Not too long ago, I sat staring at my Binance account in disbelief. My balance had sunk more than $100,000 into the red. The feeling was devastating—panic, self-doubt, and the painful question of whether trading was really meant for me.

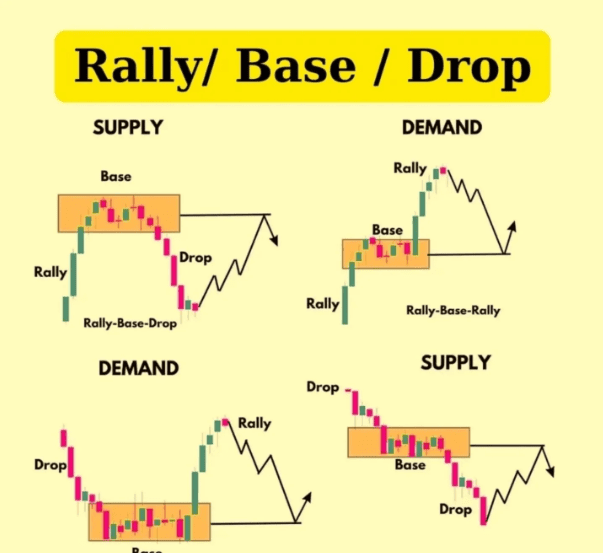

But everything changed when I discovered a simple yet incredibly powerful trading strategy: Rally–Base–Drop (RBD) and Rally–Base–Rally (RBR). This approach not only rescued my account but also transformed the way I look at the market.

Why This Strategy Works

Markets may seem chaotic at first glance, but in reality, they move in repeatable patterns. Understanding these patterns is the key to trading with confidence rather than guesswork.

Here’s how it works:

-

Rally (Strong Upward Move): Price surges with momentum, buyers take full control.

-

Base (Accumulation): The market pauses, forming small candles. This is when “smart money” — large institutional players — quietly step in.

-

Drop (Strong Downward Move): Price collapses as sellers dominate.

These phases create clear zones on the chart. Rally–Base–Drop (RBD) and Drop–Base–Rally (DBR) zones highlight where significant money flows in and out of the market. Once you learn to identify these areas on Binance charts, you stop guessing and start trading with the market movers, not against them.

How I Applied It on Binance

Here’s exactly what I did:

-

Identify Zones

I studied Binance charts to spot RBD and DBR structures. These zones are footprints of smart money, where supply and demand truly shift. -

Wait for Price to Return

Instead of chasing moves, I placed trades only when price came back to these zones. -

Use Smart Risk Management

I set stop-loss orders just outside the zones. This way, if I was wrong, the loss was small. If I was right, the trade ran in my favor naturally.

The biggest difference? I stopped trading emotionally. I no longer chased tops, bottoms, or random signals. Instead, I followed a structured, rules-based method.

Results & Lessons Learned

With discipline and patience, my earlier $100,000+ loss was gradually recovered. But the real win wasn’t just financial — it was the mindset shift.

Here are the lessons this journey taught me:

-

Trading doesn’t have to be complicated. Discipline matters more than complexity.

-

Follow the flow of smart money, not emotional predictions.

-

One clear, proven strategy beats a hundred overlapping indicators.

Today, I trade with clarity, confidence, and consistency. The RBD/RBR method gave me not just profits but also peace of mind.

Final Thoughts

If you’re struggling with losses on Binance, I encourage you to explore the Rally–Base–Drop / Drop–Base–Rally strategy. It reshaped my trading completely — and it just might do the same for you.

Remember: success in trading isn’t about predicting the future. It’s about recognizing where the real money is moving, aligning yourself with it, and staying disciplined.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.