In recent days, the cryptocurrency market has shown renewed energy, and Bitcoin Cash (BCH) appears to be riding this wave toward a potential monthly high. As of the time of writing, BCH is trading around the US $550 mark, representing approximately a 10% increase since Sunday — signalling that sentiment may be shifting in favour of upside momentum.

Demand and Supply — Signals Turning Green

Data from analytics firm Santiment show a meaningful uptick in on-chain activity: daily active addresses on the Bitcoin Cash network continue to rise, hitting 7.5 million on a recent Sunday. At the same time, the number of BCH tokens in profit — that is, held at a cost basis below the current price — has climbed from 14.67 million tokens to 17.7 million tokens.

This combination suggests that more users are actively using the network (or at least addresses are moving), and that many existing holders are now “in the green” and potentially less likely to sell immediately, creating a favourable supply-demand backdrop.

Whale Activity & Derivatives — A Close Look

Turning to the derivatives markets, there are signs that larger players (“whales”) are positioning themselves in BCH. According to data from CryptoQuant, major holders are placing sizable futures orders on BCH, which often serve as early signals of price moves.

Further data from CoinGlass indicate that BCH’s futures open interest (OI) increased by about 13.8% in 24 hours, reaching approximately US $382.96 million. Meanwhile, the funding rate (which reflects costs for maintaining long vs short positions) turned notably negative: average funding dropped to -0.0323 %, meaning shorts are paying more to stay open, a signal often favourable to longs and price appreciation.

These derivative metrics suggest that traders are starting to favour long positions in BCH — a potential tailwind for price upside, especially when combined with improved on-chain demand.

Technical Setup — The Road Ahead

From a technical perspective, BCH currently hovers around US $560 after its recent 10% jump. Key resistance is identified in the US $573 region (the 78.6% Fibonacci retracement level) while immediate support lies near US $542 (the 61.8% retracement level).

If buyers can push BCH above the US $573 mark, the next significant upside target is around US $615, which corresponds to the most recent swing high (~3 October) on the BCH/USDT daily chart.

Meanwhile, the daily MACD indicator is showing a bullish expansion (signal line rising, histogram turning green) — a positive momentum sign. However, the RSI has climbed to about 82, indicating the market may be in an “overbought” condition and could face a short-term pullback or consolidation.

If a correction occurs, support zones to watch are US $542 and then around the 200-day EMA near US $531, where bulls may look to defend.

Why “Uptober” Could Be a Factor

October historically has been an interesting month for cryptocurrencies, sometimes dubbed “Uptober” when upward momentum tends to pick up. The renewed positive sentiment in the market may be contributing to BCH’s breakout-like behaviour. As user engagement rises, whale activity intensifies, and derivatives positioning tilts bullish, the confluence of these factors may be creating a conducive environment for BCH’s next leg up.

Here’s a breakdown of the current setup for Bitcoin Cash (BCH) — with technical levels to watch and a high-level comparison to altcoins.

1. Chart & Key Technical Levels for BCH

✅ Support Levels

-

Around US $531.70: one of the first major supports.

-

Further down near US $522.90 and US $509.48 as deeper support zones.

-

A broader support “floor” nearer around US $497.63 was identified as accumulated-volume support.

🚀 Resistance Levels

-

Immediate resistance in the US $567-576 range.

-

More critical resistance near US $634.30 — a level many analysts say BCH must clear for bullish continuation.

-

On the higher end, breakout targets in the US $650-700 zone have been cited.

🔍 Current Bias & Themes

-

BCH appears to have broken out of a long-term symmetrical triangle according to some analyses, which signals potential for a larger move if momentum sustains.

-

However, there are mixed signals: some technical platforms still mark bearish components (e.g., short-term moving averages crossing negatively) while others view the daily timeframe as more bullish or at least neutral.

-

The macro / altcoin environment is turning more favourable: altcoin volume dominance reportedly back above ~46%.

🧮 What to Watch

-

Does BCH hold above the ~US $550-560 region? Holding above this zone would help maintain a bullish structure.

-

Does it break above US $634.30 with volume? That could open the way toward the US $650-700 target.

-

On the downside: a breakdown below ~US $522-531 would weaken the bullish case and potentially open a drop toward deeper supports.

2. How BCH Compares with Other Altcoins

📊 Relative Positioning

-

BCH remains one of the larger altcoins by market cap and is often discussed alongside other mid-cap coins like Avalanche (AVAX).

-

While some altcoins are seeing sharp speculative moves, BCH tends to be seen as more “established” — it benefits from clearer utility (faster/cheaper transactions vs. its parent chain) and a recognizable name.

-

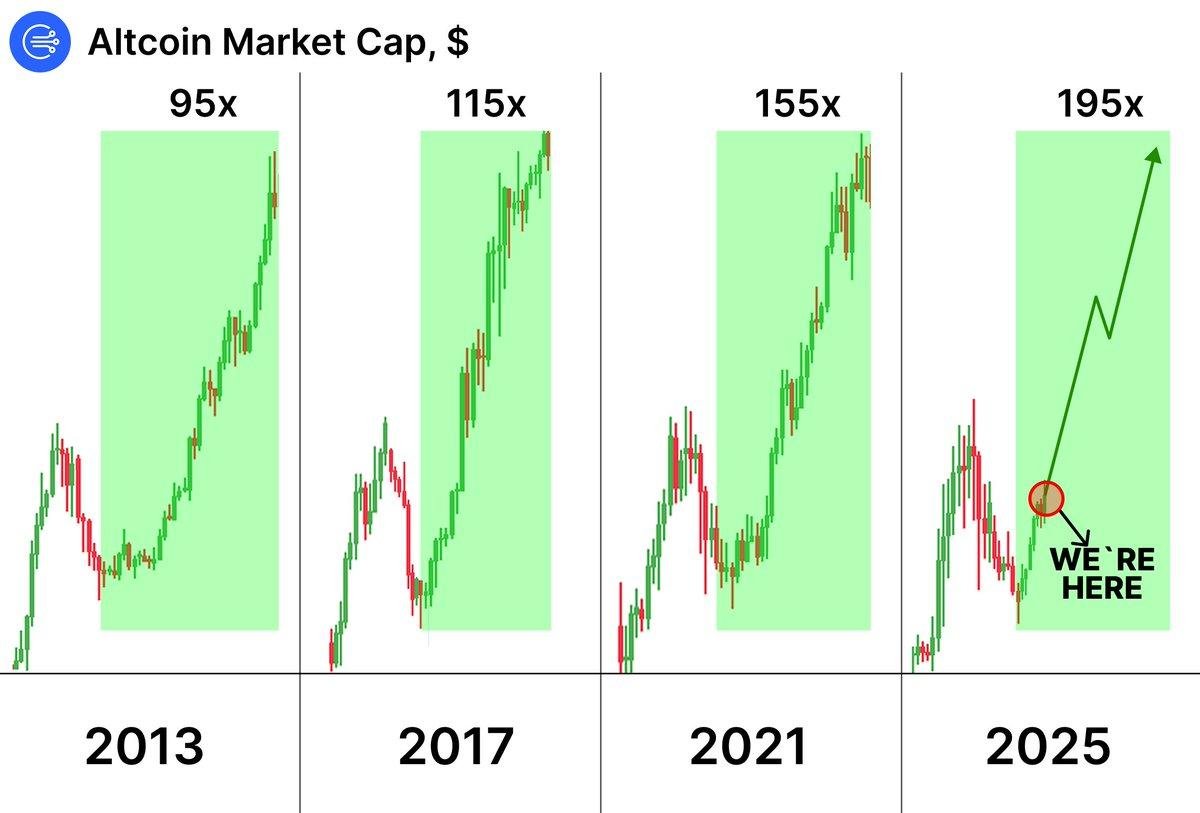

The “momentum window” known as “Uptober” (i.e., October showing historically stronger crypto performance) seems to be back in discussion. BCH could benefit if the broad altcoin market enters rotation.

✅ Strengths vs ⚠️ Risks

Strengths:

-

Clear support zones especially if broader crypto market recovers.

-

Recognisable brand and network history.

-

Breakout potential if resistance is breached.

Risks:

-

Altcoin space is competitive; newer tokens may grab momentum more rapidly.

-

BCH still needs strong breakout confirmation; risks of false moves.

-

The macro crypto market environment (regulation, ETFs, etc) still matters a lot for altcoin performance.

3. My Summary View

BCH is in a potentially favourable spot: the chart structure, support/resistance levels and broader altcoin sentiment are aligned enough that a move could unfold. But it’s not guaranteed — the breakout still needs to happen, and market rotation into altcoins must hold.

If I were trading/monitoring:

-

Short-term target: US $634-$650 if momentum sustains above US $560.

-

Downside risk: A drop below US $522-531 would reduce bullish odds significantly.

-

Watch for volume: A genuine breakout will likely come with increased volume, not just a slow drift.

-

Broader altcoin backdrop: If altcoins broadly pick up (as signs suggest) then BCH could get a lift; if rotation stalls then BCH may lag.

Final Thoughts

While nothing in crypto is guaranteed, the current setup for Bitcoin Cash is showing several favourable signals: increasing network usage, rising profitable supply, growing futures interest and favourable funding conditions, alongside technical indicators aligned for a breakout. That said, the high RSI warns of potential near-term choppiness or consolidation.

For traders and investors considering BCH, key factors to monitor in the coming days include:

-

Whether BCH breaks and holds above ~$573.

-

Movement of large-holder futures orders and open interest.

-

On-chain metrics for network activity and supply in profit.

-

Potential pullback towards support zones (~$542–$531) offering entry opportunities.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Telegram.

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.