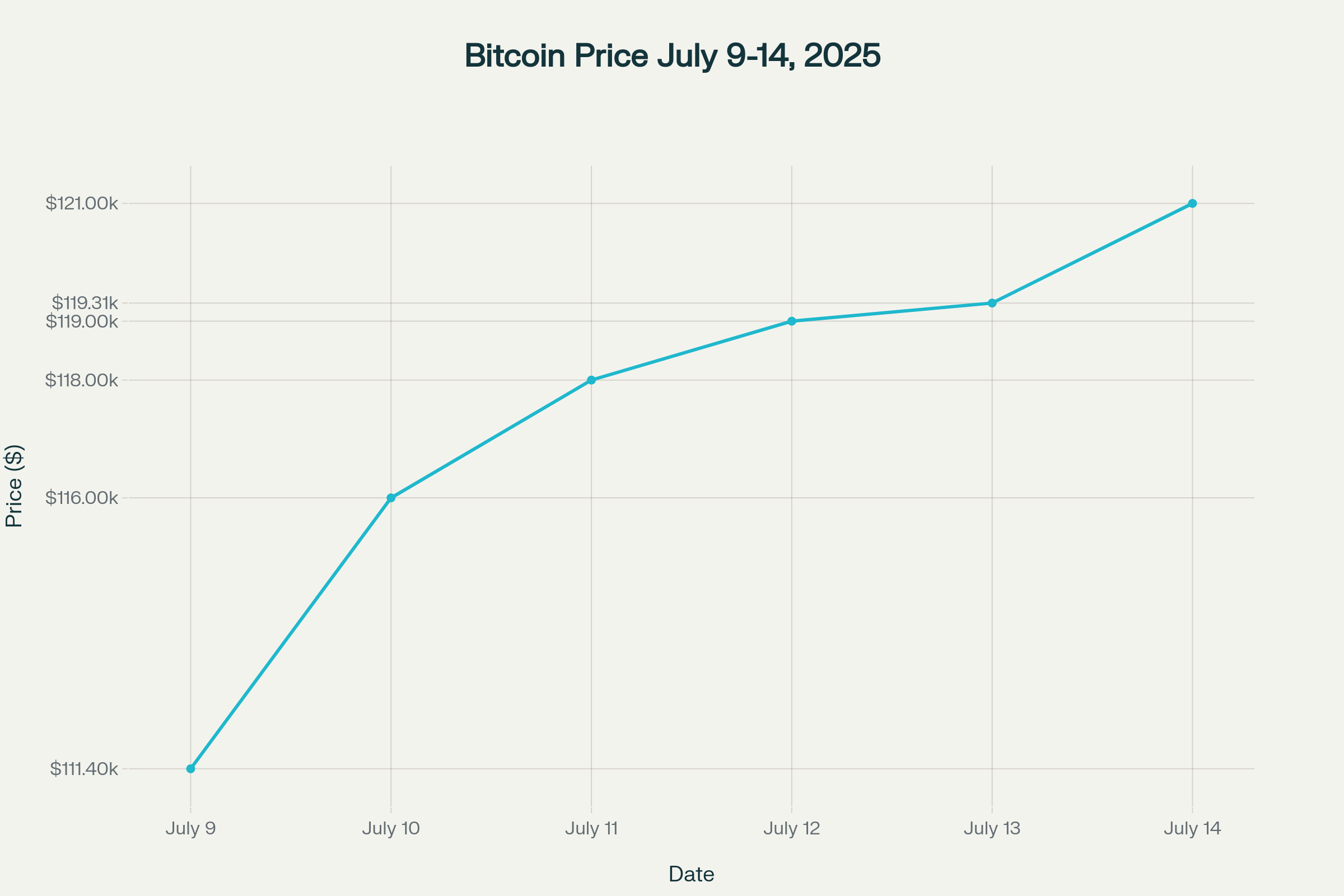

Bitcoin has shattered previous records by reaching an unprecedented all-time high of $121,000 on July 14, 2025, marking a watershed moment for cryptocurrency adoption and institutional investment . This remarkable achievement caps off a week of consecutive record-breaking performances, with the world’s largest cryptocurrency surging from $111,400 on July 9 to its current historic peak .

The Rally Behind the Records

The surge to $121,000 represents a dramatic 28% gain for Bitcoin in 2025, driven primarily by unprecedented institutional demand and regulatory clarity . The rally gained momentum following President Donald Trump’s announcement of 30% tariffs on the European Union and Mexico, which sparked investor interest in alternative assets as a hedge against traditional market volatility .

Bitcoin’s ascent has been characterized by sustained institutional buying pressure, with daily trading volumes experiencing a 23% increase as the cryptocurrency broke through each psychological barrier . The price movement reflects a fundamental shift in how institutional investors view Bitcoin, transitioning from a speculative asset to a legitimate store of value comparable to digital gold .

Institutional Adoption Reaches New Heights

The record-breaking price surge has been fueled by unprecedented institutional adoption through Bitcoin Exchange-Traded Funds (ETFs), which have become the primary catalyst for the current bull run . BlackRock’s iShares Bitcoin Trust (IBIT) has emerged as the dominant force, holding over 700,000 BTC worth approximately $81 billion and becoming the fastest ETF in history to reach $80 billion in assets under management, achieving this milestone in just 374 days .

Bitcoin ETFs have collectively surpassed $50 billion in total net inflows, with recent daily inflows exceeding $1 billion for consecutive days . This institutional surge represents a fundamental shift from retail-driven speculation to strategic corporate treasury allocation, with Bitcoin ETFs now managing $138 billion in assets across 66 different funds .

The ETF structure has democratized Bitcoin access for traditional investors, eliminating the complexities of direct custody while providing regulated exposure to the cryptocurrency market . This accessibility has attracted conservative institutional investors who were previously hesitant to enter the crypto space directly.

Corporate Treasury Adoption Accelerates

Major corporations continue to embrace Bitcoin as a strategic asset, with public companies holding Bitcoin increasing from 64 in 2024 to 151 in June 2025 . MicroStrategy remains the largest corporate holder with 597,325 BTC valued at approximately $64.4 billion, having achieved a 19.1% return on its Bitcoin holdings in 2025 .

The corporate adoption trend extends beyond traditional tech companies, with Japanese investment firm Metaplanet recently acquiring an additional 797 BTC, bringing its total holdings to 16,352 coins and securing its position as the fifth-largest corporate Bitcoin holder globally . This diversification of corporate Bitcoin adoption across different sectors and geographical regions demonstrates the growing acceptance of Bitcoin as a legitimate treasury asset.

Government Adoption and Regulatory Clarity

The regulatory environment has become increasingly favorable for Bitcoin, with President Trump’s administration implementing pro-crypto policies that have boosted institutional confidence . The establishment of a Strategic Bitcoin Reserve through executive order has positioned Bitcoin as a national strategic asset, similar to gold reserves .

El Salvador continues to demonstrate the potential for sovereign Bitcoin adoption, with the country’s Bitcoin holdings generating nearly $400 million in unrealized profits . President Nayib Bukele’s administration has accumulated 6,232 BTC since adopting Bitcoin as legal tender, representing a 137% return on investment .

Market Dynamics and Technical Analysis

The current rally has been characterized by strong momentum indicators, with technical analysts predicting further upside potential . The recent breakout above previous resistance levels around $112,000 has triggered a cascade of short liquidations, with over $650 million in short positions liquidated as prices surged .

Market analysts project Bitcoin could reach $125,000 to $140,000 per year-end, supported by continued institutional adoption and favorable macroeconomic conditions . The combination of limited supply, increased demand, and institutional legitimacy has created a powerful foundation for sustained price appreciation.

Crypto Week and Legislative Developments

The timing of Bitcoin’s record high coincides with “Crypto Week” in Washington, where Congress is set to debate crucial cryptocurrency legislation including the GENIUS Act, Clarity Act, and Anti-CBDC Surveillance State Act . These legislative developments could establish comprehensive regulatory frameworks for the crypto industry, potentially accelerating institutional adoption further .

Broader Market Impact

Bitcoin’s surge has positively impacted the broader cryptocurrency market, with total market capitalization approaching $4 trillion Ethereum has benefited from Bitcoin’s momentum, surpassing $3,000 for the first time in months, while other altcoins have experienced significant gains .

The institutional focus on Bitcoin has created a wealth effect that extends beyond cryptocurrency markets, with crypto-related stocks experiencing substantial gains . Mining companies, ETF providers, and cryptocurrency exchanges have all benefited from increased investor interest and trading volumes.

Looking Forward

Bitcoin’s achievement of $121,000 represents more than a price milestone; it signifies the maturation of cryptocurrency as an institutional asset class . The convergence of regulatory clarity, institutional adoption, and technological advancement has created sustainable demand that extends far beyond previous speculative cycles.

The current momentum suggests Bitcoin’s role as “digital gold” is becoming increasingly recognized by traditional financial institutions, central banks, and corporate treasuries worldwide . With continued institutional buying pressure and favorable regulatory developments, Bitcoin appears positioned for sustained growth throughout 2025 and beyond.

As Bitcoin continues to break barriers and set new records, it demonstrates the transformative potential of decentralized digital assets in the global financial system. The $121,000 milestone marks not just a price achievement, but the beginning of a new era where Bitcoin’s role as a strategic asset is no longer questioned but embraced by institutions worldwide.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.