The past week in the cryptocurrency market was marked by both exhilaration and caution—a mixed landscape where sharp gains in select altcoins contrasted sharply with notable downturns. With key assets like Bitcoin (BTC) and Ethereum (ETH) largely stagnant, smaller-cap altcoins captured attention as traders sought opportunity amid muted liquidity and waning conviction. According to the article from CryptoBCC, the week’s “winners and losers” tableau offers valuable lessons for investors.

Market backdrop

During the week, the broader cryptocurrency market hovered in a state of indecision. Bitcoin remained around the US $100,000 level, while Ethereum traded sideways amid significant drops in trading volume.

The lack of clear directional momentum from the major assets drove speculation toward smaller‐cap altcoins, as traders sought short-term breakout plays rather than long-term value bets.

The winners

1. SOON – Three-digit breakout potential

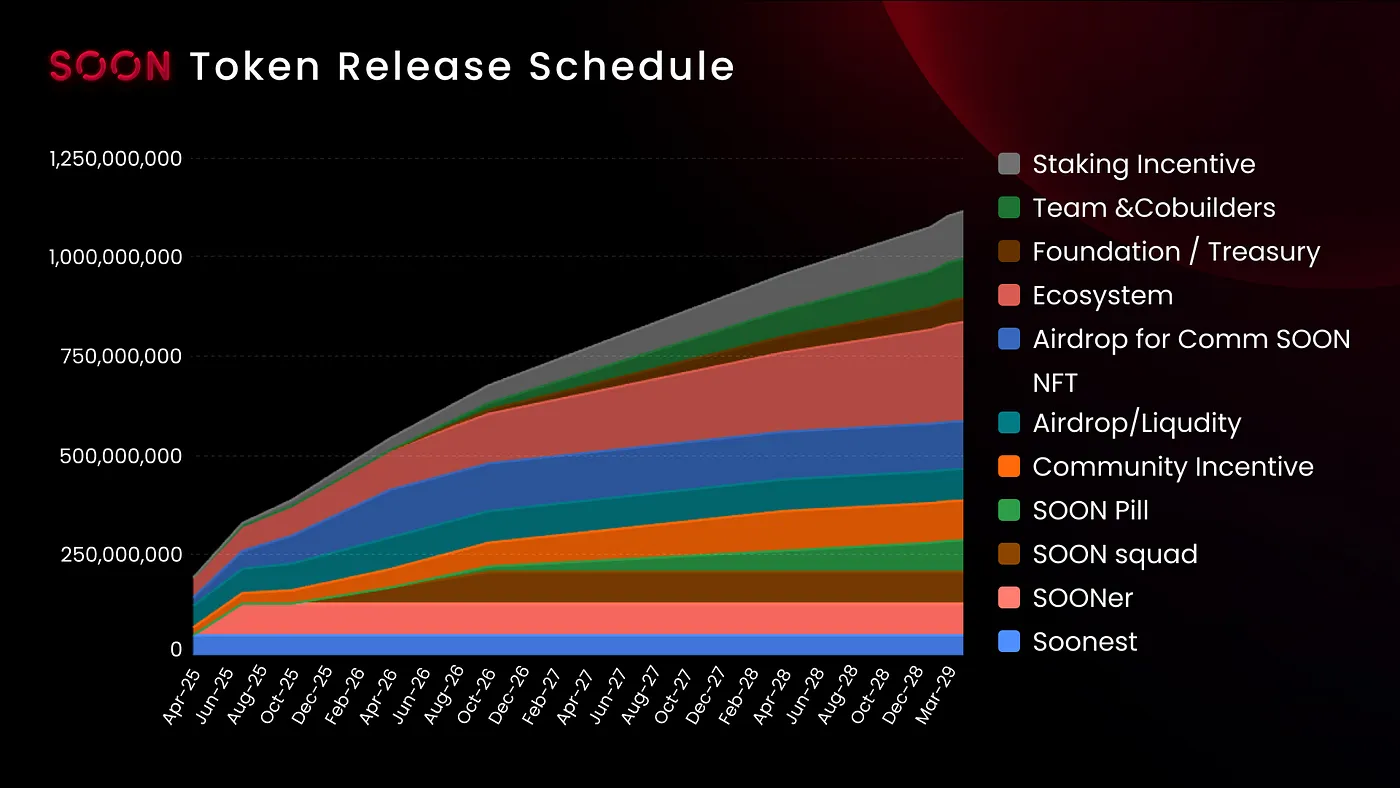

SOON was the standout performer of the week, posting a jaw-dropping ~185% rise. The asset had been consolidating in a narrow trading range under US $1, a phase often referred to by technical analysts as “price compression” — setting the stage for an explosive move.

On November 5, SOON surged ~119% to US $1.60, and then added more than 70% later in the week, forming consecutive new highs and signalling that the bulls were firmly in control.

However, indicators such as the Relative Strength Index (RSI) had already stretched into over-bought territory, suggesting that some retracement might be imminent. The article suggests a potential near-term support around US $2.15 and a resistance target near US $2.50 if momentum holds.

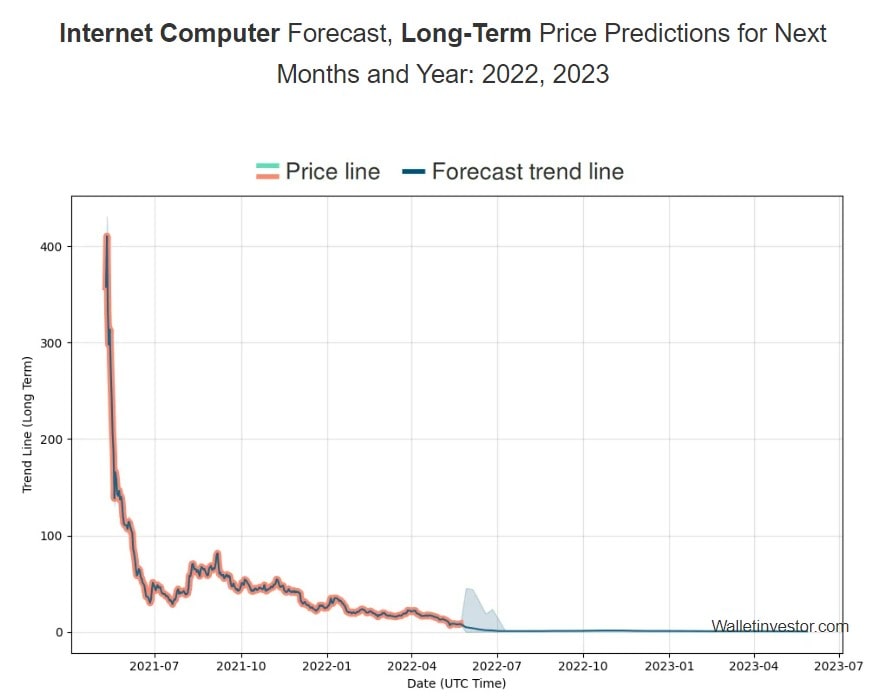

2. Internet Computer (ICP) – Back toward Q1 price levels

ICP was the second major gainer, climbing around 70% for the week. The catalyst? The launch of a new AI platform called Caffeine, which sparked investor interest and led to high derivatives open interest (OI) – over US $85 million in futures contracts.

Still, analysts caution that the surge may be driven more by news hype than by underlying fundamentals, especially since the price dropped nearly 20% after breaching US $9. Unless new buying interest materialises to absorb the derivatives pressure, the up-move may not sustain.

3. Filecoin (FIL) – Storage token in the spotlight

FIL rose roughly 54% during the week, riding momentum from the DePIN (decentralised physical infrastructure networks) narrative ahead of an event on 18 November. Derivatives data showed a whopping 819% increase in volume and a 115.8% jump in open interest, signalling strong speculative energy.

Nevertheless, two consecutive bearish candles erased more than 25% of the gains, prompting warning flags that the bulls must defend key support zones to maintain the advance.

Other smaller altcoins also posted large gains: for instance, DeAgentAI (AIA) soared ~568%, Ore (ORE) ~395%, and Tomi (TOMI) ~268%.

The losers

1. SPX6900 (SPX) – Index token loses key support

On the flip side, SPX led the decliners, falling ~25% in the week. The token exhibits a clear downtrend with four consecutive lower lows—from ~US $1.60 down to ~US $0.67.

Most recently, SPX cracked the ~US $0.80 support which had been in place since May. Despite some dip-buyers stepping in, the buying activity is too weak to trigger a meaningful trend reversal in an environment of low risk appetite. The article warns that SPX may test below US $0.60 if the current structure remains.

2. Virtuals Protocol (VIRTUAL) – AI token faces investor exodus

VIRTUAL dropped about 20% after two weeks of gains. A contributing cause: a large whale dumped 26.42 million tokens, amplifying the selling pressure. Despite previous efforts to break above ~US $1.90, the token failed to hold the breakout and risks deeper correction if current patterns persist.

3. Bittensor (TAO) – AI‐blockchain token erased recent gains

TAO fell ~20% to ~US $360, nearly wiping out gains from the prior month. On the intra-week charts, TAO attempted a recovery mid‐week but was rejected; the drop of ~8% on 8 Nov froze bulls out of the US $400 support zone. If ~US $360 breaks down, a deeper short‐term slump is likely, especially as many profit-taking from the ~US $530 top.

Other tokens falling significantly included Wilder World (WILD) down ~87%, SEDA down ~63%, and Paparazzi Token (PAPARAZZI) down ~49%.

Key take-aways

-

The week underscored the bifurcated nature of the crypto market: some altcoins exploded on speculative momentum, while others collapsed under risk-off sentiment and weak technicals.

-

For winners like SOON and ICP, the key challenge ahead is sustaining momentum beyond the initial hype—especially as RSI and derivatives metrics suggest recent moves may be overstretched.

-

For the losers, the breakdown of important support levels (as in SPX, TAO) highlights how quickly investor sentiment can swing, particularly in smaller assets where liquidity is thin.

-

More broadly: even when major assets manage to stay range-bound, speculation still thrives in less-liquid corners of the market—but those regions carry higher risk of whiplash.

-

As the article closes: staying calm, doing your research, and trading from a place of discipline remains as important as ever.

Final thoughts

This week’s crypto market action shows that the frontier of opportunity is also the frontier of risk. Assets like SOON and ICP delivered headline-making gains—but beneath the surface, both offer cautionary signals about sustainability. Meanwhile, SPX, VIRTUAL, TAO remind us that the window for gains can swiftly flip into one of losses when support fails and market sentiment turns.

Investors should view this as a timely reminder: clarity of thesis, acceptance of volatility, and preparation for both upside and downside are essential. In a market where narratives move fast and tide shifts faster, grounding decisions on fundamentals, risk management and psychology remains a best practice.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.