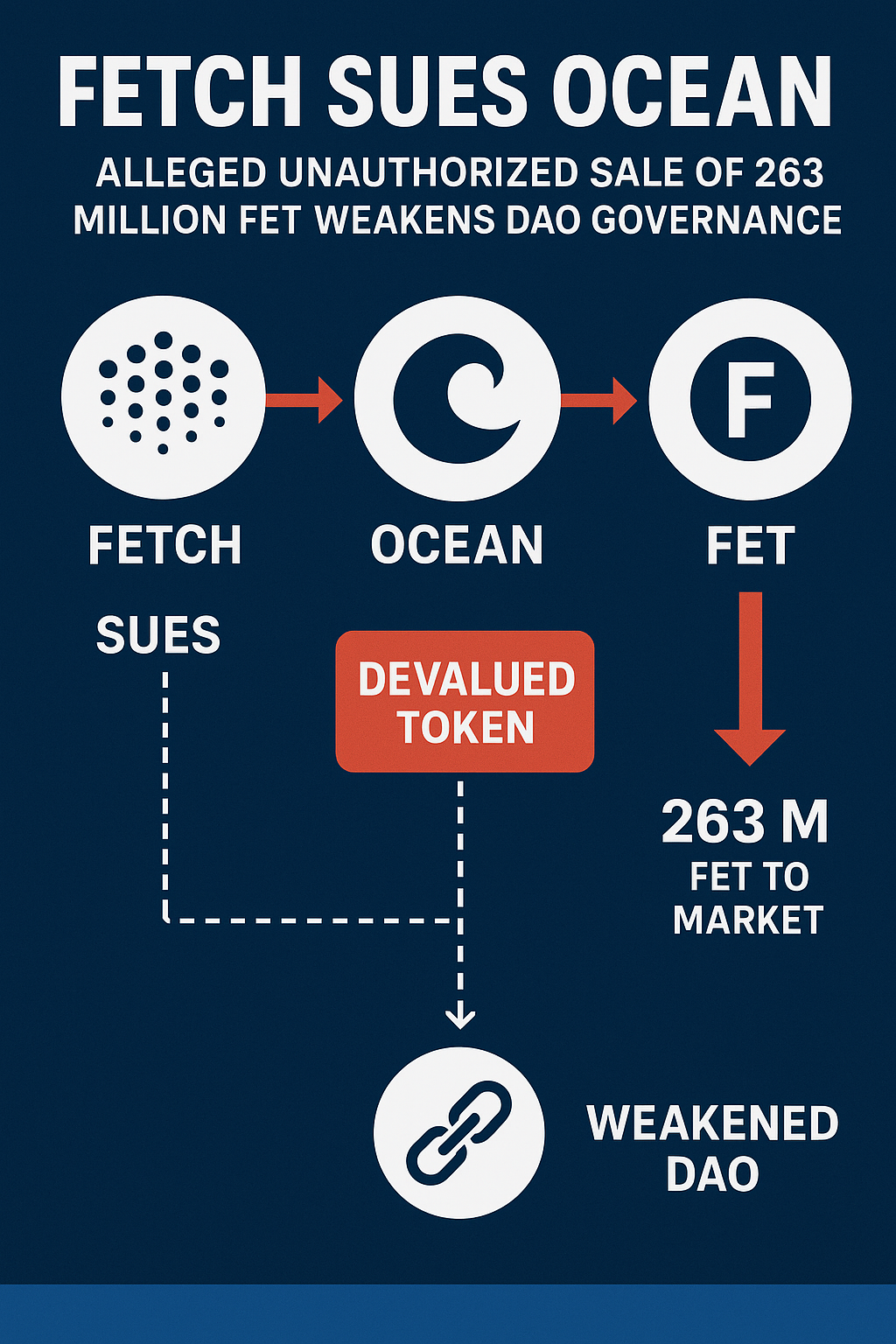

In a major development shaking the cryptocurrency sector, Fetch.ai and three FET token holders have filed a class-action lawsuit against Ocean Protocol and its founders. The lawsuit, submitted on November 4, 2025, in the Southern District of New York, alleges that Ocean Protocol misled investors about the independence of OceanDAO while converting and selling a substantial number of tokens, exerting downward pressure on FET and undermining DAO governance.

Details of the Lawsuit

The class-action complaint, registered under case number 1:25-cv-9210, targets Ocean Protocol Foundation Ltd., Ocean Expeditions Ltd., OceanDAO, and three co-founders. The plaintiffs—Fetch.ai and three token holders—claim that Ocean Protocol’s actions misrepresented the allocation and management of community tokens.

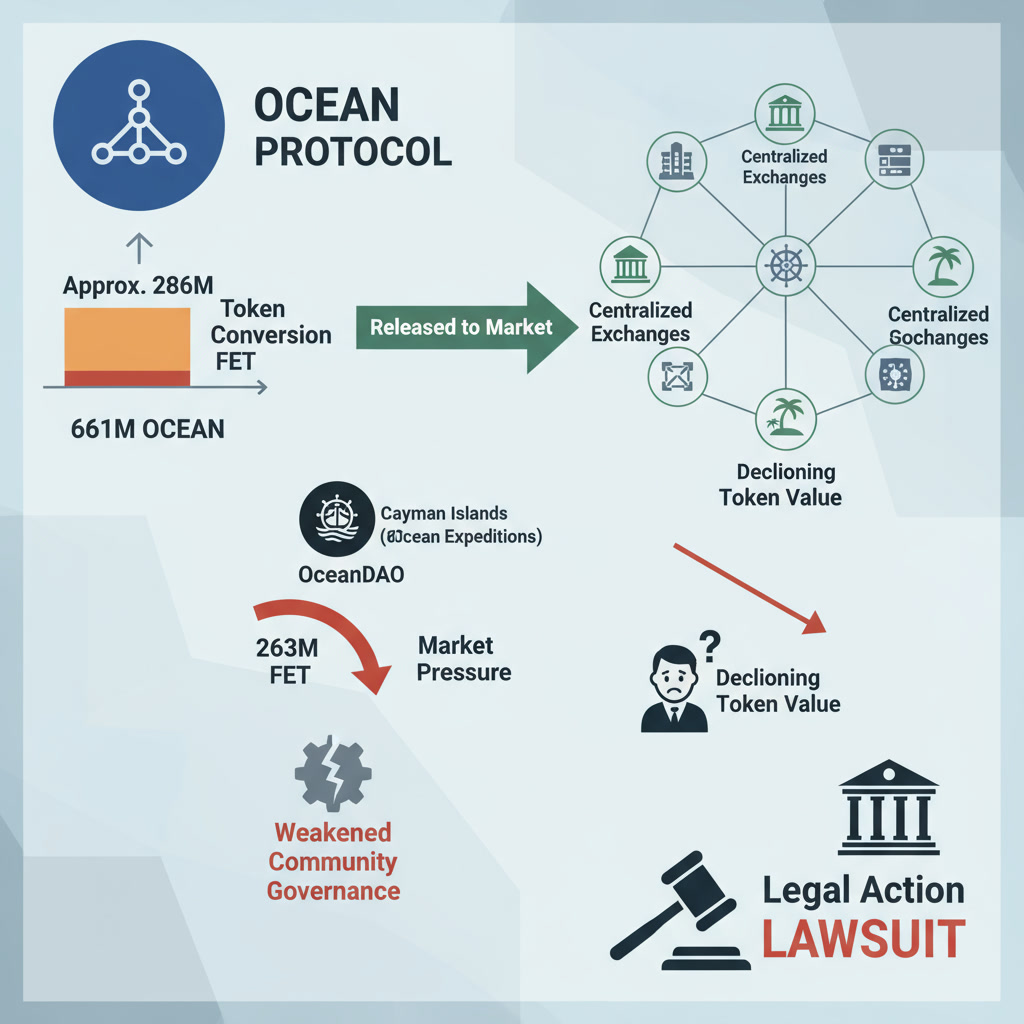

According to the filing, over 661 million OCEAN tokens were converted into approximately 286.46 million FET, with around 263 million FET subsequently released into the market. This amount represented over 10% of FET’s circulating supply at the time, contributing to significant price pressure.

Allegations Against Ocean Protocol

The plaintiffs argue that Ocean Protocol claimed hundreds of millions of OCEAN tokens were reserved for DAO rewards. In reality, these tokens were converted and sold, devaluing FET and weakening OceanDAO’s governance model.

Key points from the complaint include:

-

Conversion of over 661 million OCEAN into ~286.46 million FET.

-

Release of ~263 million FET to the market, representing over 10% of the circulating supply.

-

Transfer of DAO assets to a Cayman Islands entity, Ocean Expeditions Ltd., in late June 2025.

-

Subsequent liquidation of FET on centralized exchanges beginning in early July, followed by Ocean Protocol’s withdrawal from the ASI Alliance in October.

The plaintiffs assert that this chain of events—asset transfers, token conversion, centralized exchange sales, and alliance withdrawal—contradicts OceanDAO’s claims of community-led governance.

Impact on Market and DAO Governance

The release of a large volume of FET created downward pressure on the token’s price, eroding market confidence and the perceived legitimacy of OceanDAO’s governance. From a legal and governance perspective, the lawsuit could set a precedent regarding the accountability of founding entities for DAO assets and highlight the importance of transparency and fair allocation in cryptocurrency projects structured as DAOs.

Current Status of the Case

The lawsuit has just been filed as of November 4, 2025. The next steps in the legal process include responses from the defendants, evidence exchange, and potential settlement discussions or trial proceedings.

Conclusion

The Ocean Protocol lawsuit underscores growing scrutiny over DAO governance, transparency, and token management. By alleging that Ocean Protocol misled the community and destabilized FET through massive token conversions and sales, Fetch.ai and other plaintiffs aim to hold the project accountable and protect investor interests. The case could have far-reaching implications for DAO-operated cryptocurrency projects and the broader regulatory landscape.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.