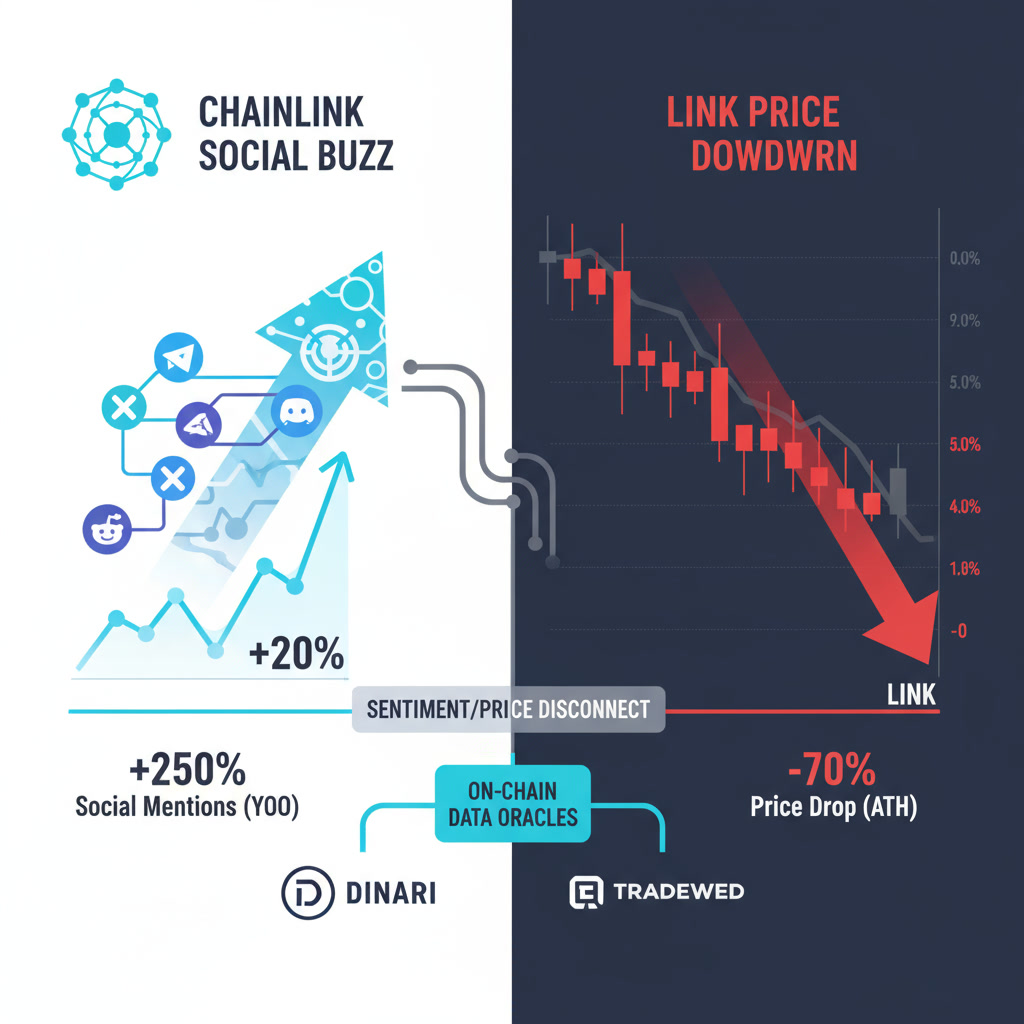

While Chainlink’s recent partnerships with Dinari and Tradeweb have fueled social excitement and reinforced the project’s role as a leading multi-chain oracle network, the price of LINK tells a different story. Despite the spike in online discussions and on-chain accumulation signals, LINK continues to trade lower, confirming a short-term bearish structure after falling below the key $15.44 support level.

1. Chainlink’s Partnerships Strengthen Its Ecosystem but Fail to Move LINK’s Price

On November 4 and 5, 2025, Chainlink announced two high-profile collaborations aimed at bridging traditional finance (TradFi) data with blockchain networks.

-

Tradeweb (Nov 4) revealed plans to publish benchmark closing prices for FTSE U.S. Treasury Bonds on-chain via Chainlink DataLink. As a major global operator in rates, credit, and equities, Tradeweb’s integration brings institutional-grade data to decentralized markets.

-

Dinari (Nov 5) announced its collaboration with Chainlink to provide real-time verification for the S&P Digital Markets 50 Index, which tracks 35 publicly listed U.S. companies advancing blockchain adoption and 15 digital assets. This partnership aims to make traditional financial indices verifiable on-chain for the first time.

These integrations enhance Chainlink’s credibility and long-term utility as the backbone of on-chain financial data. However, they have yet to generate strong buying demand for LINK tokens, suggesting that short-term market behavior remains influenced by technical and liquidity conditions rather than fundamentals.

2. Social Sentiment Soars, but Price Action Lags Behind

According to Santiment Insights, Chainlink has led social discussion volumes in early November, with weighted sentiment turning increasingly positive. The community buzz centers on Chainlink’s growing role as a bridge between blockchain and traditional finance.

Nevertheless, the price of LINK has not followed suit. Historically, when positive sentiment spikes without price confirmation, it can indicate that optimism has already been priced in—or that selling pressure from technical traders is dominating.

Investors should, therefore, give more weight to price and volume signals rather than social media enthusiasm when assessing short-term opportunities.

3. On-Chain Metrics Indicate Gradual Accumulation

Data from CryptoQuant provides hints of quiet accumulation:

-

Exchange reserves for LINK have been steadily declining, suggesting holders are withdrawing tokens from exchanges—often a bullish long-term signal.

-

Spot taker CVD (Cumulative Volume Delta) has shifted from negative to neutral, indicating that active sellers are losing dominance.

However, while these developments imply weakening sell pressure, they are not yet strong enough to confirm a trend reversal. Clear signs of rising spot demand and a bullish structure on higher timeframes are still missing.

4. Technical Outlook: Bears Take Control Below $15.44

The decisive close below $15.44 on November 3, the August swing low, has confirmed a short-term bearish structure.

-

MACD momentum remains negative.

-

OBV (On-Balance Volume) has formed new lows alongside price, reflecting continued distribution.

If selling pressure persists, the next major support lies around $11, a level that traders should monitor closely. Reclaiming the $15.44 mark and forming a higher low would be the first signal of structural recovery.

5. Good News Doesn’t Always Mean Immediate Price Gains

It’s common for fundamental news to have a delayed effect on token prices. Short-term price action often reflects liquidity, leverage positioning, and technical setups more than long-term fundamentals.

Partnerships like those with Dinari and Tradeweb enhance Chainlink’s network value and institutional credibility. Yet without confirmation from volume and momentum indicators, “good news” can remain just that—news—until the market structure supports an uptrend.

6. What Investors Should Watch Next

A balanced strategy requires tracking multiple signal categories:

-

News Flow: Monitor updates from Dinari, Tradeweb, and future Chainlink integrations to see whether real-world data pipelines expand.

-

On-Chain Data: Watch for further declines in exchange reserves and rising active addresses (Santiment, CryptoQuant).

-

Technical Structure: Key reversal signs include a breakout above $15.44, MACD crossover, and OBV recovery.

-

Capital Flows: Sustained growth in trading volume, institutional fund inflows, or ETF exposure can indicate renewed market confidence.

7. Quick Comparison: Chainlink’s Latest Integrations

| Partner | Date Announced | Main Objective | Data/Asset Type | Chainlink Solution |

|---|---|---|---|---|

| Dinari | Nov 5, 2025 | Real-time verification for on-chain financial indices | S&P Digital Markets 50 Index (35 U.S. equities, 15 digital assets) | Oracle & verifiable data infrastructure |

| Tradeweb | Nov 4, 2025 | Publishing benchmark closing prices for U.S. Treasury Bonds | FTSE U.S. Treasury Benchmark Closing Prices | Chainlink DataLink |

Conclusion

Despite rising community excitement and notable institutional partnerships, LINK’s price remains under short-term pressure. The disconnect between sentiment and market performance highlights the importance of combining technical, on-chain, and fundamental perspectives.

While Chainlink continues to expand its ecosystem with real-world integrations that strengthen its long-term outlook, traders should stay cautious in the near term—waiting for confirmation of a structural shift before turning bullish again.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.