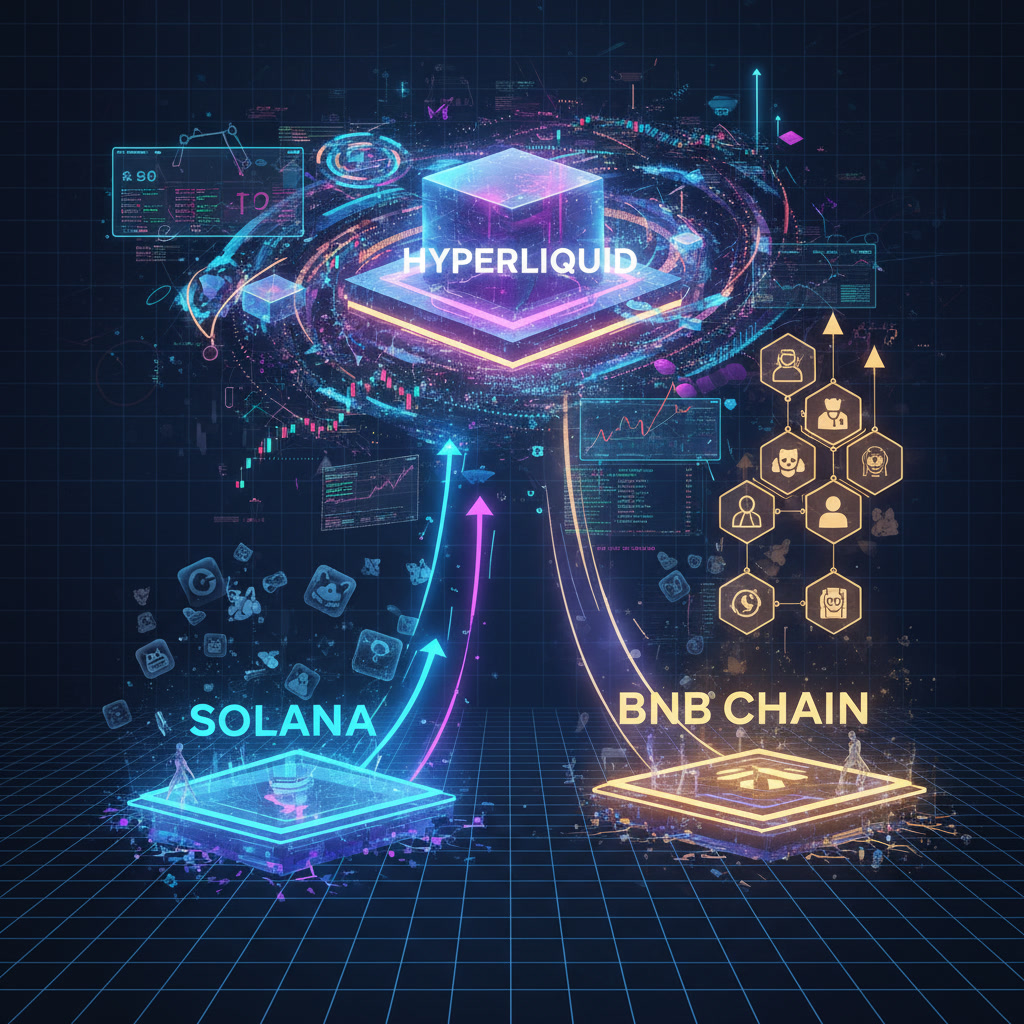

The competitive landscape of Layer-1 blockchains is shifting rapidly, and fee market share data is shining a spotlight on this transformation. Once the standout leader in transaction fee revenue thanks to an explosive memecoin boom, Solana has seen its dominance evaporate. Meanwhile, Hyperliquid and BNB Chain have surged ahead, fueled by intense derivatives trading activity and growing user bases.

According to recent market analysis, Hyperliquid now commands roughly 40% of fee market share among major Layer-1 ecosystems, while BNB Chain secures around 20%. In stark contrast, Solana has dropped from above 50% earlier this year to just 9%, marking one of the most dramatic shifts in recent blockchain economic trends.

The Rise of Hyperliquid and BNB Chain

Hyperliquid’s ascent has been nothing short of remarkable. The platform’s deep focus on derivatives trading — one of the highest fee-generating activities in crypto — has positioned it at the core of a narrative increasingly defined by advanced trading infrastructure and speculative markets.

BNB Chain, meanwhile, continues to thrive on its vast retail user base, fast confirmation times, and massive centralized exchange support. With memecoins, gaming assets, and trading applications flourishing across its ecosystem, it has become a preferred environment for high-volume traders and emerging speculative activity.

Together, these chains now make up approximately 60% of total L1 fee revenue, setting new competitive parameters for chains traditionally dominated by decentralized finance and memecoin markets.

Solana’s Decline: From Memecoin Mania to Market Realignment

Solana’s sharp fee market contraction can be traced to three key drivers:

✅ Memecoin Mania Fades

At the beginning of the year, Solana was at the center of one of the largest memecoin frenzies seen in crypto history. This activity generated unprecedented on-chain volume and fees. However, as speculative behavior cooled, so did its fee revenue.

✅ Lack of Strong Native App Demand

Despite a fast and efficient infrastructure, Solana still lacks a breakout category of sustainable, sticky applications capable of driving long-term volume. Many projects remain either early-stage or overly dependent on hype cycles.

✅ Rise of Derivatives-Driven Chains

As traders increasingly gravitate toward high-leverage environments, derivatives platforms like Hyperliquid and BNB-powered alternatives are capturing the majority of fee-rich user activity — leaving Solana behind in this market segment.

What This Means for Developers, Investors, and Ecosystems

This shift in fee distribution offers crucial insights:

| Stakeholder | Implication |

|---|---|

| Developers | Need to build practical, sticky apps — not just hype-driven experiments |

| Ecosystems | Must invest in diversified use cases and consumer-level onboarding |

| Investors | Should evaluate revenue sustainability, not just short-term token price movements |

One recurring lesson: chains with strong derivatives markets or sticky utility tend to generate stable fee revenue, while hype-driven networks face volatility once attention cycles shift.

Strategic Recommendations Going Forward

To regain ground, Solana — and other ecosystems facing similar headwinds — must:

-

Invest in real consumer and DeFi applications

-

Improve developer tooling and UX simplicity

-

Encourage diverse trading models beyond spot speculation

-

Attract institutional-grade users and liquidity providers

In the long term, fee strength equals ecosystem health, and networks that offer genuine utility will withstand market cycles.

FAQ

1. Why is Hyperliquid gaining market share?

Hyperliquid specializes in derivatives trading — a high-fee, high-volume activity that has recently exploded in popularity. Its focus on traders allows it to capture disproportionate fee revenue.

2. How did memecoin activity affect Solana’s fee share?

Memecoins generated massive volume and fees for Solana during peak hype. When interest declined, fees dropped sharply, exposing reliance on short-term speculative flows.

3. Is BNB Chain’s growth sustainable?

BNB Chain benefits from a broad user base and multiple active applications. Whether growth remains long-term depends on its ability to maintain real usage — not just speculative trading.

Conclusion

The fee race among Layer-1 blockchains is evolving fast, and speculative trading dynamics are leading the charge. While Solana’s decline reflects cyclical sentiment and ecosystem gaps, Hyperliquid and BNB Chain highlight the growing importance of trading-driven economic activity in blockchain networks.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Instagram | Telegram | Pinterest | Facebook | Discord | Tiktok | Threads | X(Twitter).

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.