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.