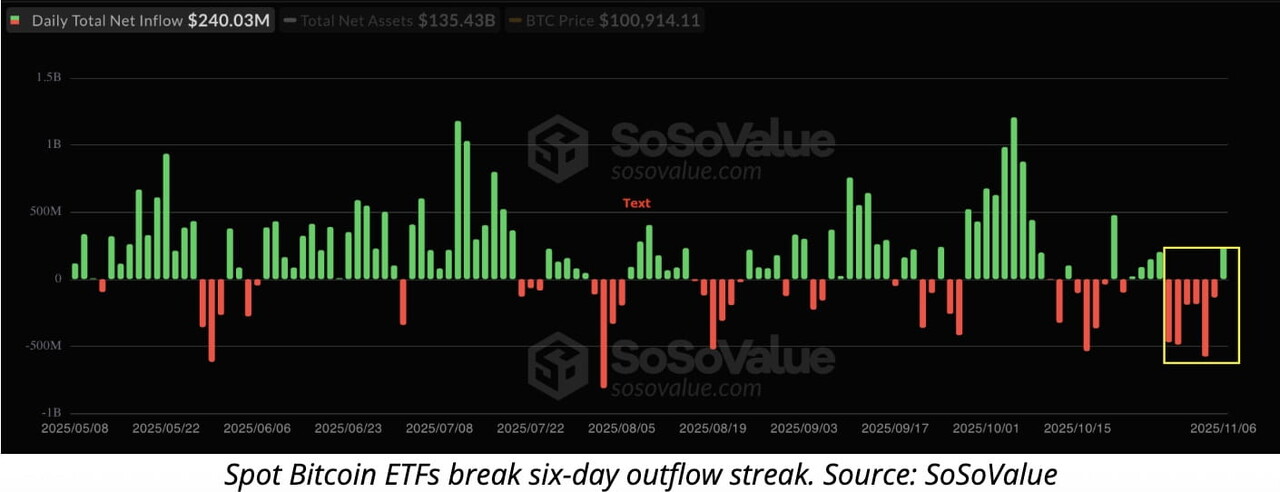

On 13 November 2025, the cryptocurrency market stands at a pivotal juncture. The major players — Bitcoin (BTC), Ethereum (ETH) — along with a broad range of altcoins including XRP, Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Cardano (ADA), Hyperliquid (HYPE), Chainlink (LINK) and Bitcoin Cash (BCH) — are all showing signs of struggle between bullish hopes and bearish pressure. Below is a detailed breakdown of each asset’s technical situation and the key levels to watch.

Bitcoin (BTC)

BTC attempted to break above the $105,000 mark earlier in the week, but was quickly met by strong selling pressure that dragged it back below $102,000.

The fact that the price was rejected at the 20‑day exponential moving average (EMA) near ~$106,302 suggests that bearish momentum remains intact.

Key levels to watch:

-

On the downside: a break below the $100,000 psychological mark could open the door to a drop toward ~$87,800.

-

On the upside: if bulls can push and close above ~$107,000, it would signal that they are regaining control and may aim higher.

In short, BTC is at a crossroads: either regain strength and break out, or risk a deeper correction.

Ethereum (ETH)

ETH’s recovery attempt has been thwarted by resistance at the upper boundary of its descending channel.

The bears are currently trying to drag ETH toward the support zone of ~$3,350–$3,050. If that gives way, a new bearish leg could take price down toward ~$2,500.

For a bullish reversal, ETH must reclaim the channel and push toward the 50‑day simple moving average (SMA) around ~$3,960, where heavy selling is expected.

The message: bulls need to step up, or else ETH may resume a deeper downtrend.

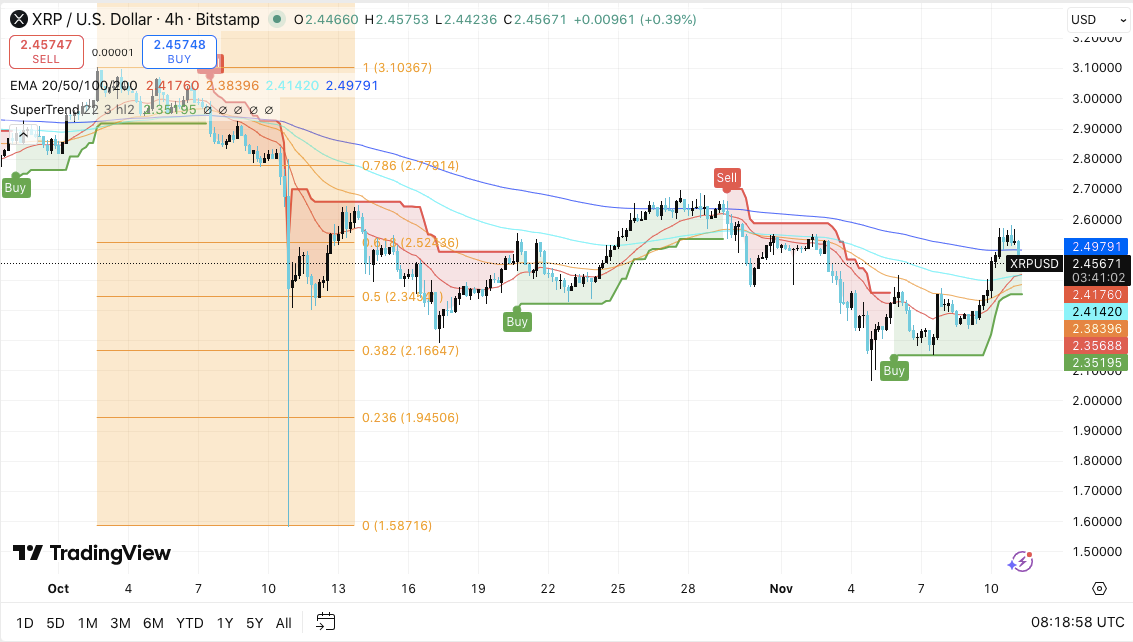

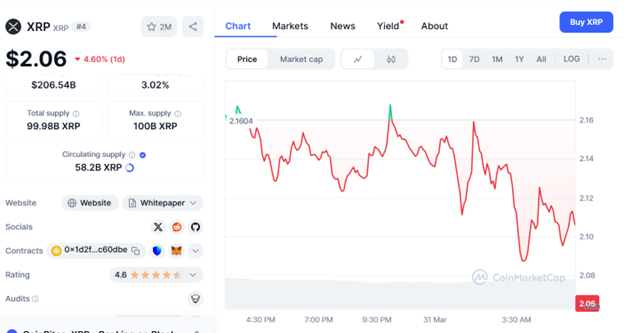

XRP

XRP managed to cross above its 20‑day EMA near ~$2.41 earlier this week, showing some bullish impulse.

However, it ran into resistance at its 50‑day SMA (~$2.58). The bears are now fighting to keep price below the 20‑day EMA.

Key levels:

-

Bearish scenario: if XRP fails to hold the ~$2.06 support level (low of 4 November), there may be further downside toward ~$1.90.

-

Bullish scenario: a breakout above the descending trendline could open up a move toward ~$3.20.

Thus, XRP is in a tug‑of‑war between stabilization and breakdown.

BNB

Downside risk: if price declines toward the strong support zone at ~$860 and fails to rebound with conviction, there is a risk of a drop toward ~$730.

Thus, BNB’s next move depends heavily on how the price reacts around ~$860.

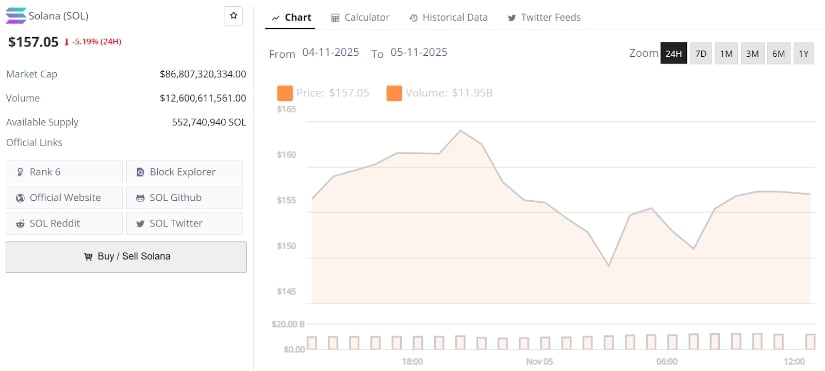

Solana (SOL)

SOL turned downwards from its 20‑day EMA (~$172) earlier in the week — a clear sign that sellers are gaining strength.

Key levels:

-

If the ~$155 support breaks, next stops could be ~$126 or even ~$110.

-

For a bullish shift, price must reclaim the EMA and then push toward the 50‑day SMA around ~$193 and ultimately target ~$210.

SOL remains under pressure unless bulls act decisively.

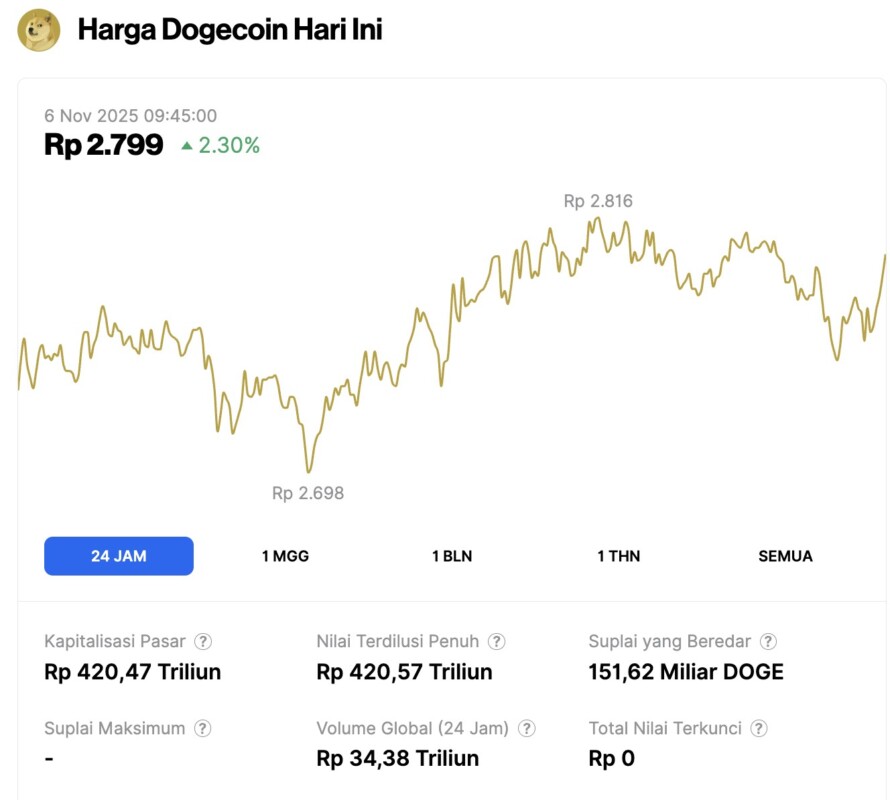

Dogecoin (DOGE)

DOGE’s attempt to surpass the 20‑day EMA (~$0.18) failed — indicating persistent selling pressure.

If price falls below the ~$0.14 support zone, a revisit of the $0.10 low from 10 October may be on the cards.

If bullish momentum returns (i.e., price breaks above EMA 20), then the next target would be ~$0.21. Meanwhile, DOGE is likely to continue oscillating in the ~$0.14–$0.29 range in the near term.

Cardano (ADA)

ADA’s rebound stalled at the 20‑day EMA (~$0.59), signalling that bears are still in control.

Downside scenario: Price could drop into the strong support zone around ~$0.50 — if that breaks, ADA may head toward ~$0.40.

Upside scenario: If price rebounds from the current or support zone and breaks above the EMA 20, then a move toward the 50‑day SMA (~$0.68) is possible, and perhaps to ~$0.75.

In short, ADA remains in a precarious position.

Hyperliquid (HYPE)

HYPE bulls have tried several times to push above the 50‑day SMA (~$42.45), but the bears continue to defend that level.

Presently, price is caught in a fierce battle around the neckline of a potential pattern:

-

If bulls win and push above the neckline, HYPE could rally toward ~$52.

-

If bears dominate and price falls below ~$37.47, then a drop toward ~$35.50 or even ~$30.50/~$28 is possible.

HYPE’s path is strongly dependent on how this neckline battle resolves.

Chainlink (LINK)

LINK turned down from its 20‑day EMA (~$16.50) and is now finding support around ~$15.43.

A slight positive is the emergence of early bullish divergence on the MACD/RSI — suggesting that selling pressure might be easing.

Key outcomes:

-

Bullish: if LINK closes above the EMA 20, then recovery toward higher levels could occur.

-

Bearish: if price breaks below ~$15.43, then the next support is the November 4 low near ~$13.69.

Thus, LINK is showing signs of potential turnaround — but confirmation is required.

Bitcoin Cash (BCH)

BCH’s price retreated from the resistance of its falling wedge pattern earlier this week — the bulls have not yet maintained a recovery.

Key levels:

-

Bullish: A successful breakout above the wedge could see price heading toward the strong resistance zone of ~$615–$651.

-

Bearish: If price breaks and closes below ~$500, that would confirm the bears’ control and likely lead to further consolidation or decline.

BCH remains in a wait‑and‑see phase — breakout or breakdown will dictate next move.

Overall Market Sentiment & Summary

The broader trend across these assets indicates that bearish pressure is still dominant, while any bullish recovery attempts are being actively resisted. For most of the assets, key moving averages and support zones are being tested — failure to hold these could result in deeper corrections.

That said, there are glimmers of hope: for LINK, the emerging bullish divergence is one such signal; for others, a successful reclaiming of EMA/50‑day SMA levels would change the narrative.

Investors should monitor not just individual coins, but also macro‑factors and market sentiment. As noted, one major strategist at Morgan Stanley Wealth Management likened the current phase for Bitcoin to a kind of “autumn” in the four‑year cycle — a time for some harvesting before the next potential spring. Meanwhile, more bullish voices still see upside for Bitcoin (e.g., targets toward $180,000) but also caution of possible drawdowns of up to 70%.

In short: the market is poised. Either a meaningful recovery is around the corner (if bulls regain momentum), or a more sustained correction is underway (if bears continue to dominate). Traders and investors alike should pay close attention to breakout/breakdown levels, manage risk carefully, and remain vigilant.

Disclosure:

This article is for informational purposes only. It should not be taken as financial or investment advice. Always do your own research before making any investment decisions.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)