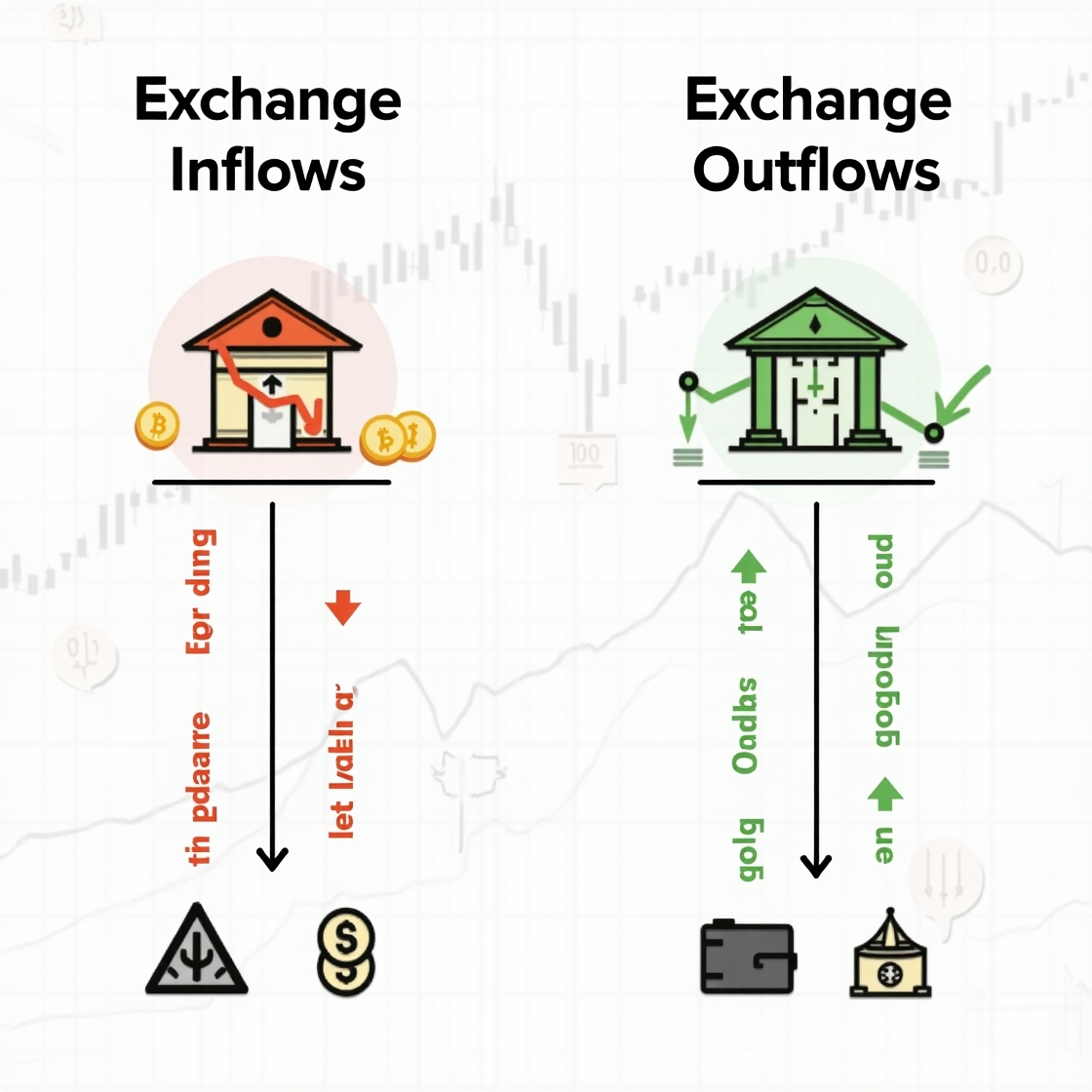

Understanding how money moves in and out of cryptocurrency exchanges is crucial for any trader aiming to navigate the crypto market effectively. These flows—called exchange inflows and exchange outflows—can serve as powerful indicators of market sentiment and potential price movements.

Let’s break down what they mean and how they influence the value of a cryptocurrency.

🟢 Exchange Inflows: Bearish Signals to Watch

Definition:

Exchange inflows occur when coins are transferred from private wallets to exchanges.

Why It Matters:

This often signals a bearish sentiment. When large amounts of crypto move onto exchanges, it usually means holders are preparing to sell. More selling leads to an increase in supply on the open market—potentially driving prices down.

Market Interpretation:

Traders interpret high inflows as a sign that holders lack confidence in the short-term price. It may indicate that they’re positioning themselves to exit their positions or take profits.

Real-World Example:

If 10,000 BTC is suddenly transferred to Binance, it could indicate that institutional investors or whales are planning to sell. This creates downward pressure on Bitcoin’s price due to increased supply on the exchange.

🔴 Exchange Outflows: A Bullish Underlying Trend

Definition:

Exchange outflows happen when coins are withdrawn from exchanges to external wallets, such as cold storage or long-term holding wallets.

Why It Matters:

This typically signals a bullish sentiment. When traders withdraw their crypto, it implies they’re not looking to sell anytime soon. This lowers the available supply on the market, which may lead to price appreciation if demand remains strong or increases.

Market Interpretation:

Large outflows suggest that investors are accumulating and choosing to hold their assets off-exchange, possibly anticipating future price increases.

Real-World Example:

Suppose there’s a noticeable spike in Ethereum outflows from Coinbase. This might indicate accumulation behavior. Traders could interpret this as a sign of confidence in ETH’s long-term value—possibly pushing prices upward due to decreased exchange supply.

📈 Why This Matters for Traders

Staying informed about inflow and outflow trends can give you an edge. By monitoring blockchain data and exchange metrics, you can anticipate potential price movements before they’re reflected on the charts.

Whether you’re swing trading or investing long-term, knowing where the money is going helps you make smarter decisions.

Pro Tip:

Combine exchange flow analysis with other indicators like volume, RSI, and market sentiment to form a well-rounded trading strategy.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.