In the highly volatile world of cryptocurrency, sustainable profits do not come from chasing “the next big wave” or relying on insider information. Instead, they come from understanding the natural rhythm of the market and human psychology. Here are six practical principles that help traders seize opportunities while minimizing risks, drawn from real-world trading experience:

1. Rapid Rises Followed by Slow Declines Often Signal a “Shakeout”

When a market suddenly spikes and then slowly drifts down, resist the urge to panic sell. This pattern is often orchestrated by major players who push prices up to attract buyers and then gradually sell off their holdings to accumulate more at lower prices.

True market tops rarely hesitate — the clearest warning sign is a sharp and decisive drop.

2. Quick Drops Followed by Slow Recoveries Indicate Distribution

A sharp fall with a weak, slow rebound is usually not a buying opportunity. It often signals intentional distribution, where market makers sell off their positions while smaller investors believe the asset has “fallen too far and is about to bounce back.”

This classic trap ensnares many retail traders, leaving them holding assets for the long term at unfavorable prices.

3. High Volume at the Top Is Not Necessarily Bad, but Low Volume Is Dangerous

If prices remain high while trading volume stays strong, the market may still have momentum to continue rising.

However, declining volume, even without a price drop, warns that capital is leaving — and a sudden fall could be imminent.

4. Volume at the Bottom Requires Careful Monitoring

A single day of high volume in a bottoming market can be a “bull trap.” Only sustained increases in volume over several sessions confirm that real money is returning to the market. This is the safer time to consider opening a position.

5. Volume Is the True “Thermometer” of Market Emotion

Price candles show results, but volume reveals the real feelings of traders.

When volume drops sharply, it indicates fear and hesitation — few participants are willing to act. Conversely, when volume rises alongside price, it signals genuine participation, and this is where true opportunities emerge.

6. The Market Is a Game of Psychology, Not Luck

Crypto trading is not gambling. It’s about reading human behavior and emotions through price and volume patterns.

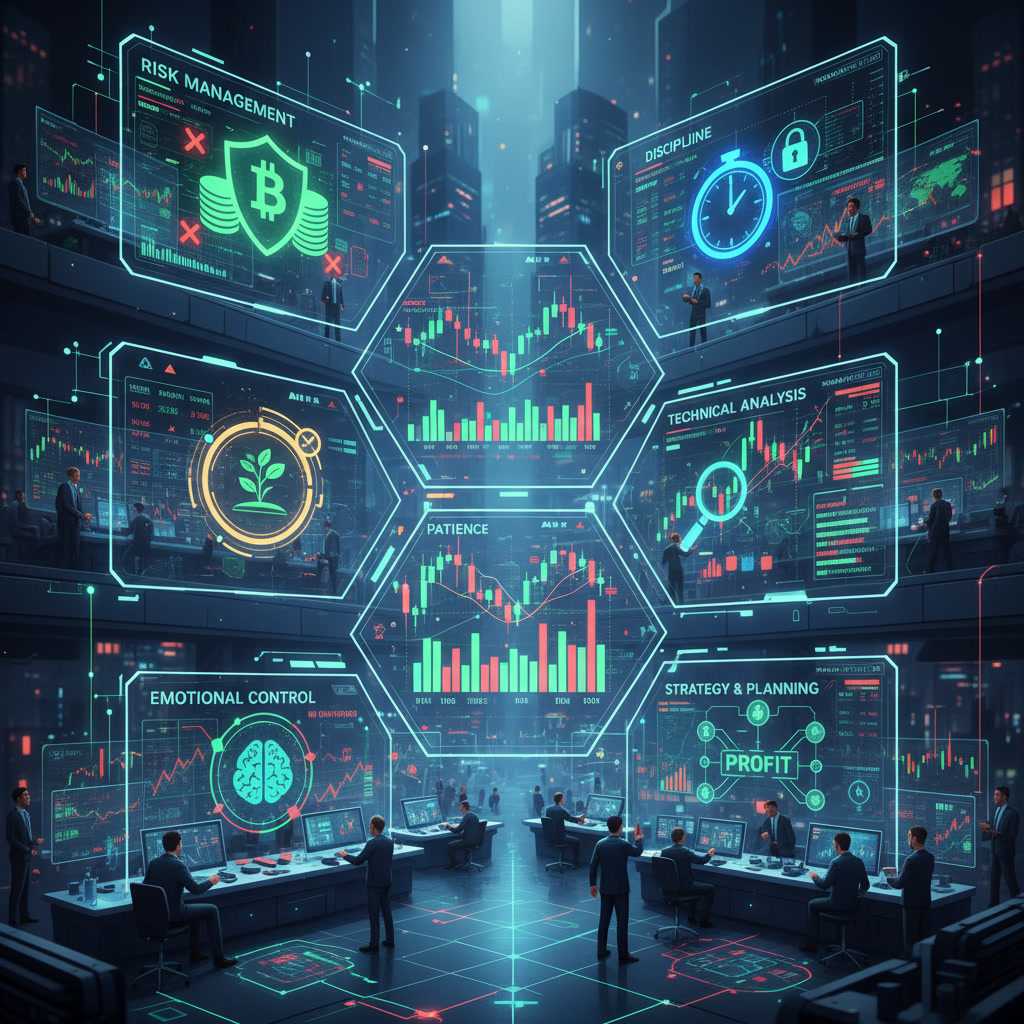

Instead of trying to “predict tops and bottoms,” focus on developing observation skills, risk management, and emotional control — these are the factors that ultimately determine long-term profitability.

Conclusion

In cryptocurrency markets, understanding money flow and crowd psychology is the key to winning. Volume never lies — let it guide your decisions rather than chasing news or short-lived excitement. Mastering these principles forms the foundation of a strategy capable of consistent and sustainable profits.

Ready to start your cryptocurrency journey?

If you’re interested in exploring the world of crypto trading, here are some trusted platforms where you can create an account:

- Binance – The world’s largest cryptocurrency exchange by volume.

- Bybit – A top choice for derivatives trading with an intuitive interface.

- OKX – A comprehensive platform featuring spot, futures, DeFi, and a powerful Web3 wallet.

- KuCoin – Known for its vast selection of altcoins and user-friendly mobile app.

These platforms offer innovative features and a secure environment for trading and learning about cryptocurrencies. Join today and start exploring the opportunities in this exciting space!

Join our crypto community for news, discussions, and market updates: CryptoBCC on Youtube | Telegram | Facebook | Discord | X(Twitter)

Disclaimer: This is not investment advice. Cryptocurrency investments carry high risk. Always conduct your own research.