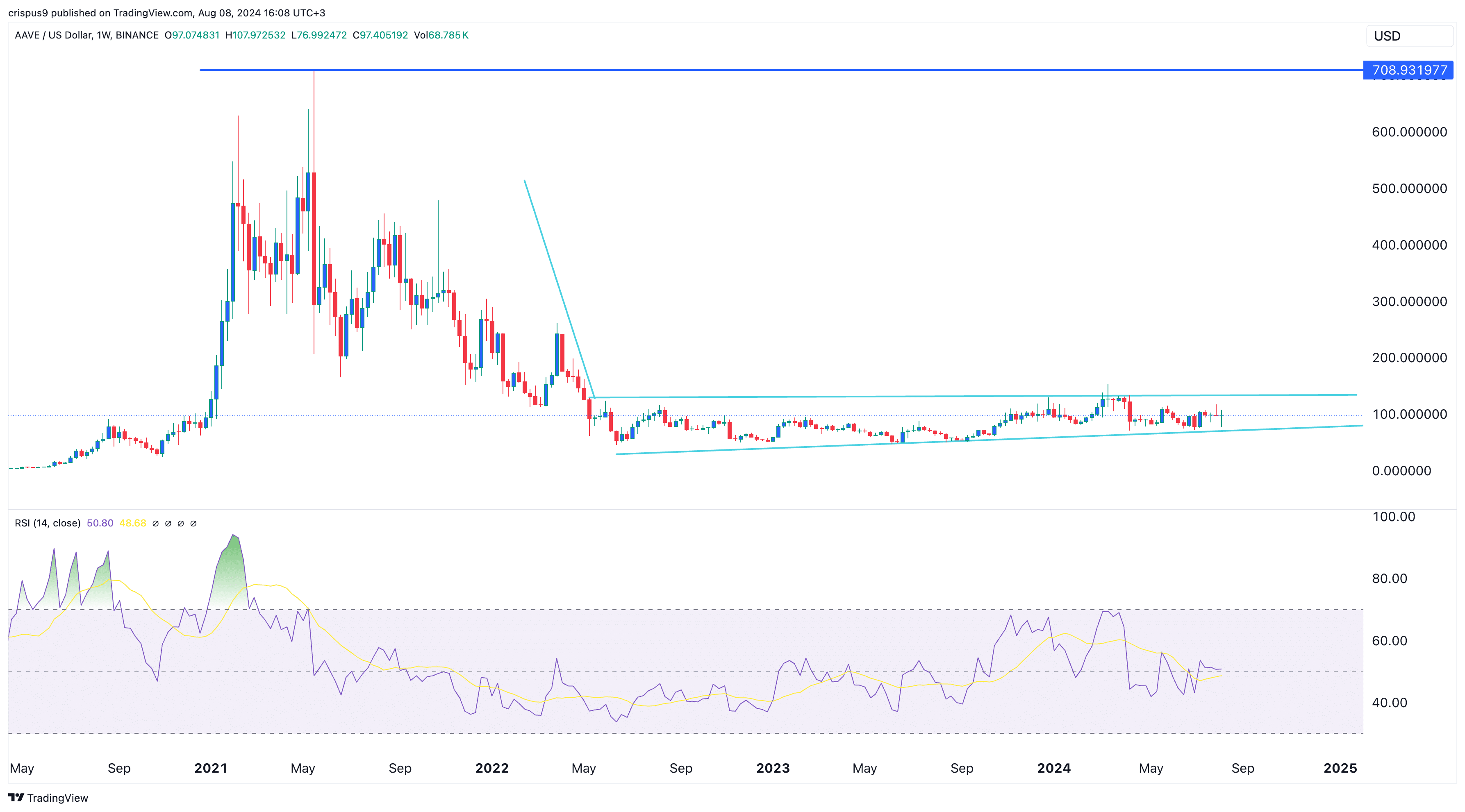

In recent weeks, the native token of the DeFi protocol AAVE has drawn significant attention as it fell back toward the USD 200 mark, raising questions about its next move and whether a rebound might be on the horizon. An analysis published by CryptoBCC outlines key support zones and market dynamics that investors should closely monitor.

Background

AAVE is the governance token for one of the most prominent decentralized finance (DeFi) platforms, and it has made headlines recently for launching a $50 million buy-back programme intended to retire up to 1.75 million tokens per week using protocol revenue. According to the report, since its pilot in May, about 94,000 tokens (worth over $22 million) have been bought back.

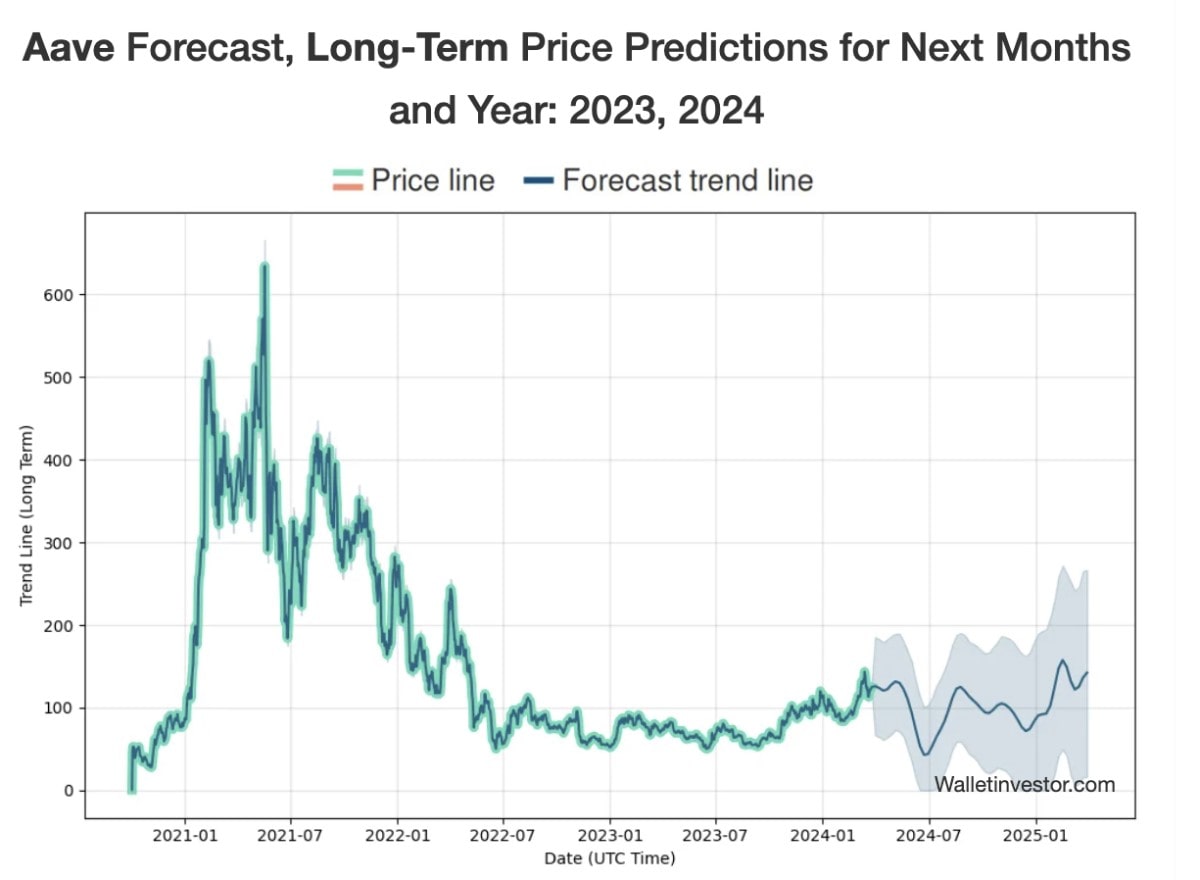

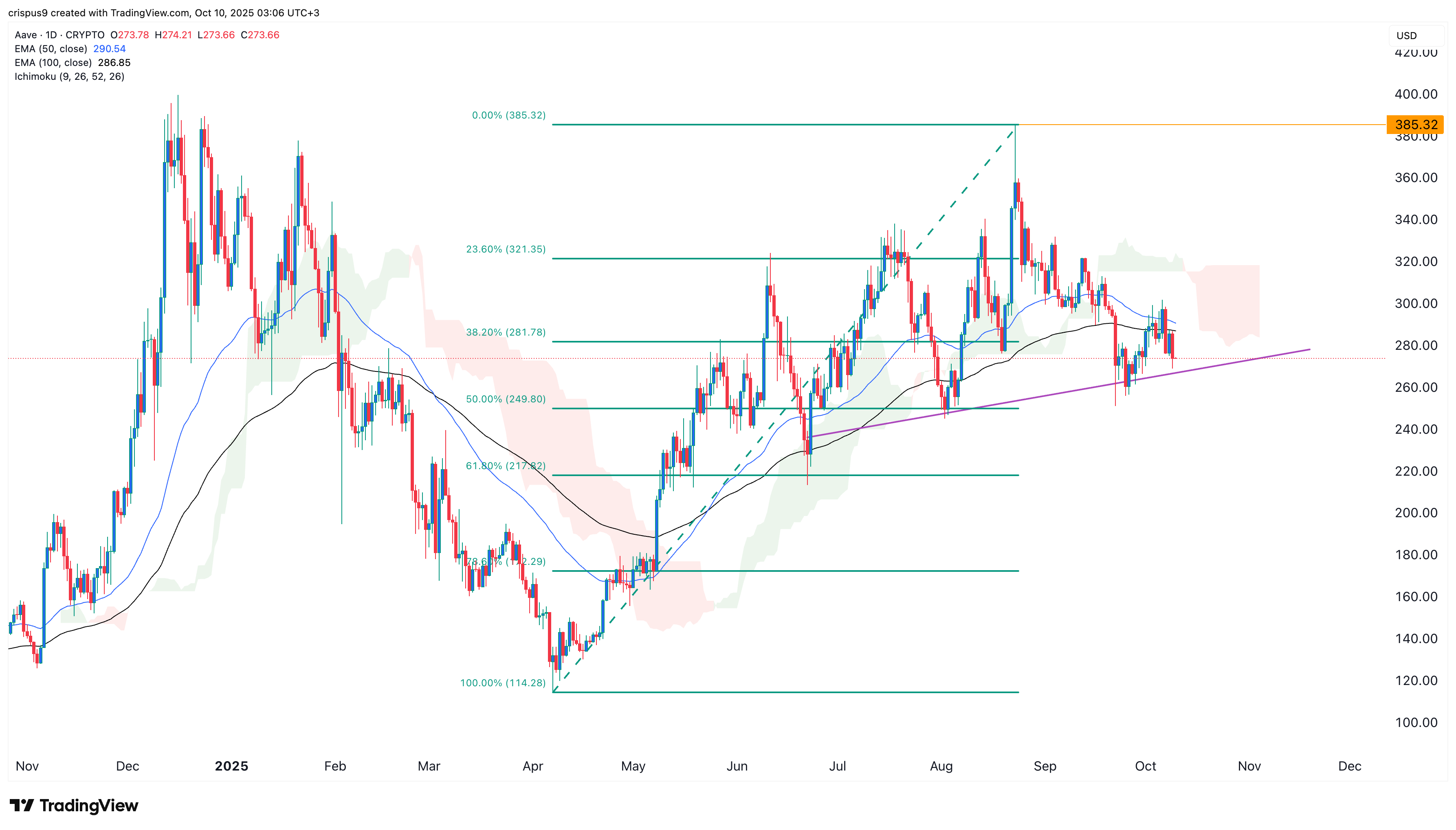

These deflation-reduction mechanics, combined with broader market momentum, helped push AAVE to around $385 in August.

However, the momentum has shifted. A recent decline in Bitcoin (BTC) — notably falling under a key support level of $108,000 on November 3 — has pulled AAVE down aggressively.

Current Weakness & Market Sentiment

The article points out multiple signs of weakness:

-

Trading-volume data from CoinGlass show that in the past 24 hours, AAVE rarely saw dominance by bullish trades, an unusual state compared to prior weeks.

-

The long/short ratio among taker trades stands at about 0.918, indicating that sell orders are outweighing buys at this moment.

-

On the daily chart, AAVE has been in a downtrend for more than a month, making successive lower highs and lower lows. It is also experiencing a bearish crossover between the 20-day and 50-day simple moving averages (SMA).

These factors imply that bulls currently lack sufficient momentum to push AAVE significantly higher, and bears may remain in control in the near term.

Key Price Zones & Support Levels

From a technical perspective, here are the critical zones to watch:

-

AAVE has formed a trading range from about $221 to $336 since May, with the lower boundary of that range (~$210-225) now acting as a strong resistance after being breached.

-

The current psychological level of ~$200 is now a battleground between bulls and bears. Breaking under it convincingly could open the way for further downside.

-

The article flags two next major support levels: around $170 and around $141. If the token fails to hold above $200, these zones could be the next potential floors.

Outlook & What to Monitor

While the long-term fundamentals (buy-back program, DeFi positioning) of AAVE remain interesting, the current technical and market picture suggests caution. Here are things to keep an eye on:

-

% Change in Market Structure – A sustained break and reclaim above the $210-225 zone (current resistance) could signal a reversal of the downtrend. Until then, lower support zones may come into play.

-

Whale & Taker Activity – Continued dominance of sell-volume taker flows or long/short ratios remaining below ~1 could suggest bearish momentum persists.

-

Broader Crypto Market Context – Since Bitcoin’s performance and market sentiment appear to be impacting AAVE, a strong rebound in BTC or broader altcoin strength could be a catalyst.

-

Fundamental Developments – Progress on the buy-back program, ecosystem growth, partnerships or protocol upgrades could help shift sentiment and price dynamics.

Final Thoughts

In summary, AAVE is in a vulnerable technical position. While its deflationary mechanics and DeFi relevance provide a supportive backdrop, the price action suggests bears currently have the upper hand. Unless AAVE can reclaim key resistance (around the $210-225 zone) and show signs of renewed buying strength, it may test deeper support levels near $170 or even $141. Investors and traders would be wise to watch these zones and accompanying market signals before assuming a recovery is imminent.

Disclaimer: This write-up is for informational purposes only and is not investment advice. Please conduct your own research and consider your risk tolerance before engaging in any crypto asset transactions.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)