In this comprehensive technical analysis, we review major indices and digital‑assets as of 4 November 2025, highlighting key support/resistance levels and the shifting market dynamics. The sentiment across the board leans cautious, with several key benchmarks showing signs of vulnerability.

1. Equities – S&P 500 (SPX)

The S&P 500 remains in an up‑trend overall, but it is showing signs that the momentum may be fading. A bearish divergence is visible on the RSI, signalling that while price is moving higher, technical strength is waning.

-

If the bears manage to push the index below its 50‑day simple moving average (~6,647), then a deeper correction toward ~6,550 and perhaps ~6,400 may follow.

-

On the bullish side, if the bulls defend the 20‑day exponential moving average (~6,764) and manage a break above ~6,920, then a run toward the 7,000 area remains possible.

Takeaway: The up‑trend remains intact for now, but the risk of a pullback is elevated.

2. US Dollar Index – DXY

The US Dollar Index (DXY) has bounced from its 20‑day EMA (~98.92), indicating renewed strength for the greenback.

-

If it stays above the 20‑day EMA, a continuation toward ~100.50, and possibly the strong resistance zone around ~102, appears plausible.

-

Conversely, a break and close below the 20‑day EMA would be the first warning of potential dollar weakness, opening the possibility of a drop toward the 50‑day SMA (~98.24).

Takeaway: Dollar strength could act as a headwind for risk assets, including equities and crypto.

3. Bitcoin (BTC)

Bitcoin opened November on a weak note; it failed to hold at ~107,000 USD and slipped below a key support area, raising the possibility of further downside.

-

A close below ~107,000 USD may complete a “double‑top” pattern, which is typically bearish and could lead toward the 100,000 USD zone.

-

The bulls need to reclaim the moving averages (the 20‑day EMA near ~110,837 USD) to show signs of life. A breakout above ~118,000 USD could shift the momentum back.

Takeaway: Bitcoin appears vulnerable in the short term, with a key support in focus and upside needing a catalyst.

4. Ethereum (ETH)

Ethereum, like Bitcoin, is showing signs of capitulation: it turned down from its 20‑day EMA (~3,937 USD) and broke a downward‑channel support.

-

Downtrend indicators (declining moving averages, RSI below ~37) suggest the bears are currently in control. A close below current support could lead to the ~3,435‑3,350 USD zone.

-

A rebound from here with a push above the moving averages would invalidate the bearish scenario and open the path to higher levels.

Takeaway: ETH is under pressure and needs to show strength soon to avoid a deeper correction.

5. XRP

XRP attempted a breakout above its 20‑day EMA (~2.52 USD) but the bears held firm.

-

Key support sits at ~2.20 USD, and if that gives way the drop could extend to ~2.00 USD or even ~1.80 USD.

-

For the bulls to re‑take control, reclaiming the downward trendline and the 20‑day EMA are crucial.

Takeaway: XRP is struggling to mount a meaningful rebound and remains exposed to further downside.

6. BNB

BNB’s chart is particularly concerning: it has closed below its 50‑day SMA (~1,092 USD) and the moving averages look set to form a bearish crossover.

-

With support at ~1,021 USD already broken, the next possible troughs are ~932 USD and perhaps down to ~860 USD.

-

The bulls need a quick rebound above the 20‑day EMA to shift the sentiment.

Takeaway: BNB appears to have reached a short‑term top, and the road ahead could be bumpy unless buying interest returns rapidly.

7. Solana (SOL)

Solana broke down from a symmetrical triangle pattern, indicating a likely downward shift in momentum.

-

The next support lies around ~155 USD. If that fails to hold, further weakness down toward ~137 USD may be in store.

-

On the upside, any recovery would likely face resistance at the 20‑day EMA (~190 USD) before a more meaningful breakout can occur.

Takeaway: SOL’s structure suggests the bears have taken control, at least in the near term.

8. Dogecoin (DOGE)

Dogecoin continues to trade within a wide range (~0.14 USD to ~0.29 USD) with no clear breakout in either direction yet.

-

If the support at ~0.14 USD breaks, price could slip toward ~0.10 USD. On the other hand, a rebound and breakout of the range would signal a return of momentum.

Takeaway: DOGE remains directionally undecided, though downside risk is present if the support gives way.

9. Cardano (ADA)

Cardano is under pressure, with bears actively trying to push the price below the ~$0.59 USD support.

-

A break below ~$0.50 USD opens the door to a deeper drop toward ~$0.40 USD.

-

Bulls need to break above the 20‑day EMA (~0.64 USD) for any chance of reversing the trend. If successful, a move toward ~$0.75 USD is possible.

Takeaway: ADA is vulnerable and the support at ~$0.50 USD is crucial.

10. Hyperliquid (HYPE)

HYPE has fallen below its 20‑day EMA (~42.73 USD) and is now near the neckline of a head‑and‑shoulders type formation.

-

If the neckline (~35.50 USD) fails to hold, HYPE could drop toward ~30.50 USD or even ~28 USD.

-

If a reversal emerges and HYPE breaks back above the 20‑day EMA, a range of ~35.50‑52 USD could develop in the near term.

Takeaway: HYPE carries significant near‑term downside risk unless buyers step in.

Final Thoughts

The overarching theme of this analysis is that risk is elevated across multiple asset classes:

-

The S&P 500 shows signs of fatigue even though the long‑term trend remains intact.

-

The US dollar’s strength adds pressure to risk assets and could be a headwind for crypto.

-

Cryptocurrencies across the board are showing weak technical setups, with several sitting at or near key supports. The absence of strong buying interest from institutional investors (e.g., the recent net‑outflows from Bitcoin ETFs) compounds the challenge.

-

Practically speaking, market participants should be on heightened alert: support levels are being tested and breakdowns could lead to sharper moves downward.

Recommendation: If you are invested in these markets, consider tight risk‑management — define your stop‑loss levels, stay attuned to major support breaks, and avoid assuming that the trend will simply resume without a catalyst.

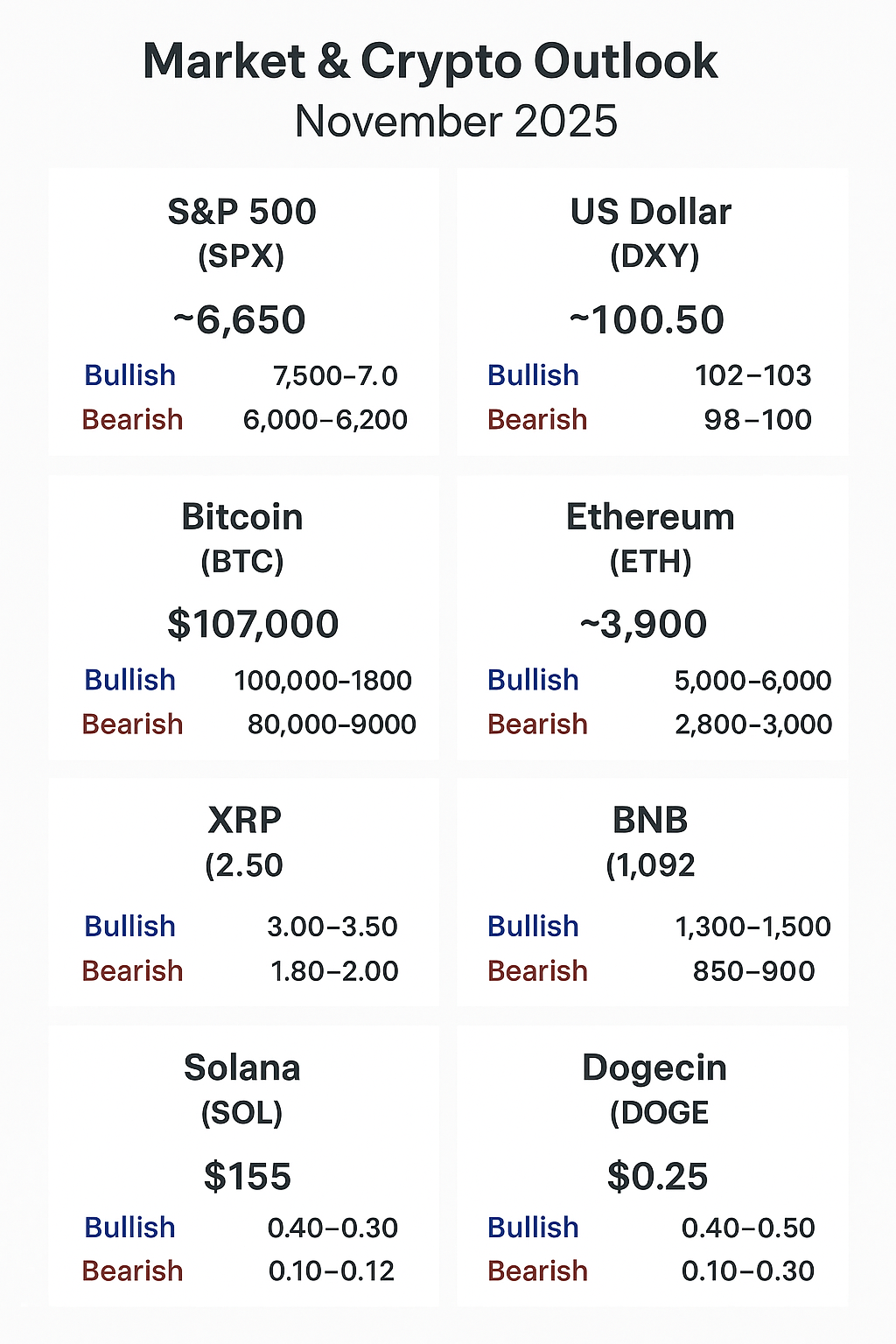

6–12 Month Outlook – Market & Crypto Analysis

1. S&P 500 (SPX)

-

Short-term risk: Currently near 50-day SMA support (~6,647). Momentum is weakening with bearish RSI divergence.

-

6–12 month projection:

-

Bullish scenario: If SPX holds above 6,550 and recovers to break above 7,000, a rally toward 7,500–7,800 could occur, supported by easing inflation and strong earnings from tech sectors.

-

Bearish scenario: A sustained break below 6,400 may trigger a deeper correction toward 6,000–6,200, reflecting recession fears and tighter monetary policy.

-

-

Macro factor: Fed rate decisions will be crucial; dovish signals could reignite risk appetite.

2. US Dollar Index (DXY)

-

Current trend: Showing strength; near-term resistance at ~100.50–102.

-

6–12 month outlook:

-

Continued dollar strength is likely if the Fed maintains hawkish stances.

-

However, overshooting above 102–103 may trigger profit-taking, creating a temporary pullback in USD.

-

-

Impact: A strong dollar can pressure risk assets like equities and crypto, while benefiting USD-denominated commodities.

3. Bitcoin (BTC)

-

Current technicals: Failed to hold $107k; risk of a double-top pattern forming.

-

6–12 month outlook:

-

Bullish: Institutional adoption, ETF inflows, and Bitcoin halving anticipation (if applicable) could drive BTC toward $150k–$180k.

-

Bearish: Weak macro sentiment or regulatory hurdles could see BTC retest $80k–$90k support.

-

-

Key levels to watch: $100k, $90k, $120k for trend confirmation.

4. Ethereum (ETH)

-

Current technicals: Rejected at 20-day EMA; RSI below 37 indicates strong bearish momentum.

-

6–12 month outlook:

-

Bullish: Ethereum adoption via Layer-2 scaling, staking rewards, and smart contract demand may push ETH to $5k–$6k.

-

Bearish: Failing key supports ($3,350–$3,400) could see ETH dip toward $2,800–$3,000.

-

-

Catalysts: Merge upgrades, institutional ETH products, and DeFi activity.

5. XRP

-

Current technicals: Struggling below 20-day EMA; near $2.20 support.

-

6–12 month outlook:

-

Bullish: Legal clarity and adoption in cross-border payments could take XRP toward $3–$3.50.

-

Bearish: Extended legal/regulatory uncertainty may push XRP below $2 toward $1.80.

-

6. BNB

-

Current technicals: Below 50-day SMA; potential bearish crossover.

-

6–12 month outlook:

-

Bullish: Binance ecosystem growth and staking rewards could support $1,300–$1,500.

-

Bearish: Exchange regulation and market volatility could drop BNB to $850–$900.

-

7. Solana (SOL)

-

Current technicals: Broke symmetrical triangle; near $155 support.

-

6–12 month outlook:

-

Bullish: SOL adoption in Web3 apps may push SOL toward $250–$300.

-

Bearish: Continued network instability or crypto winter conditions may drag SOL to $120–$130.

-

8. Dogecoin (DOGE)

-

Current technicals: Trading sideways between $0.14–$0.29.

-

6–12 month outlook:

-

Bullish: Meme coin hype or celebrity-driven catalysts could spike DOGE to $0.40–$0.50.

-

Bearish: Absence of adoption and declining interest may see a drop toward $0.10–$0.12.

-

9. Cardano (ADA)

-

Current technicals: Bears pushing toward $0.50 support.

-

6–12 month outlook:

-

Bullish: Smart contract adoption and ecosystem growth could support a rally toward $0.80–$0.95.

-

Bearish: Failure to expand dApps and developer interest may push ADA to $0.40 or below.

-

10. Hyperliquid (HYPE)

-

Current technicals: Below 20-day EMA; head-and-shoulders forming.

-

6–12 month outlook:

-

Bullish: If market sentiment improves and HYPE adoption rises, possible upside toward $50–$52.

-

Bearish: Breakdown below $35 could trigger a slide toward $28–$30.

-

Overall Crypto & Market Insights

-

Crypto sentiment remains bearish in the short term, with multiple assets testing key supports.

-

Equity markets are cautiously positioned, vulnerable to macro shocks and Fed policy.

-

Dollar strength is a headwind for risk assets; any weakening could trigger a relief rally.

-

Investor strategy: Prioritize risk management, diversify holdings, and monitor catalysts like regulatory news, ETF flows, and network upgrades.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.