In a dramatic turn across the cryptocurrency landscape, the flagship asset Bitcoin (BTC) plunged to approximately $104,000, triggering a broad-based liquidation that hit major altcoins hard. According to recent market analysis, three prominent tokens — XRP, BNB and Solana (SOL) — experienced steep declines as investor sentiment collapsed and technical risk piled up.

A Sudden Capitulation in Crypto Markets

The sharp downturn of Bitcoin set the tone: after dropping below the $104,000 threshold, the crypto market entered a phase of panic selling with more than $1 billion in value wiped out in just 24 hours.

With the overall mood souring, altcoins such as XRP, BNB and SOL were especially vulnerable — lacking the defensive strength of Bitcoin and riding on thin momentum.

Technically, the market reveals signs of further risk ahead: many coins show “death-crosses” (short-term moving averages crossing below longer-term ones), oversold momentum indicators, and broken support levels.

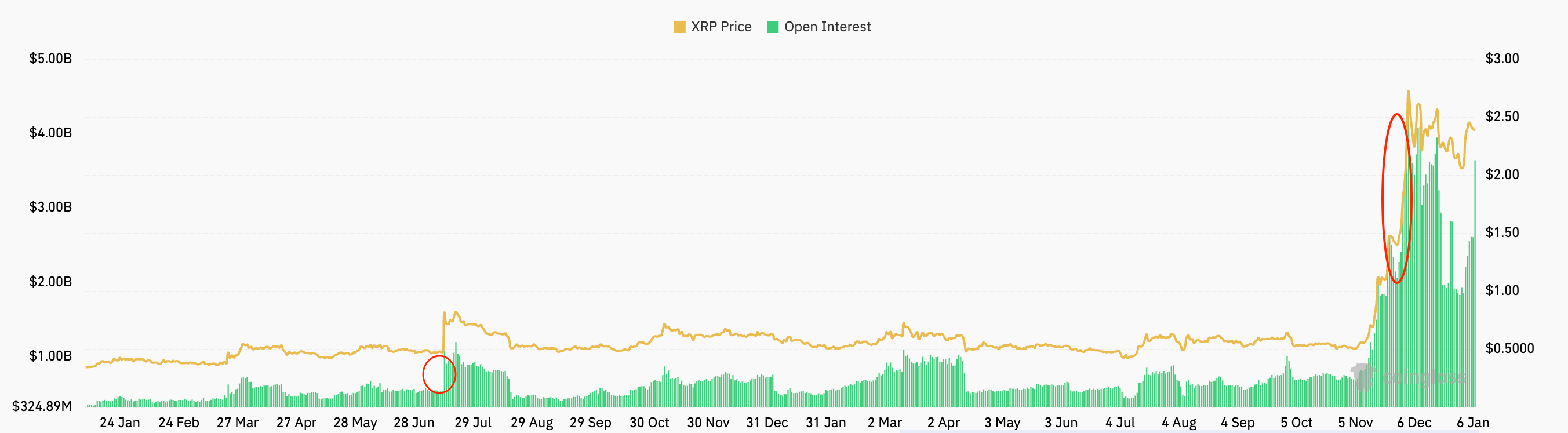

XRP: Holding the Line… For Now

XRP managed to claw back about 1 % in the latest session after earlier dropping nearly 8 %.

Support around $2.30 remains critical — this level previously held grounds on October 11 and is now under pressure. If that level fails, analysts warn of possible decline toward $2.19 and even $1.90 (previous lows).

Technical indicators add to the caution: the 50-day exponential moving average (EMA) is poised to cross under the 200-day EMA (a classic “death-cross”), the MACD is weakening, and the RSI has dropped to about 39 — indicating growing selling pressure.

On the flip side, if buying interest returns, a move up toward the 200-day EMA (around $2.60) could provide a relief rally.

BNB: Flag-Bearish Signals Intensify

BNB’s slide has deepened after breaking downward from a so-called “bear flag” pattern on the 4-hour chart — a bearish continuation pattern that warned of this move ahead.

Currently trading below $1,000, BNB is targeting the next support region at $932 (its late-September low). Should that fail, the drop could extend toward $819, matching the “25 % downside” target derived from the flag’s height.

From a technical standpoint, the 4-hour 50-EMA has already crossed below the 200-EMA (“death-cross”), with the 100- and 200-EMA lines further converging — a warning that short-term momentum may now be fully bearish. The MACD remains negative and the RSI remains in a weak zone.

However, should BNB reclaim the $1,000 zone, the 50-EMA near ~$1,075 may become the next resistance to watch.

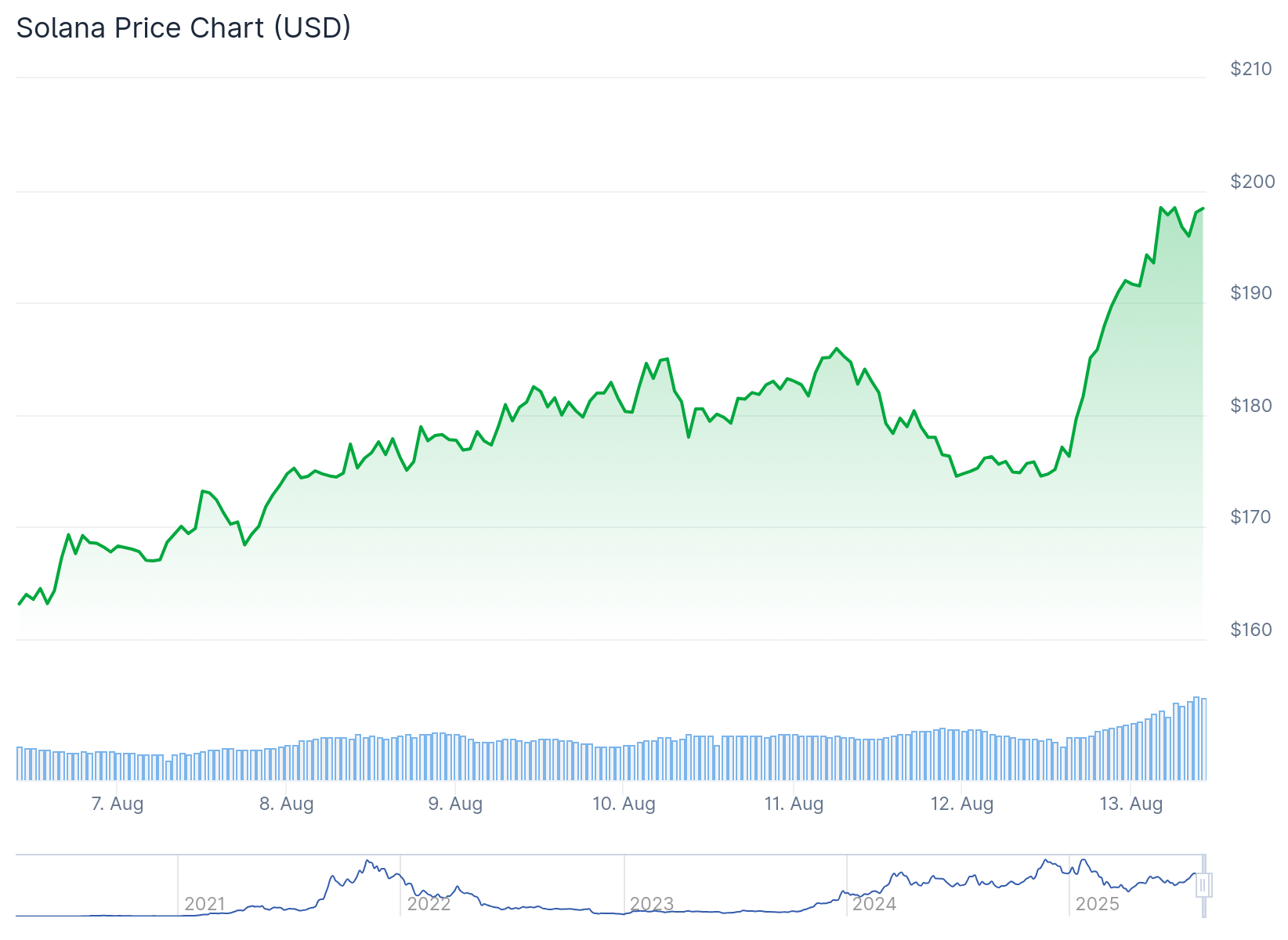

Solana (SOL): Institutional Inflows Don’t Prevent a Fall

Perhaps one of the more paradoxical cases: Solana is declining despite strong institutional interest. On the day of the drop, SOL ETFs in the U.S. reportedly received ~$70.05 million in fresh inflows — a record high and the fourth consecutive day of positive institutional flow.

Nevertheless, SOL lost a key support level around $174, raising concern for deeper correction toward $153.

Technically, the 50-day EMA is nearing a cross under the 100-day EMA — another red flag for bearish reversal. MACD is in the negative zone and RSI has dropped to ~32, flirting with oversold territory.

To reverse the trend, SOL needs to reclaim $174 decisively and aim toward the 200-day EMA at approximately $186. Until then, risk remains elevated.

Broader Implications & What to Watch

-

Sentiment is weak. With Bitcoin’s slide and altcoins breaking support, the crypto market’s fear index is sharply elevated.

-

Technical risk is real. Multiple coins approach key moving average crossovers, which have historically preceded deeper corrections.

-

Institutional inflows aren’t always protective. As the Solana case shows, even when money is flowing in, if technicals and overall sentiment are poor, price may still decline.

-

Support zones matter. Watch the critical support levels highlighted above for each coin — if they break, next steps may see larger downside.

-

Recovery signs should be taken seriously. If any of these coins can reclaim key resistance levels (like XRP $2.60, BNB ~$1,075, SOL ~$186), it may mark the beginning of stabilization.

Final Thoughts

The current crypto pullback underscores a reminder: even high-profile tokens like XRP, BNB and SOL are not immune to broad market stress. While each has unique fundamentals and catalysts, when Bitcoin stumbles, the altcoin ecosystem can see amplified downside.

For investors and traders, this moment demands caution: pay attention to support zones, monitor technical signals closely, and ensure risk management is active. Recovery remains possible — but only if conditions shift decisively.

—————————————————-

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Want to stay updated with the latest insights and discussions on cryptocurrency?

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

For collaborations and inquiries: CryptoBCC.com@gmail.com

Disclaimer: Always do your own research (DYOR) and ensure you understand the risks before making any financial decisions.